Contractors Pollution Liability (CPL) - What To Know

As political tensions rise around global warming and environmental regulations increase, it becomes more important for contractors to purchase pollution liability insurance.

It is a coverage that we suggested for contractors in our article, “A Guide To Contractor Insurance In 2021.” The risks of a pollution incident have the potential to bankrupt contractors, even those with strong balance sheets. Which is why we believe this coverage is critical for established contractors today, and even more so into the future.

According to Risk & Insurance in their article, "4 Reasons Pollution Claims Are Rising in Frequency and Severity," pollution claims are getting worse, and we should not expect this trend to slow down anytime soon.

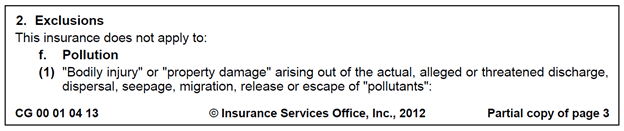

To clarify what we mean by “worse,” the number of incidents are increasing in both frequency and severity. And unfortunately, the most common policy that contractors hold (the commercial general liability policy) offers no coverage for these incidents due to this exclusion:

If you have commercial general liability coverage, review your program and determine the quality of your insurance policy. If you do not have contractor’s pollution liability (CPL) insurance, this article explains how it could help your business and how to get the best deal on this coverage.

Looking For Contractors Pollution Insurance?

We can help! Get started below for a free quote. Available in most states.

What types of contractors need pollution liability coverage?

Although not exhaustive, here is a list of the different contractors in four different categories who need CPL pollution insurance.

Construction Contractors

- Managers

- Demolition and general

- Homebuilders / developers

- Marine

- Street and road

Environmental Contractors

- Abatement

- Environmental remediation

- Site restoration

- Cleanup

- Emergency spill response

Operations And Maintenance Contractors

- Airport fueling

- Maintenance

- Plant operations

- Wastewater

- Sewer and utility

Trade Contractors

- Aboveground and underground storage tanks

- Electrical

- HVAC

- Industrial

- Mechanical

- Pipeline

What does contractor’s pollution liability insurance cover?

Contractor’s pollution insurance pays for damages that you become legally obligated for as a result of a "pollution incident" arising out of your activities.

If you examine the policy language, the term "pollution incident" means:

a. Discharge, dispersal, seepage, migration, release or escape of pollutants into or upon land, the atmosphere, or any watercourse or body of water; orb. Inhilation of, injection of, contact with, exposure to, existence of, growth or presence of fungi or microbes;That results in bodily injury or property damage.

A common misconception is that a pollution incident hasto involve some sort of harmful chemical or oil spill. But that is simply not true! A pollution incident is putting any substance somewhere it doesn't belong. For example, if you were to spill milk into a body of water, it could be a pollution claim. The EPA even has an entire page about it.

Different Ways To Purchase Contractor’s Pollution Liability Insurance

As with many forms of insurance, there are usually multiple ways to get the coverage. For contractor’s pollution liability coverage, there are two common ways:

Add it to your general liability insurance.

Depending on the coverages you want, the limits of liability you need, and your general liability insurance carrier, adding pollution liability to your general liability policy might be the best choice.

This is not an option offered by most insurance companies, but some (usually those with experience in the energy industry) can indeed include CPL an add-in to your general liability policy. Usually, this is a limited pollution policy, but sometimes it has what you need and costs much less than purchasing a stand-alone policy.

Purchase a stand-alone policy.

The stand-alone pollution liability policy has the best coverage of the two options. It is more customizable and offers higher limits of insurance. If you have any substantial pollution risks, we always suggest getting a stand-alone pollution program.

Reasons Why Contractors Purchase Pollution Liability Coverage

There are plenty of reasons why contractors would need pollution liability insurance, but here are the ones we most commonly hear about:

Project Requirements

Contractors often need pollution liability insurance because the project requires it.

This is becoming more standard with large building projects, but if you are an oil and gas contractor, this coverage is likely a requirement for any project.

Legal Costs, Penalties & Pollution Expertise

If you have ever dealt with the EPA on a pollution dispute, you know how expensive and time-consuming of an ordeal it can be.

Contractors often purchase pollution liability insurance to help them handle lawsuits, both the legal costs and processes. It’s critical to have an experienced team help you get through the lawsuit in a way the business can survive.

Cleanup Costs

Cleaning up a pollution incident can be massively expensive. From environmental testing to hiring contractors to aid in the cleanup, it is a financial ordeal that can last months or even years.

Pollution liability insurance helps you pay for the cleanup costs and assists you through the cleanup process.

Coverage Considerations

Transportation

AmWINS Group, the nation’s largest insurance wholesaler, sums up the problem with contractors and transportation pollution in the article titled "Transportation Pollution Liability: From Point A to B and In Between":

"When a cement truck turns over and pollutes a stream, how is that insured's exposure addressed? If a freight hauler is unloading drums of soap and one of those drums turns over and spills into a storm drain, how will the insured be protected? ... While unendorsed contractor's pollution liability ("CPL") policies may include coverage for vehicle use at a jobsite, they typically offer little or no coverage for transportation exposures away from a jobsite."

If you’re a contractor with transportation operations, ask your broker to include transportation pollution liability (TPL) coverage on your contractors pollution liability insurance policy to protect you from these risks.

Non-Owned Disposal Sites

Citing regulations found under the Comprehensive Environmental Response, Compensation and Liability Act (CERCLA), parties found to be responsible for contaminating disposal sites may also be liable for any pollution incident that happens at the site, whether you own the property or not.

Even if you were 1 of 100 different contractors who dumped material at a disposal site, the EPA has the right to collect the full cost of cleanup from a single contractor (usually the one with the deepest pockets).

Non-owned disposal coverage adds these sites you don't own, but use for disposal, to your pollution liability policy.

Occurrence-Based Claims Form

In this article we review what a claims-made insurance policy means and the negatives that go along with a policy like that. Most contractors pollution liability insurance policies are written on this form.

Essentially, a claims-made policy states that you have to submit a pollution claim during the same policy period (however long you have had the pollution policy with the same insurance carrier) that the pollution incident happened.

The problem is sometimes you don't know a pollution incident has occurred until years later, and if you switched insurance companies and didn't purchase a tail policy…you are out of luck.

With an occurrence-based pollution insurance policy, you have an unlimited time period to discover and report the claim if the incident occured while the policy was active.

Due to the nature of pollution and the delayed discovery period, we suggest looking into an occurrence-based policy. If one is not available (or price prohibitive), talk to your insurance broker about what a claims-made policy means for your business.

Best Contractor's Pollution Liability Insurance Companies

CNA Insurance

One of the most widely held insurance programs for contractors pollution liability is the CNA pollution liability program. In addition to low minimum premiums, this provider offers coverage for generation, transportation, storage, and disposal of pollutants (for both owned and non-owned sites). This program is usually a great value for your money and is a popular choice among contractors.

Tokio Marine

Tokio Marine (often referred to as PHLY E&S), specializes in contractor’s pollution liability insurance. As recommended above, Tokio Marine can offer all the additional coverages of transportation pollution and non-owned disposal sites, on an occurrence-based form. Tokio Marine serves a wide variety of contractors, such as:

- General contractors

- Roofers

- Utility Contractors

- HVAC/Mechanical

- Street and Road/Highway

- Electrical/Plumbing

- Painting/Weatherization

- Design/Build Contractors

- Construction Managers

- Masonry/Concrete

- Excavating/Grading

- Steel Erectors

- Water/SewerCarpentry

- Drywall

- Demolition

Summary

Contractor’s pollution liability insurance is a policy that contractors need and will become more important as environmental regulations tighten up in the future.

If you have any questions about your current CPL insurance policy or are looking to purchase your first, let us know. We can walk you through the process and help you pick the best insurance coverage for your business.

About The Author: Austin Landes, CIC

Austin is an experienced Commercial Risk Advisor specializing in property & casualty risk management for religious institutions, real estate, construction, and manufacturing.

THE INFORMATION ON THIS WEBSITE IS PROVIDED FOR INFORMATIONAL PURPOSES ONLY. Nothing on this website should be construed as a solicitation, proposal, offer, recommendation, endorsement, or advice regarding any insurance product. The information on this website is of a general nature and is not intended as a substitute for individual consultation with a licensed insurance professional. In no event will we undertake to advise you regarding your need for any insurance product. YOU ARE RESPONSIBLE FOR DETERMINING WHAT INSURANCE PRODUCTS YOU NEED AND IN WHAT AMOUNTS, BASED ON YOUR UNIQUE EXPOSURE TO RISKS AND ABILITY TO BEAR LOSSES. We are licensed insurance brokers in the following states: WA, OR, ID, MT, WY, CA, NV, UT, AZ, CO, MN, SD, NE, KS, OK, TX, IA, MO, AR, LA, WI, IL, KY, TN, MS, IN, GA, FL, OK, VA, NC, SC, DE, MD, DC, NJ, CT, RI, VT, NH, PA, and ME. Insurance products and features are subject to underwriting criteria and may not be available in all states.