ACORD 126: Everything You Need To Know

If you purchase general liability insurance, chances are you will see the ACORD 126 form. Depending on the insurance company you work with, you might even have to submit this form every year.

You won’t typically complete this form yourself. Your broker will most likely ask you questions and fill out the form on your behalf. However, you will need to sign it, so it’s important to understand what it means.

What is the ACORD 126?

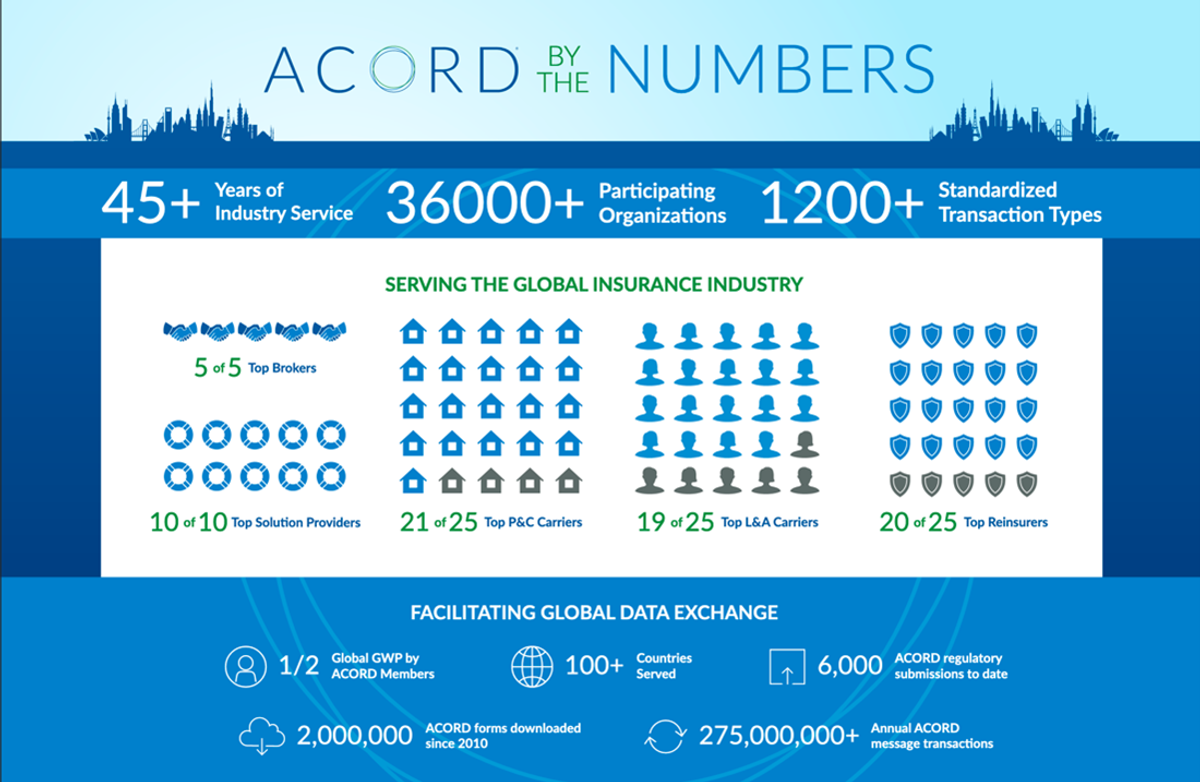

The ACORD 126 is the preferred form to collect underwriting information on individuals or companies seeking commercial general liability insurance. ACORD (Association for Cooperative Operations Research and Development) is a nonprofit comprising 36,000 organizations whose goal is to standardize the flow of information among insurance institutions.

Source: acord.org

Almost every insurance company and insurance broker in the world uses this standardized form to collect, verify, and update the information needed to underwrite a general liability insurance policy that fits your business from an exposure and coverage standpoint.

Need help from an insurance expert?

We can explain ACORD 126 and every other form you might need, while providing a free quote in 5 minutes. Choose an option below.

When do you need to fill out the ACORD 126?

Most businesses won’t need to fill out the ACORD 126 every year because basic policies are auto-renewed indefinitely. Small businesses in particular are usually eligible for auto-renew. As long as the nature of your operations and level of risk remain the same, the existing policy information should be enough.

It’s important to notify your insurer of any changes that could affect your risk profile or coverage needs, because you may need to submit an updated form. And some insurance companies may want a new submission once every three years regardless of the policy.

Whether you need to fill out the ACORD 126 is determined by a few different factors. Here are three times you’ll often need to submit this form.

For a new policy, renewal, or verification

The ACORD 126 form is used to collect relevant business information when first underwriting your general liability policy. When renewing your current general liability policy, the form is used to confirm or update your existing information. And when your insurance company wants to verify the information you provided them is correct, they will also require you to fill out and sign the form.

If you’re switching insurance companies

When you’re switching insurance carriers, you’ll likely need to submit an ACORD 126 during the policy application process. The form provides the new insurer with comprehensive information about your business’s operations and risk exposures, ensuring that your new policy accurately reflects your coverage needs.

When you have a surplus lines policy

If you have a surplus lines policy, which is for unique and high-risk situations that a standard policy won't cover, you may need to submit the ACORD 126 every year. The risk profile for surplus lines policies can change quickly, so your information needs to be reviewed more often to ensure you have the right coverage amounts.

When you have a high-risk or complex policy

High-risk businesses and large corporations often have complicated policies that require them to submit the ACORD 126 every year. These businesses have more potential exposure to liability and experience more volatility, so insurance carriers want to make sure they keep coverage aligned with these changing needs.

What Each ACORD 126 Section Means

Although as a customer, you probably won’t fill out this form yourself, you might be wondering what each section of the ACORD 126 means before you sign it. You can click below to download a blank, fillable ACORD 126, or follow along as we go through each section starting from the top of the application.

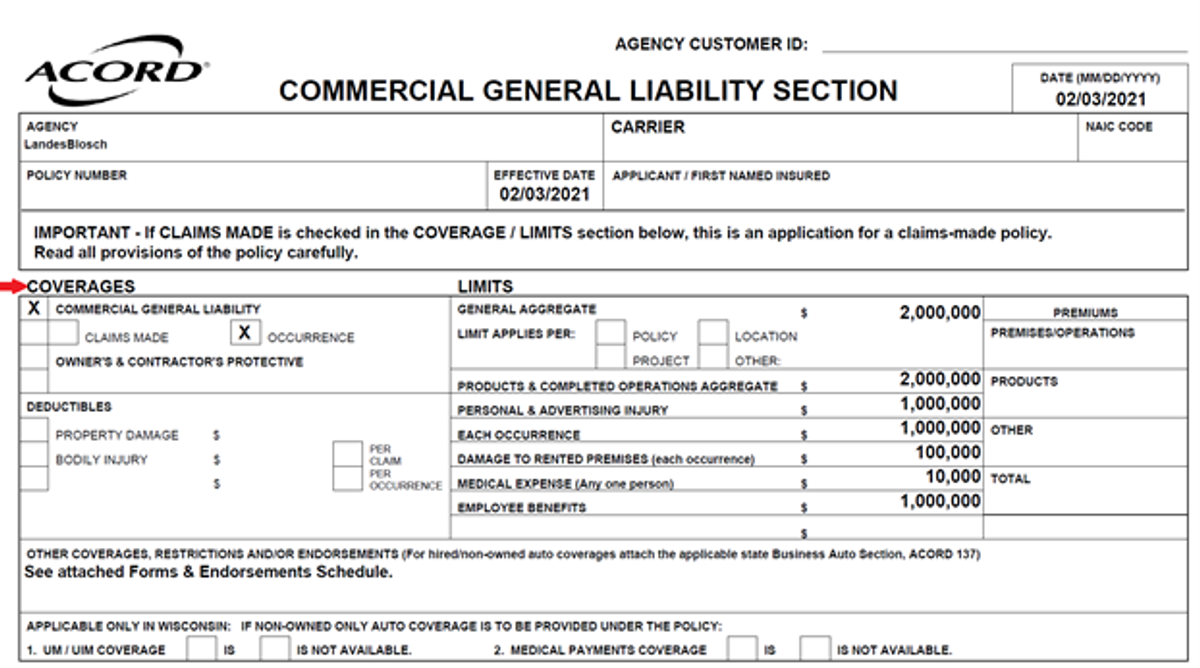

Coverages/Limits

The first part of the ACORD 126 is the coverages section. This is where you submit your policy limits, or the limits you’re requesting on a quote, to the insurance company.

In addition to the limits, you have the option to choose a claims-made policy or an occurrence-based policy. You can also use this section to request either a property damage or bodily injury liability deductible.

Schedule Of Hazards

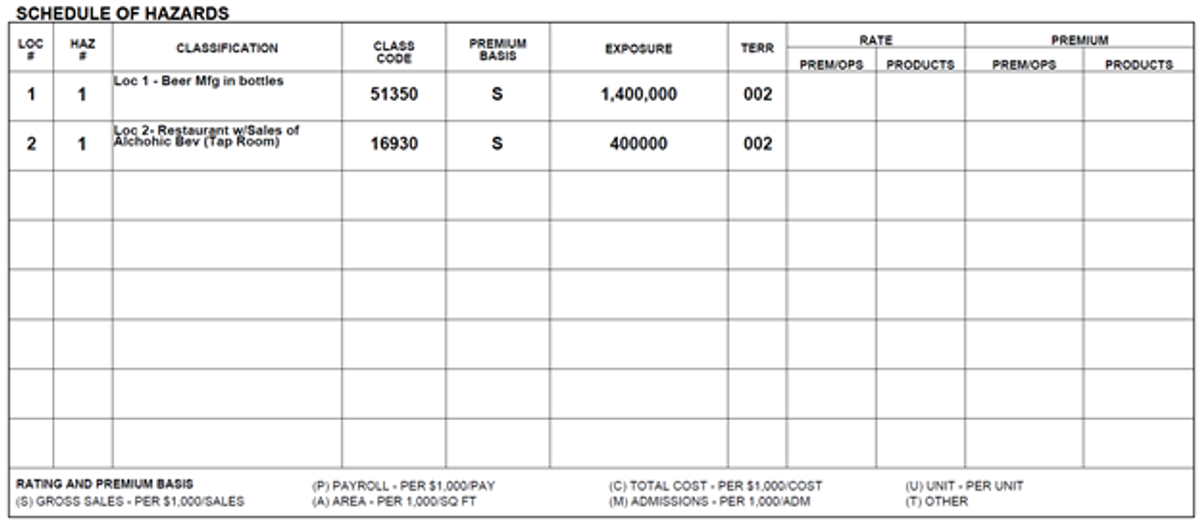

Unlike the coverages section, which describes the coverages that you have or want to purchase, the goal in the schedule of hazards section is to collect information about your business relevant to the rating of your insurance policy.

The classification is a description of the operations you perform. The class code is the corresponding numerical code for the description of operations.

The premium basis is the rating factor, which determines the risk level for the classification code. For example, below “S” is listed as the premium basis for both classifications. “S,” or Gross Sales, is the best way to determine the risk of a company in that classification.

Payroll (P) is another commonly used premium basis in ACORD 126 forms, especially for contractors in the construction industry.

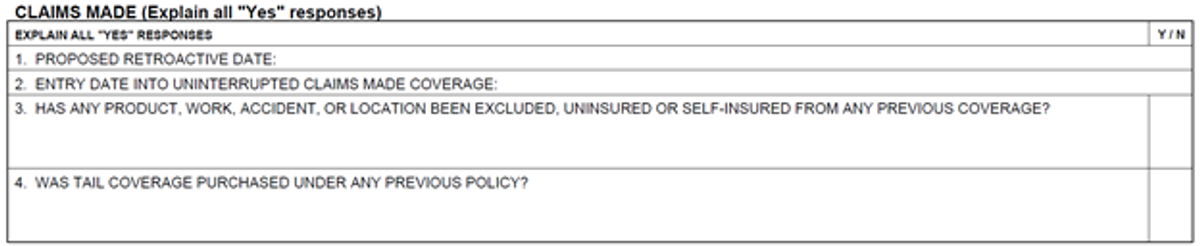

Claims Made

It is very rare to have a claims-made general liability policy, but they do exist. A claims-made policy contains a unique set of claims reporting requirements. If you have (or are requesting) a claims-made general liability policy, you will need to fill out this section.

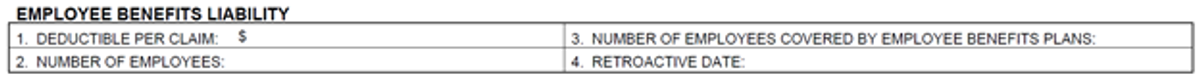

Employee Benefits Liability

Employee benefits coverage is an add-in to many commercial general liability insurance policies. If you add an employee to your payroll, but fail to correctly add that employee to the benefits program, this policy will kick in and pay for the mistake.

We most frequently see claims for mistakes in the company-sponsored life insurance or health insurance programs.

If you are requesting or renewing this coverage, you need to fill out the employee benefits liability section.

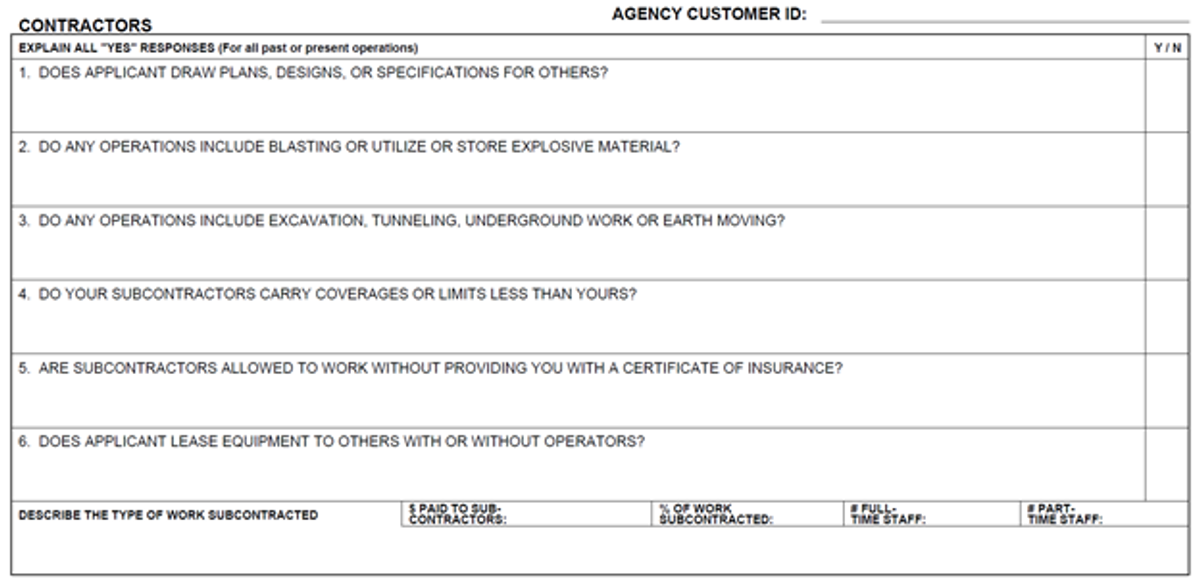

Contractors

The contractors section is reserved specifically for contractors who are quoting or renewing their commercial general liability insurance.

Since contractor insurance comes with a unique set of risks, insurance companies need to ask a unique set of questions while underwriting the policy. If you’re a contractor, this part of the form needs to be filled out.

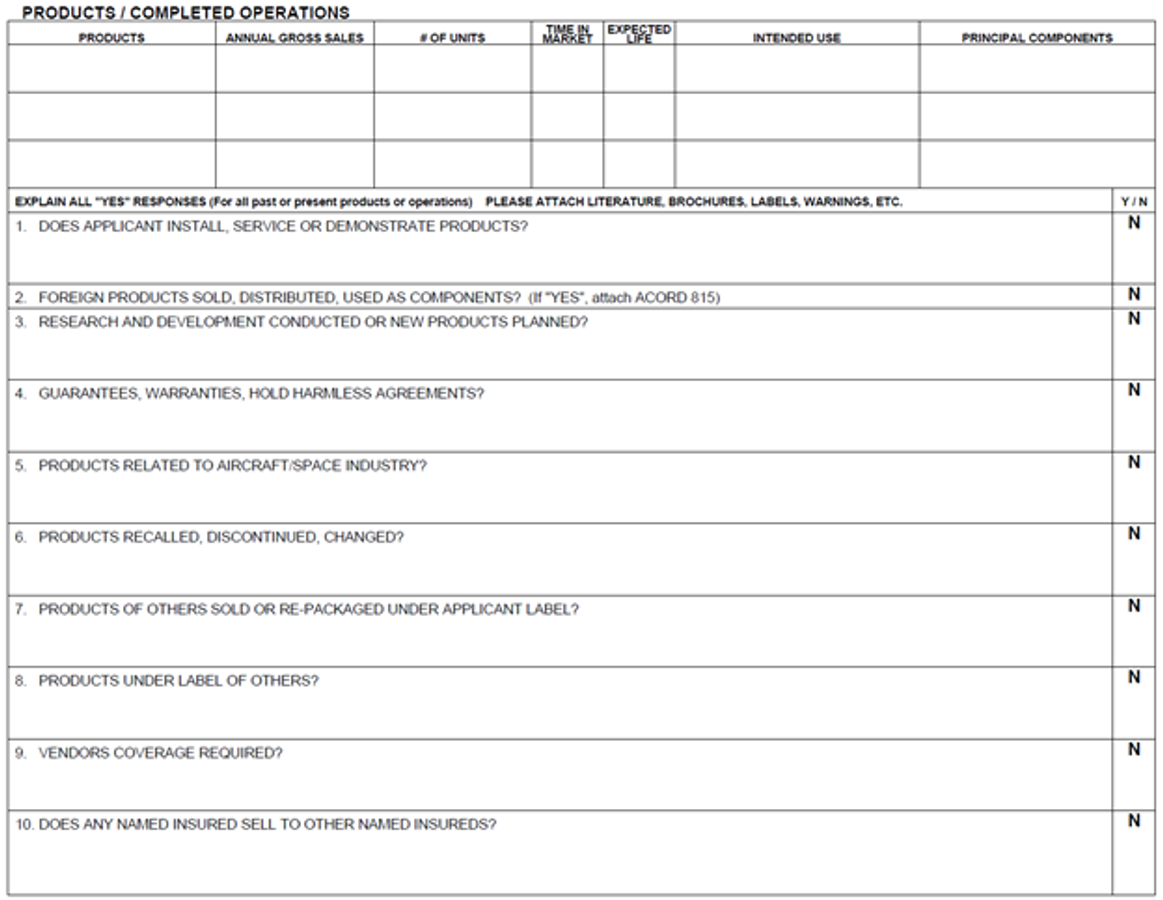

Products/Completed Operations

Whereas the previous section was reserved for contractors, this section is reserved for companies with heavy products and completed operations risk (usually manufacturing and construction companies).

The goal of this section is to determine what products you offer, customer contracts you have, and vendor controls are in place.

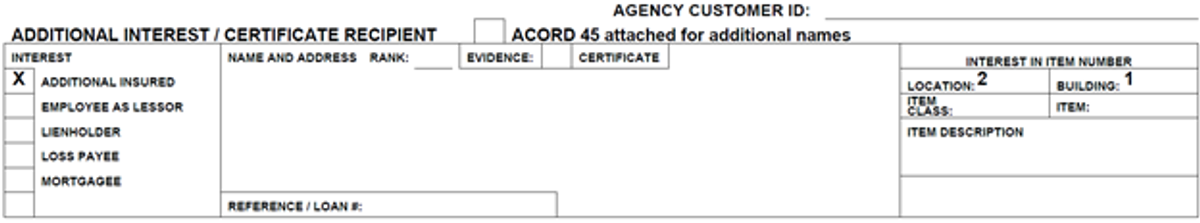

Additional Interest/Certificate Recipient

If you have additional insureds, you will need to list them on a supplemental ACORD form (ACORD 45). But if you only have one additional insured or loss payee, you can add them in this section of the ACORD 126.

For example, you might need to put the name of a certain customer or vendor in this field if they have requested additional insured status on your commercial general liability policy.

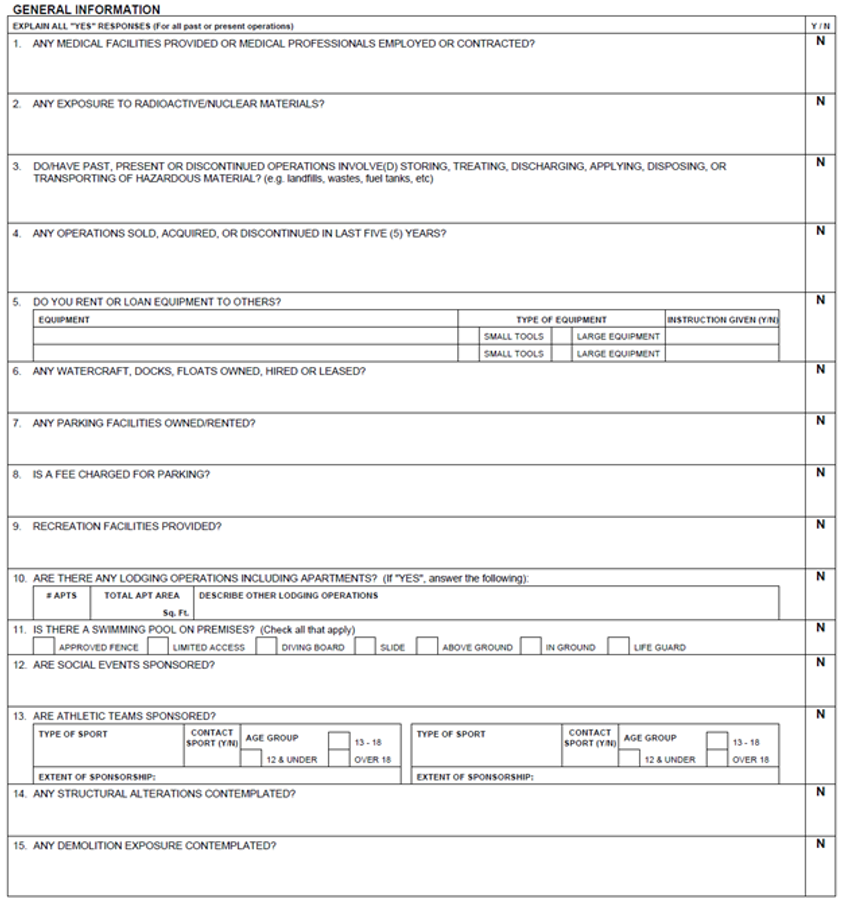

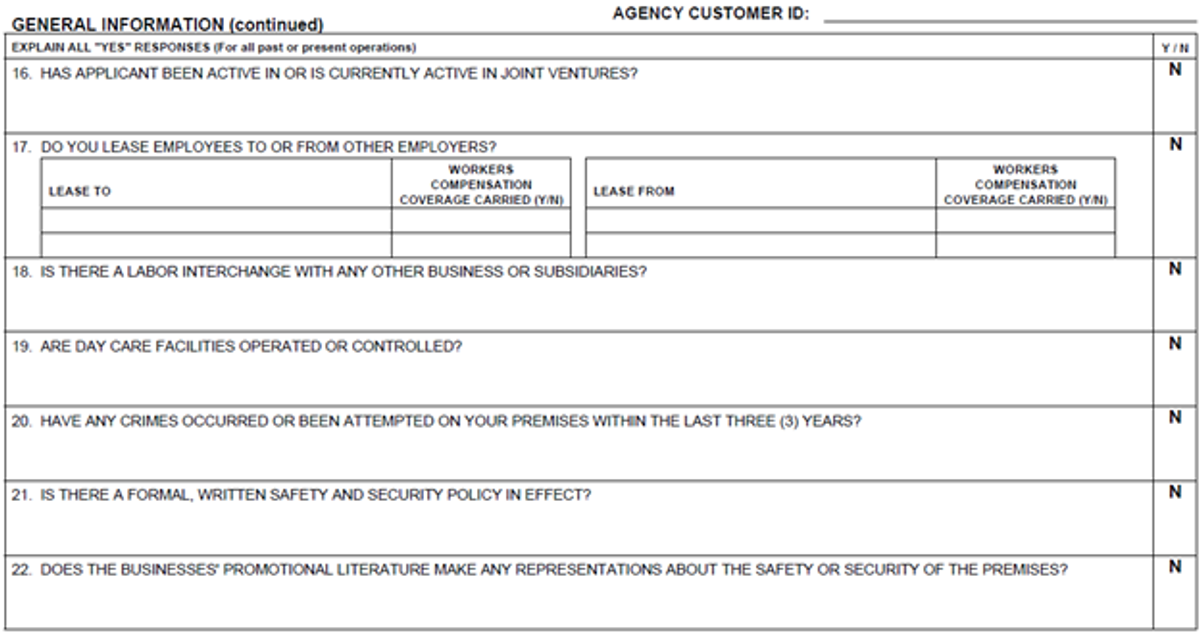

General Information

All applicants need to fill out the general information section. This is where insurance companies try to understand the true risk they’re covering through a series of 22 yes/no questions. The answers help your insurance company predict whether your operations could result in certain claims.

Remarks

The remarks section is where your broker might detail certain information about the policy or reference a certain form or application.

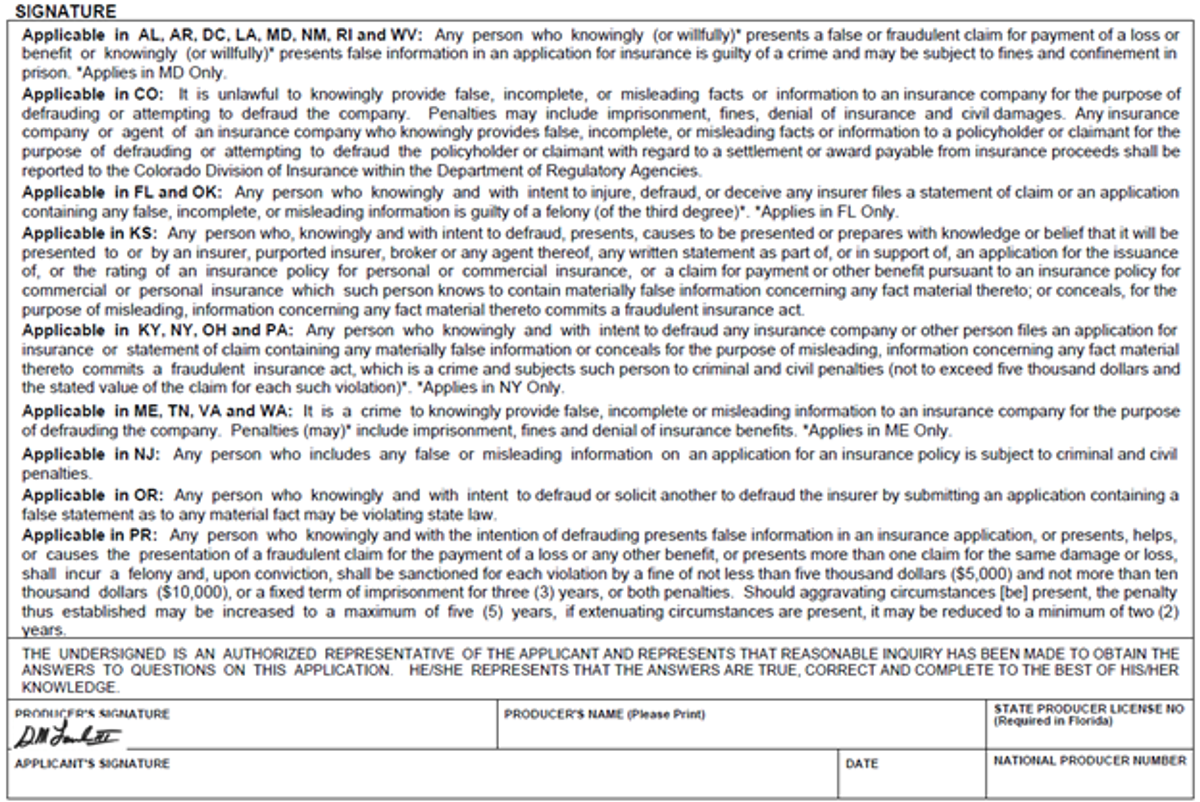

Signature

The final section of the ACORD 126 is for your signature. This section states that you are an authorized representative of the company, are authorized to sign, and the application is correct to the best of your knowledge.

Get Quality Coverage That You Can Afford

Fill out the form below and get a free quote in 5 minutes.

Summary

The ACORD 126 form is a necessary application that you will frequently see if you purchase commercial general liability insurance. If you need help filling out this application or are unsure about what you are signing, let us know.

About The Author: Austin Landes, CIC

Austin is an experienced Commercial Risk Advisor specializing in property & casualty risk management for religious institutions, real estate, construction, and manufacturing.