What Is Completed Operations Liability Insurance?

Completed operations liability is an insurance coverage typically included on most commercial general liability (CGL) policies. It pays for damages caused by your work that occur after you complete a job. This coverage is most often utilized by construction companies.

Unlike your standard general liability coverage, you do not need to be on the client’s premises to trigger coverage. This is why completed operations liability insurance is so critical for contractors. As they complete more and more jobs, they increase the chance that their work will harm someone.

For more information on contractor insurance and our recommended coverages, visit our guide to contractor insurance.

What does completed operations liability insurance cover?

Completed operations insurance coverage is highly integrated into the general liability policy, and it is subject to many of the same coverage triggers and exclusions. The difference between completed operations insurance and other insurance is that completed operations insurance strictly covers liability arising from work you have already completed, rather than work that is in process.

This policy covers:

- Damage your completed faulty work causes to others’ property

- Bodily injury your completed faulty work causes to someone

- Legal bills for a lawsuit alleging either property damage or bodily injury

Are you fully covered for a completed operations situation?

Let's find out. Fill out the form below for a free quote. Available in most states.

Although your defense costs are usually unlimited, the settlement or judgments the insurance company is obligated to pay is restricted to the per occurrence and completed operations aggregate listed on the declarations page.

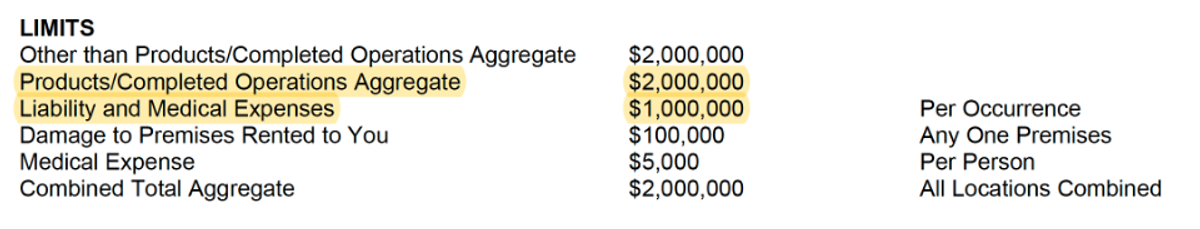

Here is an example of those limits:

As you can see, each claim can have a maximum payout of $1,000,000 per incident and a cap of how much the insurance policy will ever pay (even with multiple claims) of $2,000,000.

If you are working on large buildings or a significant quantity of projects, we suggest purchasing an excess liability policy to increase not only the per occurrence limit, but also the completed operations aggregate.

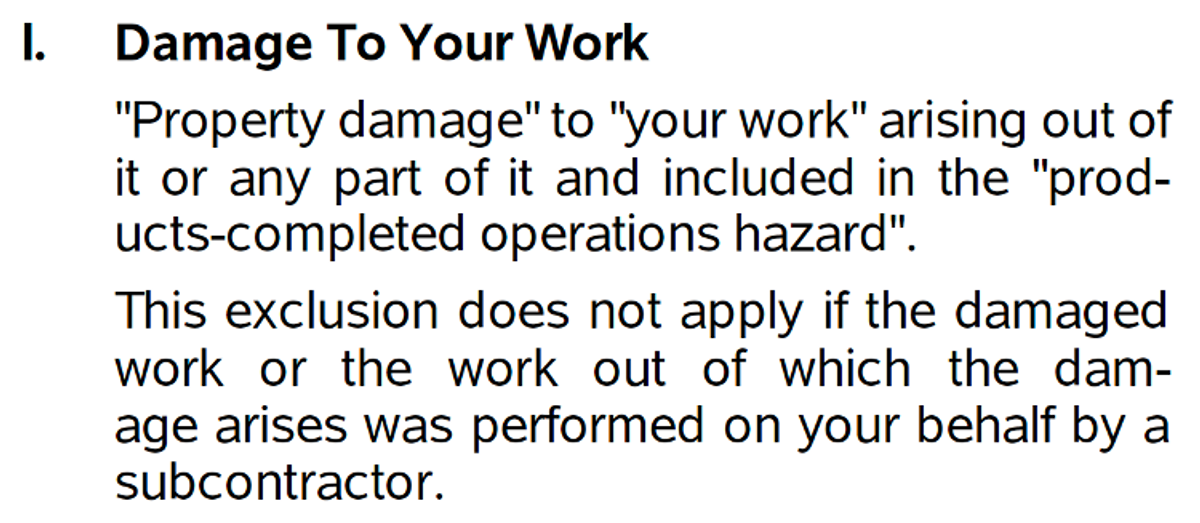

Bear in mind there are some situations that are not covered. The most common of these is the “Damage To Your Work” exclusion.

This is what it looks like:

Although completed operations coverage includes liability arising from damages to other property, it does not replace your completed work which caused all the damage in the first place. For example, if your faulty electrical work caused a fire, it would pay for damages resulting from the fire but not replace the electrical work that caused the fire. It won’t pay you to do the work a second time.

That being said, this exclusion does raise some concerns for contractors who utilize subcontracted labor. If you hire a subcontractor, is it your work or the subcontractor’s work? If faulty work caused by one subcontractor damages the work of a separate contractor, will the policy pay to replace subcontractor work?

Here is what the policy would pay from a general contractor’s perspective:

- Property damage to your work resulting from your own work: Excluded

- Property damage to a subcontractor’s work when the damage results from your work: Covered

- Property damage to a subcontractor’s work when the damage results from that subcontractor’s work: Covered

- Property damage to a subcontractor’s work when the damage results from the work of another subcontractor: Covered

- Property damage to your work when the damage results from your subcontractor’s work: Covered

This seemingly small detail only accounts for a sentence on the policy, but in reality this could be millions of dollars on a large project.

Concerned about the cost of claims?

We have helped businesses find the right coverage at the lowest price for 100 years. We can help you, too.

Completed Operations Claim Examples

Plumbing Contractor

A plumbing contractor is hired to install a sink for a residential home remodel. Six months after the project is completed, the homeowner finds that a portion of their home has standing water in it.

After hiring a disaster restoration team to clean up the water, it is determined that the leak arose from faulty work caused by the plumbing contractor hired to do the sink.

All in all, there is over $50,000 worth of water damage and cleanup expenses.

Luckily, the plumbing contractor had completed operations liability. This covered all the damages caused to their client and also paid for the plumber’s legal defense team in the ensuing lawsuit. However, it did not pay to replace the faulty plumbing.

Electrical Contractor

An industrial manufacturing purchases a building to house their heavy manufacturing processes. After the purchase, it is determined that more electricity is needed than the building can safely handle.

The manufacturing company hires an electrical contractor to refit the building with new electrical equipment and wiring.

A couple years after the project is completed, the entire building burns down in an electrical fire. The building and the expensive machinery inside are a total loss.

The manufacturing company sues the electrical company for the amount necessary to replace the building and the equipment, as well as pay for their lost revenue in the process.

The electrical contractor knows that the work that they performed would not cause this fire, but that doesn’t stop the lawsuit. The completed operations coverage pays for all the defense costs and expert witnesses necessary to get the lawsuit dismissed. The total defense costs total $150,000, but are taken care of by the insurance company.

Grading Contractor

A local family purchases a one-acre lot in an established neighborhood with the goal of building a custom home. After coming up with the design and deciding on a builder, the first thing their builder does is hire a contractor to grade the land.

Fast forward a year. The house is complete and the family has moved in. There is an awful storm that results in record rainfall and flooding.

The neighbors call the family and notify them that when the contractor graded the dirt in their yard, they did so in a way that changed the flow of water drainage. This change caused the neighbor’s house to flood. The new drainage path also caused significant erosion to the family’s property.

The family contacts the builder and the builder files a claim under their completed operations insurance. Remember, subcontractor work is covered, so their policy will pay for the damage caused by the water diversion and the erosion of the land.

Completed Operations Considerations

If you plan to close your construction business, you should continue to purchase completed operations for a couple of years.

Even if you retire or move on from your business, you still face liabilities associated with your completed projects. The positive news is that with each year that passes, the probability of anything happening decreases.

We suggest that you purchase a small policy to cover the completed operations exposure while you wind the business down. This policy will be very appreciated if a past project goes wrong!

You might have a contractual obligation to keep completed operations insurance years after a project concludes.

Some project owners or general contractors will require you contractually to carry completed operations insurance for a certain number of years after a project concludes. It is important to know what coverages you are contractually obligated to purchase.

For example, if you know you have to purchase this coverage for the next five years, you might implement certain risk management or quality checks to limit the number of claims that you turn in. This is because if the claims result in a large premium increase, you still have to purchase the (much more expensive) coverage.

Even though your subcontractors list you as an additional insured, that doesn’t mean it includes completed operations.

Many general contractors assume that having a subcontractor add them as an additional insured means that that coverage will extend to completed operations, too.

Unfortunately, this is not the case. To have coverage under someone else’s completed operations insurance, you must ask for a specific additional insured endorsement: the CG2037. This includes completed operations in the additional insured coverage.

Summary

Completed operations insurance is must-have insurance coverage for every contractor. If you are unsure whether your business has a significant completed operations risk, or if you need help reviewing the exclusions on your policy, let us know.

About The Author: Austin Landes, CIC

Austin is an experienced Commercial Risk Advisor specializing in property & casualty risk management for religious institutions, real estate, construction, and manufacturing.