Non-Profit Foundation Insurance: Cost & Checklist

·

3 minute read

Foundations may exist to give money away, but that does not make them immune to risk. When you steward endowments, award grants, and host fundraising events, one lawsuit or wire‑fraud incident can drain years of charitable work overnight. This guide explains why insurance matters, which policies protect modern foundations, and how to secure robust coverage without overspending.

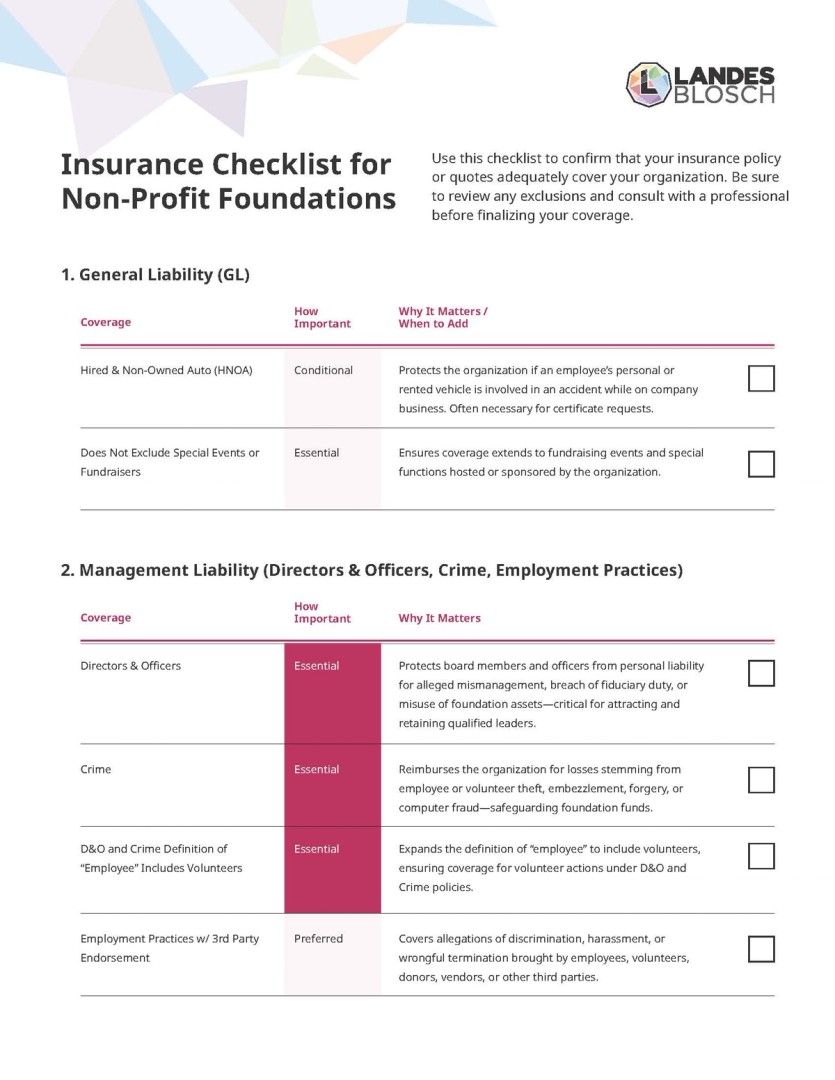

Download: Insurance Checklist for Non-Profit Foundations

Download our free checklist of insurance coverages that non-profit foundations should have!

Why You Need Insurance As A Foundation

Your Board Members Need It

Even well‑run boards face accusations of misallocating funds or violating their fiduciary duty to the organization. Directors & Officers (D&O) coverage shields individual board members’ personal assets when those allegations surface.

Attractive Target for Theft & Cyber Crime

A foundation’s balance sheet can tempt internal embezzlement and external wire‑transfer fraud. Crime and Cyber policies reimburse stolen funds and data‑breach response costs.

Public‑Facing Events Create Physical‑World Risk

Galas, charity runs, or volunteer activities still carry slip‑and‑fall liability. General Liability and Umbrella limits address bodily‑injury and property‑damage claims.

Grant & Donation Contracts Often Require Proof of Coverage

Major donors may insist on certificates of insurance before releasing funds or partnering on programs.

Ready To Get A Quote?

Complete our quick online quote or schedule a call with a specialist to get covered.

Insurance Policies Foundations Need

| Policy | What It Covers | Why Foundations Need It |

|---|---|---|

| Directors & Officers (D&O) | Allegations of wrongful acts, mismanagement, or breach of fiduciary duty against board or officers. | Protects personal assets of volunteer board members and attracts high‑caliber directors. |

| Crime | Employee or volunteer theft, embezzlement, fraudulent electronic fund transfers, forgery. | Foundations manage liquid assets—prime targets for internal and external theft. |

| General Liability (GL) | Bodily injury & property damage occurring in the physical world (e.g., donor trips at an auction). | Required by many venues; forms the backbone of event liability protection. |

| Cyber Liability | Data‑breach response, ransomware payments, notification costs, regulatory fines. | Even small donor databases contain PII that attackers can monetize. |

| Employment Practices Liability (EPLI) | Claims of discrimination, harassment, or wrongful termination of staff or volunteers. | Grants and scholarship decisions can spark discrimination allegations. |

Pro Tip: Purchase a comprehensive Management Liability package that combines D&O, Crime, and EPLI (and often Cyber) under one set of seamless wording. Secure this bundle first, then layer in GL and Umbrella for event‑related risk.

Pricing Snapshot (Real Quotes We’ve Placed)

| Foundation | Assets | GL/Umbrella | D&O | Crime | Cyber | Annual Total | Monthly Cost |

|---|---|---|---|---|---|---|---|

| Traumatic Brain Injury Research Foundation | $5m | $1,018 | $2,200 | $1,310 | $2,955 | $7,483 | $624 |

| Family Medical‑Grant Charity | $2.5m | $400 | $1,070 | $1,470 | $123 | ||

| Rural‑Town Scholarship Fund | $500k | $500 | $491 | $1,000 | $1,991 | $166 |

Best Insurance Providers for Non-Profit Foundations

If you steward grants, endowments, and public-facing programs, the right insurance partner can save your mission time, money, and stress when something goes wrong. Below are providers well-suited to foundations, with nonprofit-friendly options across D&O, EPLI, Crime, Cyber, and General Liability.

| Provider | Why it's a good fit | Get a quote |

|---|---|---|

| LandesBlosch | Foundation-savvy advisors who can bundle Management Liability (D&O/EPLI/Crime) and Cyber, align coverage with grant/donor requirements, and address event and volunteer exposures. | → Request a Quote |

| Philadelphia Insurance Companies (PHLY) | Dedicated nonprofit & human services programs with a strong management liability suite (e.g., D&O/EPLI/Fiduciary) plus GL and related coverages; built-in nonprofit enhancements like volunteer consideration and third-party EPL (eligibility varies). | Contact via LandesBlosch for a custom quote |

| Chubb | Deep private/not-for-profit management liability offering with robust EPL risk-management resources; scales from small community foundations to large institutions. | Contact via LandesBlosch for a custom quote |

| USLI | Nonprofit-focused D&O/EPLI and complementary GL options; support for exposures common to charities and foundations, including events, volunteers, and donor-facing operations (eligibility varies). | Contact via LandesBlosch for a custom quote |

Why LandesBlosch Leads This List

Nonprofit risk isn’t one-size-fits-all. We design board-level protection for fiduciary and grant-making exposures, tighten crime and cyber around wire-transfer and donor-data risks, and coordinate event/volunteer liability—then benchmark carriers like PHLY, Chubb, and USLI to fit your budget and governance needs.

The Bottom Line

Insurance isn’t a luxury, it’s fiduciary duty. Pair an iron‑clad Management Liability package with General Liability and you’ll mitigate 95 % of the exposures foundations face today. Skipping coverage to save a few hundred dollars now can jeopardize millions earmarked for your mission later.

Non-Profit Foundation FAQ

About The Author: Austin Landes, CIC

Austin is an experienced Commercial Risk Advisor specializing in and leading LandesBlosch's design professional, real estate, and construction teams.