What Does General Liability Insurance Cover?

·

9 minute read

Imagine this: a customer slips and falls in your store, injuring their back. They decide to sue you for medical expenses and lost wages. Without the right insurance, this incident could cost your business thousands of dollars and potentially lead to bankruptcy. This is where general liability insurance comes into play. It acts as a financial safety net, protecting your business from the unexpected costs of accidents, property damage, and legal fees.

It isn't just slip and falls, though. General liability insurance can cover a wide variety of claims that can happen in a business. From a defective product that you manufacture and foodborne illnesses that you serve your customers to defamation lawsuits. General liability insurance is the foundation upon which businesses protect their business from the majority of negligence claims that can happen to them.

In this article, we will dive into the specifics of what general liability insurance covers and why it is a crucial component of your business risk management strategy.

Get Your Best Options For General Liability Insurance

Check out our options and create the perfect insurance plan. Get your free quote now.

What Commercial General Liability Covers

General liability insurance is designed to protect your business from a wide range of risks and unexpected events. There are 5 categories of coverages that the CGL insurance policy provides:

Bodily Injury

If a customer, client, or visitor gets injured on your business premises, general liability insurance can cover the medical expenses, legal fees, and any settlements or judgments if you are found liable. For instance, if a customer slips on a wet floor in your store and breaks their arm, this coverage helps manage the associated costs.

Property Damage

Accidents happen, and sometimes they result in damage to someone else’s property. General liability insurance covers the cost of repairing or replacing damaged property. For example, if one of your employees accidentally knocks over a valuable item in a client’s office, this insurance will cover the cost of the damage.

Personal and Advertising Injury

This part of the coverage protects against claims of libel, slander, copyright infringement, and advertising mistakes. If your business is sued for making defamatory statements about a competitor or for inadvertently using copyrighted material in your advertising, general liability insurance can help cover the legal costs and any settlements.

Medical Payments

Regardless of fault, general liability insurance can cover immediate medical expenses if someone is injured on your business premises. This is particularly useful for minor incidents, as it helps prevent them from escalating into more significant legal issues. For example, if a delivery person sustains a minor injury while dropping off goods at your location, this coverage can take care of their initial medical costs.

Legal Defense

In the event that a covered claim leads to a lawsuit, general liability insurance covers your legal defense costs, including attorney fees, and court costs. This ensures that a legal battle does not cripple your business financially. Whether it’s a small claim or a major lawsuit, having this coverage means you can focus on running your business without the constant worry of potential legal expenses.

An Example of a General Liability Claim

Leon owns a plumbing company called "Leon's Best Plumbing Company, Inc." Recently Leon's Best Plumbing Company, Inc was involved in a bathroom remodel for a residential customer. Later it was discovered that the pipes were installed improperly and consequently, the entire house was flooded causing $75,000 in water damage.

Would this be covered?

In most general liability policies, the damages outlined in this example would have coverage because it is "property damage" the insured caused a person or company.

What commercial general liability insurance doesn't cover

It would be nice if every business liability insurance policy were just the "insuring agreement." We would be able to save much paper and spend a lot less time reading over insurance forms. Sadly, this is not the case. The rest of the insurance contract is used to define and limit the coverage from all "bodily injury" and "property damage" to what the insurance company intends to cover. Each policy comes with its own set of unique exclusions. As a business owner, it is worth the time going over every exclusion on all insurance contracts.

Common Exclusions

- Expected or intended injury - The policy will not pay for claims that result from intentional damage. One cannot purposely cause bodily injury or property damage and expect a liability insurance policy to respond or settle the claim.

- Contractual liability - The insurance policy does not cover additional liabilities that you assume in a contract unless you would have been otherwise legally responsible without the agreement.

- 1st party damage - Business liability insurance is a 3rd party coverage that covers damage that you cause to other parties or entities. A liability policy will not cover bodily injury or property damage to yourself. Coverage for yourself and your property can be purchased via different types of insurance such as commercial property or workers compensation insurance.

- Damage to your product or work - The commercial liability insurance policy will not pay for or replace the work that you performed, only the work of others that your product or work damaged. This purpose of this exclusion is to prevent commercial general liability insurance from acting as a warranty policy. Using the claims example from above; Leon's insurance would cover damage to the house, but it would not pay to replace the work that his company installed incorrectly.

- Recall of products - Although other policies can cover this exposure, liability insurance will not pay for the costs associated with recalling your products.

- Electronic Data - This insurance will not pay for most claims arising out of the handling of electronic data. Electronic data coverage can be purchased on a separate cyber liability insurance policy.

How to check your exclusions

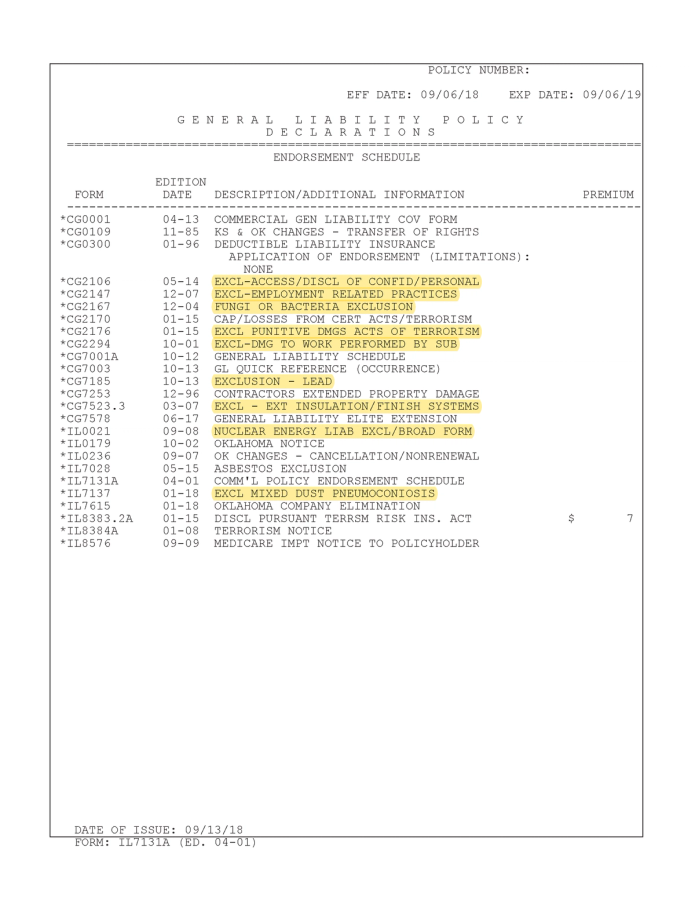

Below is an example of an endorsement schedule for a general liability policy that comes with every commercial insurance policy. On the liability policy, you want to look down the list and find the endorsements that say "Exclusion" or any variation of the word. I have highlighted the example below in the method just described. These are the items that you should keep track of and discuss with your insurance broker.

Every liability policy will come with exclusions. It is an unavoidable reality of commercial insurance. As a business owner, you need to know what those exclusions are so that you are more aware of your potential exposures. If any exclusion is a deal breaker, you can often find coverage with a separate policy or see if any insurance carrier will provide coverage with the terms you need.

Additional Tips & Considerations

Look for Premises/Operation Limitations

Frequently insurance policies will include an endorsement that limits coverage to a select location, operation, or both. The commercial general liability insurance policy will only cover the defined activities or areas that you provide to them at the onset of the insurance contract.

The presence of these endorsements are sometimes unavoidable, but both you and your insurance broker should be aware of these limitations. It would be best if you also let your broker know about any work that might not fall inside the limitation endorsement.

Look for Subcontractor Limitations

Usually listed as the CG 2294 endorsement, this excludes coverage to any independent contractors or subcontractors. If you are hiring (or even considering hiring) any subcontractors, it is critical that this is removed. Frequently this exclusion can be removed for a $100 charge. It is worth getting if a subcontractor were to leave you responsible for any damages.

Review the Exclusions Listed on the Endorsement Schedule Page

As mentioned above, looking at your endorsement schedule page is something that you should commit to doing every renewal. It is a quick process that can save you potentially millions of dollars. Just because you are renewing with the same carrier does not mean that there are no new exclusions or limitations on the renewal policy.

About The Author: Austin Landes, CIC

Austin is an experienced Commercial Risk Advisor specializing in and leading LandesBlosch's design professional, real estate, and construction teams.