What Is A Certificate Of Liability Insurance (COI)?

If you run a business, chances are you’ve been asked to provide a certificate of liability insurance (COI) to a company you are working with. Some of you reading this might even be the party requesting a certificate of liability!

Need a certificate of insurance?

We can help, in as little as 5 minutes. Get an instant quote or call us today. Available in most states.

A certificate of liability insurance is proof that you possess liability insurance coverage. This document describes the types of liability coverage you have; it also details the coverage and provides information about the insurance company issuing the coverage.

People and businesses require this certificate of insurance because hiring an uninsured business to perform work for them could lead to big consequences.

This document assures those you do business with that you are insured. Additionally, if they need to sue you (or if a separate party files a lawsuit against both of you), the insurance company will pay for the damages.

The certificate of liability insurance packs as much information as it can on a single page. This can make the document tricky to read and hard to understand if you don't know what you’re looking at.

Here is everything you need to know about providing a certificate of insurance for liability.

Why do companies request a certificate of liability insurance?

Each company might have a different reason to request a certificate of insurance. As a general rule of thumb, parties will request a certificate if they think doing business with you exposes them to risk.

Here are some common business relationships that will often require certificates of insurance on file:

Landlords

When you lease a building (or part of a building) and run your business from it, your presence exposes your landlord to certain risks.

For example, if you had a customer on your premises trip and fall in the building, that customer might sue both you and the landlord for the resulting damages.

The risks can be even greater. If you don’t have a general liability policy and you burn down the building by accident, your landlord has less chance at reparation for the damaged property.

Vendors

Certain suppliers or vendors might require you to provide a certificate of liability insurance to ensure that they will be covered if you harm their business or harm a customer as you use their products.

General Contractors

If you do construction work for a general contractor, you will almost certainly have to deal with certificates of liability insurance.

When something goes wrong on a project, general contractors want to know that your insurance policy will cover problems resulting from the work you performed.

Property Owners/Managers

In addition to general contractors, property owners will often require certificates of liability if you are working directly for them. Sometimes both the general contractor and property owner will request them at the same time.

Property owners want to know that if your work causes damage to their property, your insurance will pay for repairs.

Banks

Although it is common for banks to request a certificate of property insurance, they will often want a certificate of liability insurance as well.

Since they have an interest in the property that you are financing through them, they want to know that your insurance will cover them if a lawsuit arises from that property's operation.

Business Relationships

Sometimes close business relationships just want a certificate of liability insurance. Usually, large companies with risk management or compliance departments will require all vendors to file a certificate regardless of what tasks you are performing.

What information is included on the certificate of insurance?

Certificates of liability insurance are almost always provided on the Acord 25 form, a standardized document that the insurance industry uses to provide proof of insurance.

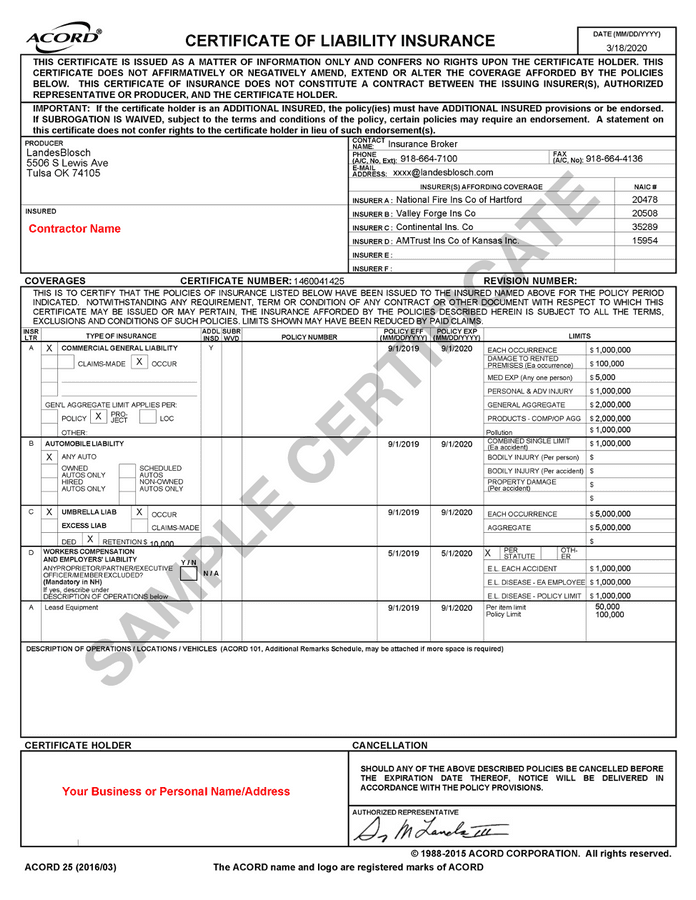

Here is an example of one:

As you can see, there is a lot of information packed on that certificate. There’s a lot to digest, but first, let’s discuss the details that almost everyone requesting a certificate of insurance from you will look at.

1. Insured Name/Address

This is information about your business. The information on the certificate must match the information you provided when you registered your business with your state.

The name on your certificate also needs to match the company name provided to the party requesting it.

If your name on the certificate differs any from the name you gave to the party requesting it, the certificate might get rejected.

2. Broker Information

The certificate provides your insurance contact information so a reader can verify coverage or contact your insurance broker team.

3. Insurance Company Information

One of the fundamental principles of insurance is that the insurance company is able to pay a claim if you file one.

Many companies that you work with will only do business with companies insured by insurance companies of a certain financial rating (usually a rating provided by A.M. Best).

The insurance company information and the NAIC # allow you to check these important details about the insurance companies you are working with.

4. Coverage Types And Information

The insurance certificate provides policy types, policy numbers, coverage limits, and policy expiration dates of each liability policy you have (or are willing to disclose).

The company requesting a certificate will compare this section against the coverages that you are contractually required to have.

5. Description Of Operations

This section can be the trickiest part of the certificate. The description of operations is the section where any customized coverage wordings are provided. You can list details about additional insured status, waiver of subrogation, primary and noncontributory, and more.

Sometimes insurance companies can request wording in this section that does not reflect the actual coverages in your insurance policy. For example, saying “General Liability in respects to all damages” cannot be on the certificate since all policies have some exclusions. It is important to only issue certificates that only include coverages on the actual insurance policy.

6. Certificate Holder

The certificate holder section is where the information about the company requesting a certificate is listed.

Issuing a certificate with a specific certificate holder in addition to the date the certificate is issued provides reassurance that the policy is in effect and the certificate is legitimate.

Common Certificate Requests

Although issuing a certificate of insurance is as simple as calling or sending your insurance broker an email, your policy may be adjusted to comply with a request.

In general, the more information you can provide about your insurance requirements, the better.

Here are three common requests that could hold up your certificate requests or require extra changes made to your insurance policies:

1. Additional Insured Endorsements

If you are performing work for a company, they will often require that you include them as an "additional insured" on your liability insurance policy.

Allowing a company to be added as an additional insured on your policy provides assurance to the company that your policy will cover you and them if a claim happens as a result of your operations.

2. Waiver Of Subrogation Endorsement

According to global insurance company Hiscox, "A subrogation claim is one in which the insurance company pays a claim for the insured, and then seeks reimbursement from a third party who had liability for the incident that led to the claim."

If it is determined that another party was negligent after paying for an insurance claim, the insurance carriers will seek money to help pay for the claim.

A waiver of subrogation endorsement waives the right of your insurance company to subrogate against anyone who requests this endorsement on your certificate of insurance.

3. Primary And Noncontributory Endorsement

Some companies might require that you have a primary and noncontributory liability policy. In a situation where multiple parties might be liable, your insurance policy will be the primary insurance policy that responds and will not seek contribution (a.k.a. noncontributory) from the certificate holder's insurance.

Commonly Made Mistakes

When issuing certificates of insurance, there is frequently back-and-forth between the insurance broker and the certificate holder.

Sometimes this is due to negotiations on the specific wording on the certificate; sometimes, the certificate holder doesn’t have the necessary coverage to comply.

Don't Make a Mistake in Coverage

Get options on the best insurance policies for your business.

Unfortunately, sometimes there are just mistakes or miscommunications. Here are some common ones:

1) "For Information Only" Certificates Don't Work

We often hear of contractors and small businesses asking for a certificate with the certificate holder left blank. Their goal is to hand out the certificate to all their customers to prove their insurance.

Although this might work if your customers are individuals and not companies, it is not a good practice. Companies can get stuck with higher insurance bills if they don't collect complete certificates of insurance in certain business dealings. A certificate with "insured copy" in the certificate holder line could leave them with a penalty on their insurance audit.

2. A certificate of liability insurance is different from a certificate of property insurance.

Sometimes a bank will request a certificate of insurance thinking it will be obtaining evidence of property insurance, not a certificate of liability insurance.

If you are leasing equipment or getting a loan on a piece of property, the bank will either ask for evidence of property insurance by itself or in combination with a certificate of liability insurance.

3. The certificate holder needs to be an exact entity name, not a "doing-business-as" name.

Just because you know a company as a certain name does not mean that is their corporation’s name. Companies frequently use DBA names for marketing purposes.

For example, AIG is one of the largest insurance companies in the world. Everybody knows them by this name, and when referring to the company, everyone says AIG. However, if you were to issue a certificate to them, you would need to list "American International Group, Inc" since that is their company name.

Tips and Tricks

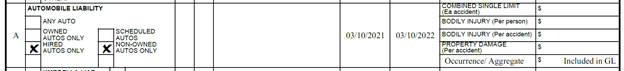

Include "hired and non-owned" coverage under the auto section if you do not own any business vehicles.

Many companies requiring a certificate of insurance will require you to have $1,000,000 of commercial automobile liability to start working together.

But what if you don't have any company vehicles?

A trick is to purchase hired and non-owned auto liability on your general liability policy and put that coverage in the automobile area of your certificate.

Here is an example of how this can be done:

Purchase "blanket" endorsements, if possible.

If you plan on issuing more than a couple of certificates each year, it is almost always wise to purchase a blanket additional insured endorsement.

This means that as long as someone contractually requires you to add them as an additional insured under your policy, your insurance policy automatically adds them.

This means that you can issue certificates quickly and easily, with no extra charges.

Generate the simple certificates via a mobile app or website

Most insurance agencies these days have a mobile app or an online portal where you can generate simple certificates of insurance instantly. You should ask the agency that you work with about these capabilities and if they offer this. Using this method, you should be able to comply with most of your certificates on your without having to wait for a team to generate them.

Keep in mind that for specific scenarios, you might still need to consult with your insurance agent. This applies to more complicated certificates, but if you have that "blanket" wording that we mentioned above on your additional insured endorsements this can make the process of getting certificates much more streamlined.

If you switch insurance companies, make sure the new company is capable of complying with your COI requirements.

Nothing is worse than spending your time shopping around for an insurance policy and purchasing one, only to find out later that the company is unable to comply with certain requirements. Whether it be certain endorsements or hard-to-find coverages, not every insurance company will be able to take care of all your certificate needs. Make sure to disclose what endorsements or certificate requirements you might have before you take an insurance policy.

Summary

Dealing with certificates of insurance can be a laborious task, and it will only become more of a hassle if your insurance policy isn't optimized for your business operations.

If you need a certificate of insurance, let us know. We can walk you through the process of generating a certificate and complying with insurance requirements.

About The Author: Austin Landes, CIC

Austin is an experienced Commercial Risk Advisor specializing in property & casualty risk management for religious institutions, real estate, construction, and manufacturing.

THE INFORMATION ON THIS WEBSITE IS PROVIDED FOR INFORMATIONAL PURPOSES ONLY. Nothing on this website should be construed as a solicitation, proposal, offer, recommendation, endorsement, or advice regarding any insurance product. The information on this website is of a general nature and is not intended as a substitute for individual consultation with a licensed insurance professional. In no event will we undertake to advise you regarding your need for any insurance product. YOU ARE RESPONSIBLE FOR DETERMINING WHAT INSURANCE PRODUCTS YOU NEED AND IN WHAT AMOUNTS, BASED ON YOUR UNIQUE EXPOSURE TO RISKS AND ABILITY TO BEAR LOSSES. We are licensed insurance brokers in the following states: WA, OR, ID, MT, WY, CA, NV, UT, AZ, CO, MN, SD, NE, KS, OK, TX, IA, MO, AR, LA, WI, IL, KY, TN, MS, IN, GA, FL, OK, VA, NC, SC, DE, MD, DC, NJ, CT, RI, VT, NH, PA, and ME. Insurance products and features are subject to underwriting criteria and may not be available in all states.