Understanding Business Catastrophe Liability

·

5 minute read

While insurance protects against events such as slip-and-falls, fender benders, and damage to a client's property, most business owners purchase liability insurance to protect themselves against catastrophic claims that would otherwise bankrupt their companies.

Up until fairly recently, large business catastrophe liability claims were something of a rarity. Nowadays, settlements and judgments exceeding $1 million are common occurrences.

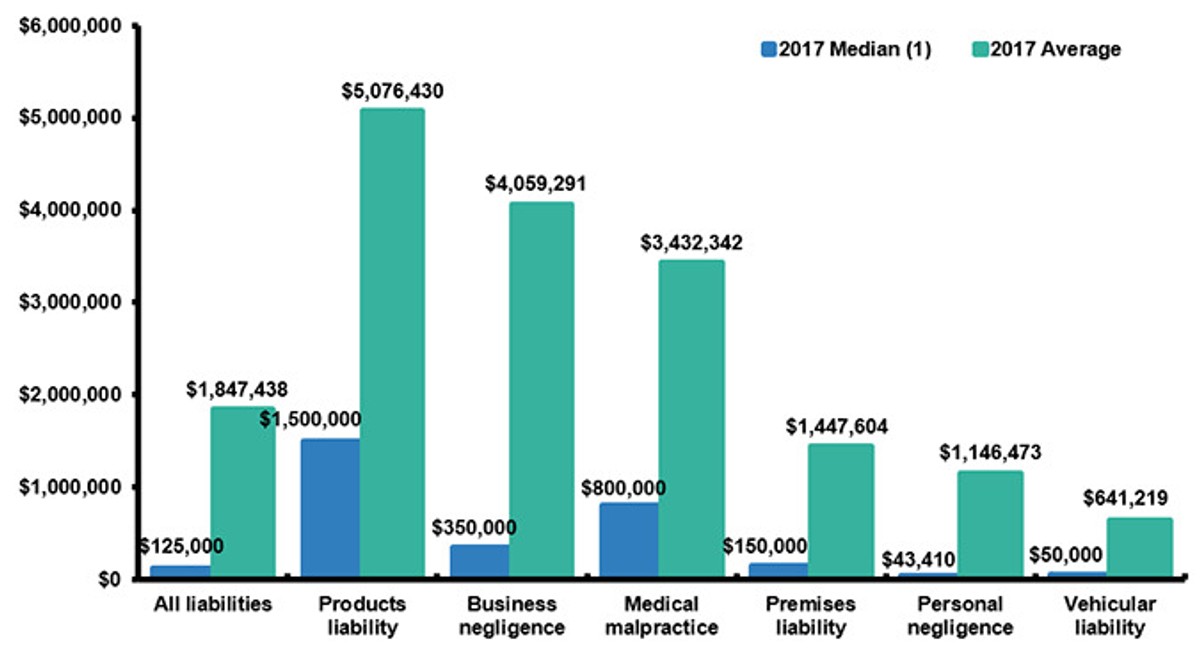

As shown in the graph above, the average jury award claim in 2017 was $1.8 million, and that figure is trending upward each year.

Although there are hundreds of contributing factors to this phenomenon, one of the most widely discussed causes is "social inflation." It has several causes, but is primarily attributed to the arrival of younger generations in the jury box and the anti-corporate sentiment that is growing in America.

In a recent article called “5 Reasons Why Juries Are Awarding Billion-Dollar Verdicts," Risk and Insurance said, "The majority of our jurors believe corporations are unethical and will do anything to maximize a profit."

To make matters worse, private equity firms are taking plaintiffs that are willing to settle, guaranteeing their settlement amount, and investing in the subsequent lawsuit to make a profit. This is turning out to be a successful strategy, which in turn drives up the rate of catastrophe losses for businesses.

In the past, the first $1,000,000 of a liability policy was considered the only "working layer" for many businesses, meaning it was the only policy expected ever to see a claim. These days, many umbrella policies are underwritten for claims frequency.

In a recent whitepaper called, "Excess and Umbrella Markets Continue to Change in 2020," CRC Insurance gave us an example of how settlement amounts are continuing to increase, even if the court ruled there was no wrongdoing:

"In 2018, Werner Enterprises, Inc., one of the country's largest trucking companies, was shocked by massive jury award for a 2014 fatal car accident in Texas. According to Werner, the commercial vehicle could not avoid the collision when a pickup crossed over into oncoming traffic. Werner's truck was operating below the speed limit and did not lose control. In addition, authorities did not find the Werner driver at fault for the accident. However, the plaintiff's attorney argued that Werner's truck should have pulled off the road completely due to inclement weather, and the jury agreed – to the tune of $89 million."

Now is the time to prepare your business for a catastrophic liability incident. It is no longer out of the question that you will experience a claim that exceeds $1,000,000, and this trend will likely continue for the foreseeable future.

Cover You Worst Case Scenario.

Schedule a call or start an online quote today.

Common Types Of Business Catastrophe Liability Claims

Automobile

It probably comes as no surprise that auto liability is one of the most common business catastrophe events that can happen. This is especially true if you are using larger trucks or your employees are driving a lot of miles.

With increasing medical costs, rising vehicle costs, and growing social inflation, we are now seeing verdicts of $30 million, $50 million, and sometimes up to the $100 million range.

Premises Liability

Leasing or owning a building for your business comes with greater potential for a large premises liability insurance claim. This is especially true for buildings with frequent foot traffic.

Here is an example of how premises liability can result in a catastrophe:

In 2013, a malfunctioning swimming pool heater caused carbon monoxide to enter a nearby hotel room, resulting in the death of a child. The case settled for $12,000,000.

Accidents and mistakes happen, even if you take great pride in your risk management and property maintenance which is why business catastrophe liability is so important.

Products Liability

Although not as applicable to all businesses, products liability has the highest average verdict amount of any type, with a staggering $5 million average.

If you develop or manufacture any products, this should be on your mind as a potential catastrophe that could befall your business.

Summary

The courts are awarding record verdicts against businesses for a variety of reasons. It has become more prudent for business owners (especially those who are involved in high hazard operations) to prepare their catastrophe risk management plan and catastrophe risk insurance for the possibility that their business could eventually be impacted.

If you want an expert to review your excess liability insurance policies, let us know. We will help you determine what limits to get and benchmark your insurance policy against similar businesses.

About The Author: Austin Landes, CIC

Austin is an experienced Commercial Risk Advisor specializing in and leading LandesBlosch's design professional, real estate, and construction teams.