What Does Coffee Shop Insurance Cost?

·

3 minute read

Hot drinks, expensive espresso equipment, and steady foot traffic make coffee shops deceptively risky. One poorly written policy can force an owner to shut the doors - or put personal assets on the line. After helping shops across the U.S., here’s a straightforward guide to the coverages you actually need and real‑world price points you can use as a benchmark.

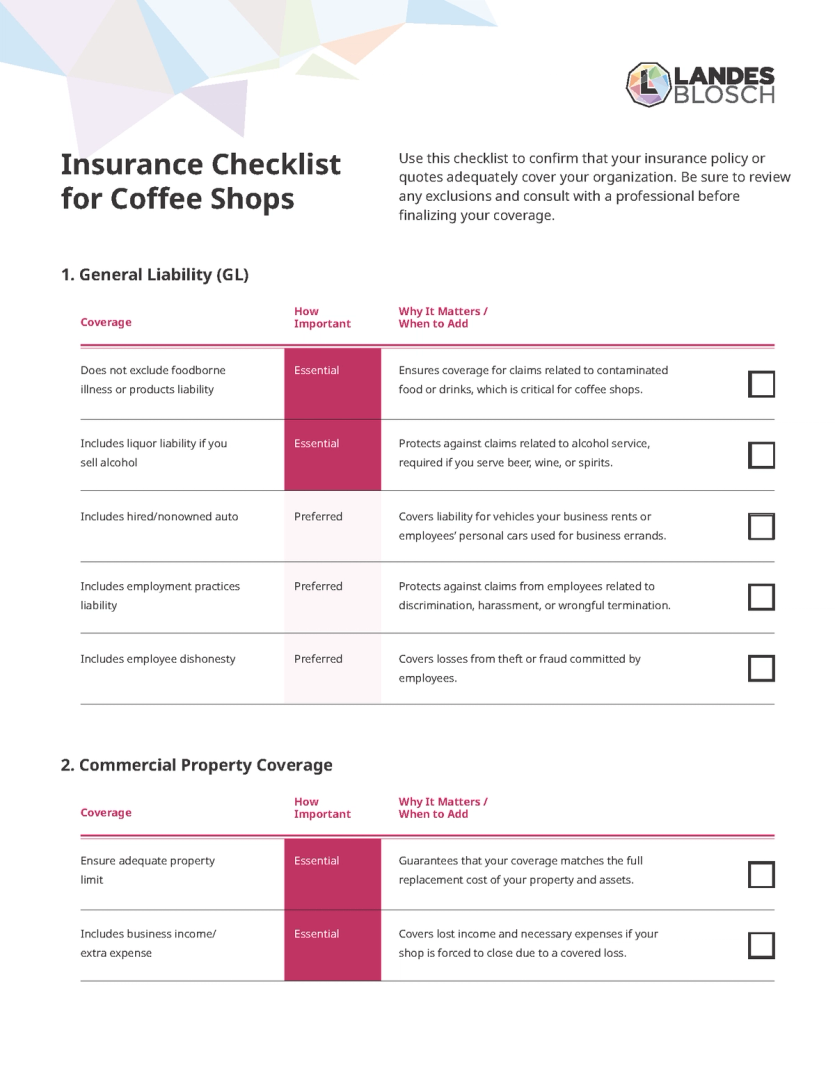

Download: Insurance Checklist for Coffee Shops

Download our free checklist of insurance coverages that coffee shops should have!

Why Coffee Shops Need Insurance

- Landlord requirements - Most leases require a Certificate of Insurance (COI) and specific endorsements before you can open.

- Property loss - Fire, theft, water damage, or power surge can take out espresso machines, grinders, and POS systems.

- Employee injuries - Cuts, slips, back strains, and burns happen behind the bar.

- Customer injuries - Hot‑beverage burns and slip‑and‑fall incidents are the most common claims.

You can cover these four primary risks - and most others - with a Business Owner’s Policy (BOP) for liability + property and a Workers’ Compensation policy for employee injuries.

The Two Core Policies (Explained)

Business Owner’s Policy (BOP)

A BOP bundles General Liability and Commercial Property into one policy (often with Business Income). It’s typically the best value for coffee shops.

- General Liability (inside the BOP): Covers bodily injury and property damage to others - e.g., a customer burn or a slip on a wet floor. Also responds to foodborne illness claims.

- Commercial Property (inside the BOP): Covers gear you own - espresso machines, grinders, brewers, refrigerators, furniture, décor, signage, and inventory - on your premises.

Workers’ Compensation

Covers employee injuries while working for you (medical bills, lost wages, and related costs). Required in most states as soon as you have employees - full‑time or part‑time.

Pricing Snapshot (Real Examples)

Quoted from well‑rated carriers for typical coffee‑shop operations. Use as ballpark only; premiums vary by state, prior losses, safety controls, and coverage limits.

| Annual Revenue | Property (Contents) | GL Premium | Property Premium | Workers’ Comp | Annual Total | Approx. Monthly |

|---|---|---|---|---|---|---|

| $250,000 | $50,000 | $585 | $717 | $730 | $2,032 | $170/mo |

| $1,000,000 | $250,000 | $1,032 | $2,115 | $1,682 | $4,829 | $403/mo |

| $5,000,000 | $1,500,000 | $4,244 | $12,644 | $6,959 | $23,847 | $1,987/mo |

Best Insurance Providers for Coffee Shops

Whether you’re a single-location café or a growing chain, the right carrier (and broker) can speed up quotes, satisfy landlord requirements, and make claims a whole lot less stressful. Here are three strong options we frequently place coffee shops with.

| Provider | Why it's a good fit | How to get it |

|---|---|---|

| LandesBlosch | Independent broker with hospitality experience. We shop multiple carriers and tailor BOP, Workers’ Comp, and endorsements (e.g., additional insured, waiver of subrogation) to your lease and operations. | → Request a Quote |

| The Hartford | Well-known small-business carrier with dedicated coffee shop/restaurant programs and a solid Business Owner’s Policy (BOP) for cafés. | Contact via LandesBlosch for a custom quote |

| Chubb | Comprehensive property & liability solutions. Their BOP works well for small shops and can scale as you grow. | Contact via LandesBlosch for a custom quote |

| Travelers | National carrier with dedicated food & beverage/restaurant solutions and a solid small-business BOP. | Contact via LandesBlosch for a custom quote |

Why LandesBlosch Leads This List

As a licensed commercial insurance broker across a wide footprint, we place coffee shops with top-rated carriers and fine-tune coverage for real-world café risks—equipment breakdowns, spoilage, slips and burns, and business-income interruptions. Working directly with us means your policy is built around your menu, your gear, and your lease obligations.

The Bottom Line

Pair a solid BOP with Workers’ Comp and you’ll cover 95% of the claims most coffee shops face. The price gap between airtight coverage and a policy riddled with exclusions is usually small - until a claim hits. Compare endorsements carefully and don’t skip out on the essentials.

Coffee Shop FAQ

About The Author: Austin Landes, CIC

Austin is an experienced Commercial Risk Advisor specializing in and leading LandesBlosch's design professional, real estate, and construction teams.