Tail Insurance Coverage - What Is It?

“Tail coverage” is an optional insurance provision found on a claims-made policy. It allows the insured to report claims against a policy for a specified period after the policy has expired.

It is critical to understand that this provision is not found on every insurance policy. It exists only on claims-made policies.

Need Help From An Expert?

Schedule a call to talk or get started on a quote today.

But what is a claims-made policy, and how do you know if you need tail coverage insurance?

Here is everything you need to know.

The Difference Between Claims-Made Vs. Occurrence-Based Insurance Policies

The difference between a claims-made and occurrence-based policy has less to do with coverage and more to do with how much time passes between when a claim happens and when you report it to the insurance company. Both occurrence and claims-made policies can cover the same perils, but have different outcomes.

Before we dive deeper, let’s discuss the three relevant components to reporting a claim.

Occurrence: An occurrence is when the claim occurs. For example, if someone slips and falls on your property, the occurrence is the exact moment of the slip and fall. The occurrence is not when the lawsuit is filed, and not when you first become aware of it.

The Discovery: The discovery is the moment you find out about an occurrence. This often happens after the occurrence.

The Reporting: The reporting is the action of telling your insurance company about the occurrence. This should directly follow the discovery of the claim.

Now that you know the components, here are how they differ on each type of insurance policy:

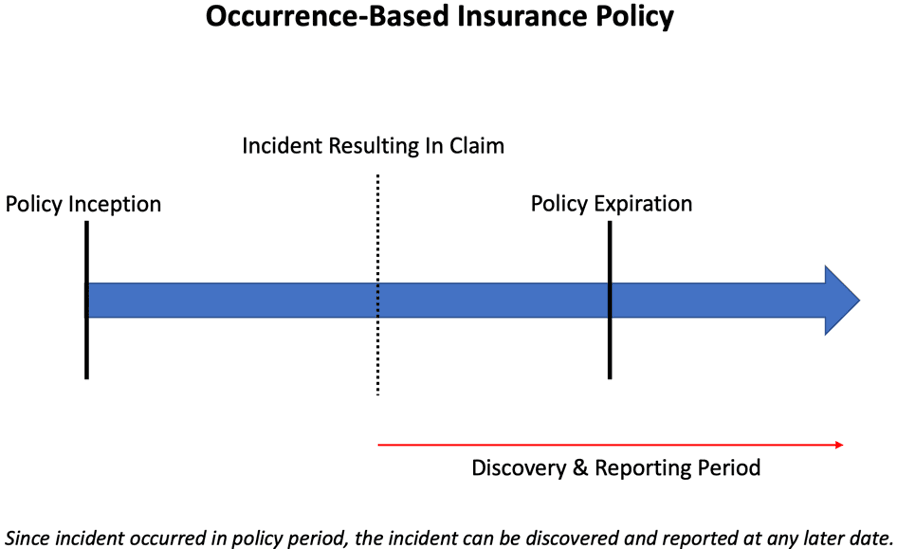

Occurrence-Based Liability Insurance

In general, the occurrence policy is the better form of the two policies. It allows you an unlimited amount of time to discover and report the claim, even if the policy you had when the claim happened has expired.

Here is what we mean:

The red arrow indicates that the discovery and reporting date extend indefinitely. This is the simpler policy; it makes it easier to change insurance providers and it provides the most coverage.

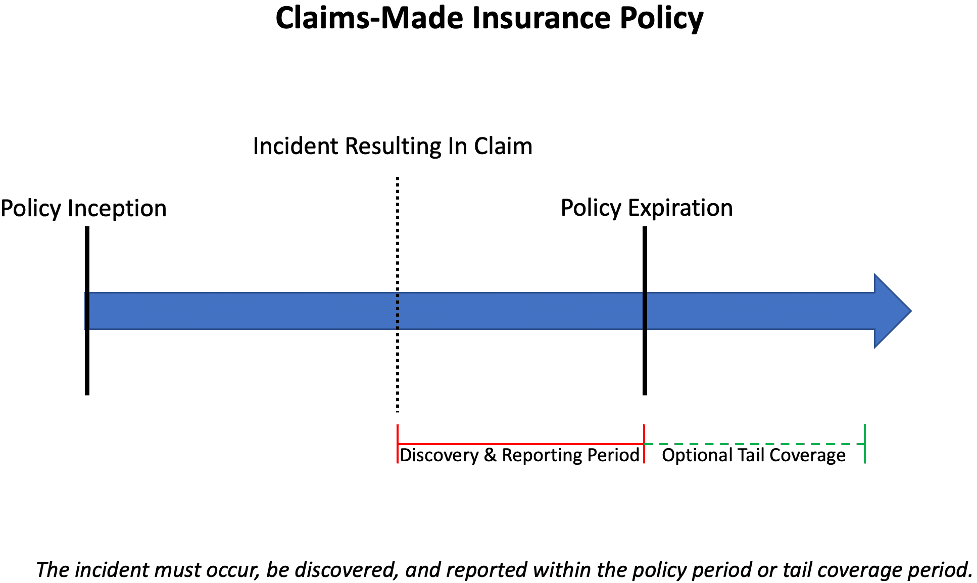

Claims-Made Liability Insurance

Although claims-made insurance policies are a little more complicated, they are unavoidable in certain types of coverage.

If you have a claims-made policy, the claim has to occur, be discovered, and be reported all within the policy period. However, that policy period extends for the length of time you had insurance with that same company. For example, if you maintained professional liability insurance from 1/1/2005 to 1/1/2015 with the same insurance company, the policy period would be for 10 years.

As indicated in the illustration, optional tail coverage extends the discovery and reporting dates to include a date range outside the policy period.

Common Claims-Made Insurance Policy Types

Tail insurance coverage isn't necessary on every insurance policy because not all policies are on a claims-made basis.

Here are the common policies that could benefit from the addition of tail coverage insurance:

- Errors & Omissions/Professional Liability Insuranc

- Directors & Officers Insurance

- Employment Practices Liability Insurance

- Crime Insurance

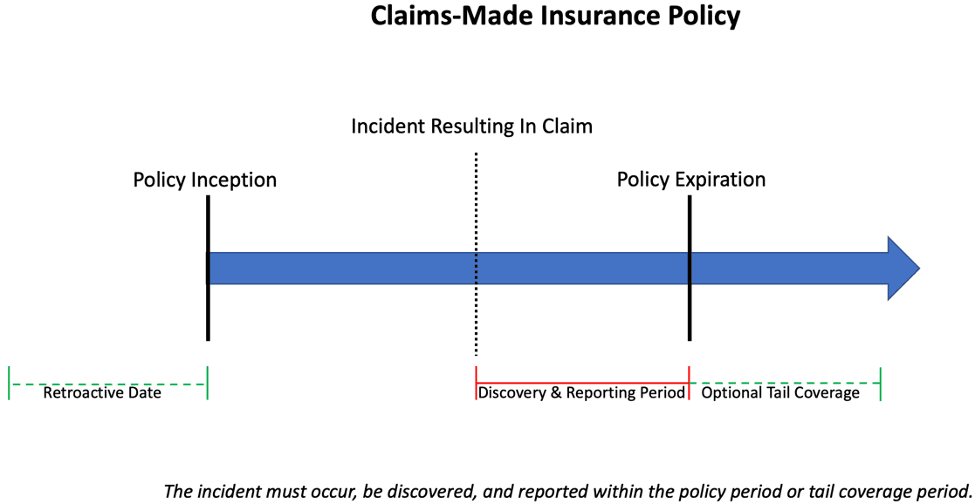

What is the difference between retroactive coverage and tail coverage?

Many purchasers of these policies don’t know they have options when it comes to filling in the claims-made coverage gap. In fact, the alternative, called “retroactive coverage,” can often be better than purchasing the tail coverage.

In contrast to tail coverage, which allows you to extend the reporting period of a claim, retroactive coverage allows you to cover incidents that might have happened (but you are unaware of) before the inception date of the insurance policy.

LandesBlosch Recommendation: Purchase "Full Prior Acts Coverage," If Available.

When purchasing a claims-made insurance policy, we recommend requesting that the new policy include "full prior acts" coverage. This is an agreement that the new insurance company will cover all covered incidents that occurred in the past that you have not yet discovered or reported.

If you are in a particularly high-risk industry or have had previous claims, you will often not be offered this coverage. We suggest looking into it anyway and asking for a price. It is frequently priced either competitively or better than the tail coverage alternative. Many carriers will offer full prior acts as a way to win the business.

When do you need tail insurance coverage?

Tail coverage is not something you will normally purchase. It is an optional coverage that you will need when a compelling event comes along that causes you to cancel the insurance that you currently have.

Here are a few examples:

1) You are changing insurance companies.

The most common example of when companies need tail insurance coverage is when they are switching insurance carriers for either a better deal or better coverage.

When ending one insurance policy and switching to another, you will need to purchase a tail or retroactive coverage so that claims that have occurred, but you do not yet know about, are covered by the old policy or the new policy.

2) You are closing the business.

If you own a company that has a claims-made policy, you still have risks that you could be liable for when you close the doors.

As an example, let’s say you are an accountant and make an error that a client does not discover until a later date. This error leads to a financial loss for the client. You may have closed your practice, but they can still sue you.

As businesses close, they often purchase tail coverage that will last for a couple of years. This allows them to report any claims that occurred while the business was still open.

3) You change your business operations.

Not every operation that a business performs requires a claims-made policy. If you performed certain high-exposure tasks but no longer do so, you can purchase a tail so that a claim arising from previous work is covered into the future.

How much does tail insurance coverage cost?

The cost of the tail can vary by insurance company. It is priced per year of coverage in addition to the policy expiration date. Standard tail pricing is roughly 100% of the annual premium of the expiring insurance policy.

How long should tail coverage last?

We generally suggest that the tail coverage last as long as the statute of limitations in each state. This allows a claim to happen within the policy period and to lengthen the reporting timeframe so a suit cannot be brought against you. We highly recommend that you look at the risks that your business may face and purchase a tail that reflects your operations and state laws.

Summary

Managing tail and retroactive coverages on a claims-made policy can be very complex. If you want a review of your current insurance program and advice on how to handle purchasing tail coverage, let us know.

About The Author: Austin Landes, CIC

Austin is an experienced Commercial Risk Advisor specializing in property & casualty risk management for religious institutions, real estate, construction, and manufacturing.

THE INFORMATION ON THIS WEBSITE IS PROVIDED FOR INFORMATIONAL PURPOSES ONLY. Nothing on this website should be construed as a solicitation, proposal, offer, recommendation, endorsement, or advice regarding any insurance product. The information on this website is of a general nature and is not intended as a substitute for individual consultation with a licensed insurance professional. In no event will we undertake to advise you regarding your need for any insurance product. YOU ARE RESPONSIBLE FOR DETERMINING WHAT INSURANCE PRODUCTS YOU NEED AND IN WHAT AMOUNTS, BASED ON YOUR UNIQUE EXPOSURE TO RISKS AND ABILITY TO BEAR LOSSES. We are licensed insurance brokers in the following states: WA, OR, ID, MT, WY, CA, NV, UT, AZ, CO, MN, SD, NE, KS, OK, TX, IA, MO, AR, LA, WI, IL, KY, TN, MS, IN, GA, FL, OK, VA, NC, SC, DE, MD, DC, NJ, CT, RI, VT, NH, PA, and ME. Insurance products and features are subject to underwriting criteria and may not be available in all states.