Plumbing Contractor Insurance (Cost & Coverages)

·

6 minute read

Water is unforgiving. Small leaks become major losses, mold shows up fast, and one burst line can flood a whole floor. Fair or not, plumbers are often blamed even when the water issue was not your fault. A poorly written insurance policy can push a good shop to the brink, while a solid one can save the business. After reviewing hundreds of plumbing contractor programs, I have seen both: rock solid protection and policies so riddled with exclusions they are closer to a scam than insurance.

This guide explains the coverages a plumbing contractor actually needs, shows real world pricing benchmarks, and offers a downloadable checklist you can hand to any agent so you are fully protected without overpaying.

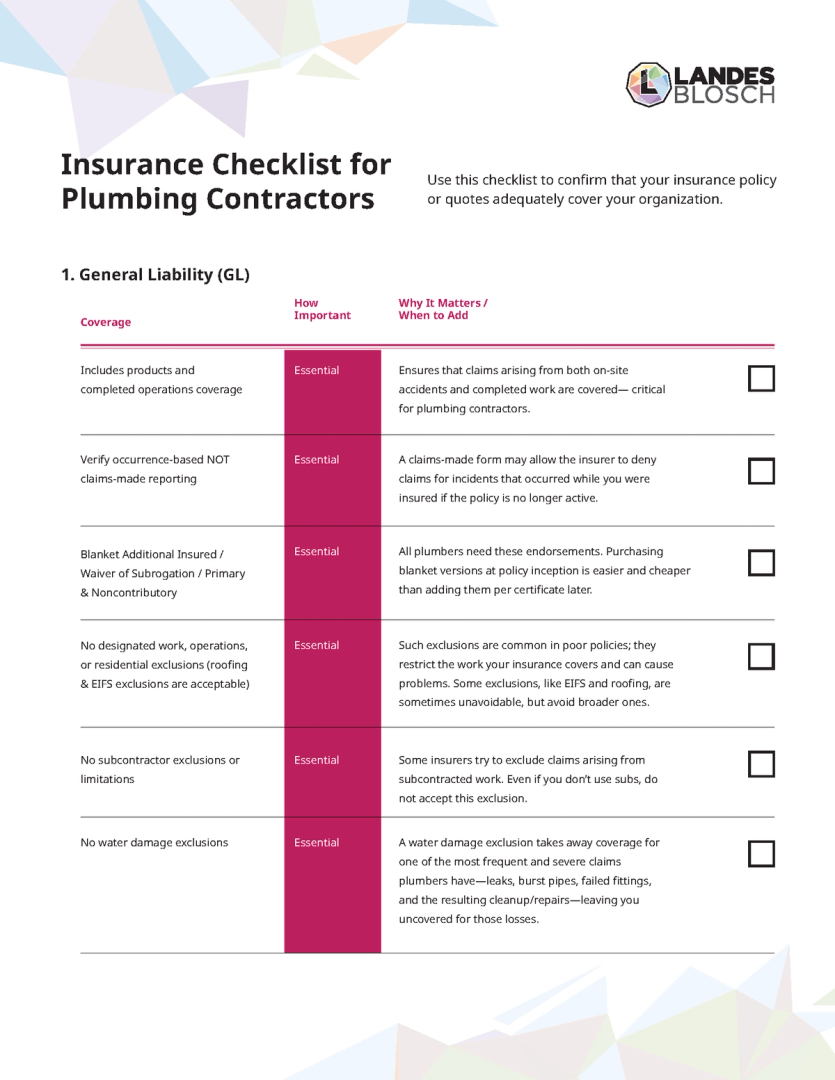

Download: Insurance Checklist for Plumbing Contractors

Download our free checklist of insurance coverages that plumbing contractors should have!

Why Plumbing Contractors Need Insurance

Water and property damage liability

Even careful work can lead to water damage. A failed fitting, an unnoticed pinhole, or a pressure issue after you leave can trigger six figure cleanup bills, and you will likely be named in the claim.

Bodily injury hazards

Burns, slips, cuts, falls from ladders, and hot work injuries send workers and bystanders to the hospital. If it is your employee, that is workers’ comp. If it is a customer or third party, that is general liability.

Underground and utility strikes

Service laterals, sewer lines, gas lines, and water mains bring explosion, collapse, and underground exposures. If your policy quietly excludes underground work, you are carrying the risk yourself.

Contract and licensing requirements

GCs and owners require certificates of insurance, specific endorsements, higher limits via an umbrella, and bonds before you can start the job or pull a permit.

Completed operations claims

Weeks or months after completion, a hidden defect can cause water damage or mold growth. If your completed operations coverage is restricted, you can lose the very protection you expected to have.

Basic Insurance Plumbers Actually Need

Below is the core insurance coverages that plumbers need. Pairing these correctly covers 90 to 95 percent of the claims we see. For larger plumbers we recommed additional lines such as pollution or E&O, but this guide is to cover the basics of what plumbers need to meet certificate requirements and cover their primary risks.

1) General Liability (GL) your first line of defense

Covers third party bodily injury and property damage during the job and after completion, also called completed operations.

2) Workers’ Compensation

Pays medical bills and lost wages for employees injured on the job and includes Employer’s Liability. Required in most states once you hire staff. Confirm owners are included or excluded as intended and your class codes are correct.

3) Commercial Auto

Liability and physical damage for vans, trucks, trailers, jetters, and vac units. Add Hired and Non Owned Auto when employees use personal vehicles or you rent.

4) Umbrella or Excess Liability

Adds 1 million to 10 million or more above GL, Auto, and Employer’s Liability. Many GCs and municipalities require it. Make sure it follows form over all three.

5) Tools, Equipment, and Materials, also called Inland Marine

Protects tools and equipment, where theft is common, plus an installation floater for pipe, fixtures, and materials in transit or waiting to be installed.

8) Bonds

License and permit bonds for jurisdictions you work in. Bid, performance, and payment bonds for larger projects. Line up surety capacity early if you are growing.

Common Coverage Traps To Avoid

Some carriers keep premiums low by carving out the exact claims you are most likely to file. Scan the endorsement page and reject policies with any of the following:

- Operations or designated work limitations like excluding residential work

- Subcontractor/1099 warranty or exclusions

- Water damage exclusions or tight limitations

- Absolute fungus or bacteria exclusion that removes completed operations coverage

- Underground property damage exclusions when you work below grade

Carriers add exclusions when they believe a claim is likely. Your job is to get as few exclusions as possible at a fair price.

Pricing Benchmarks For Plumbing Contractors

Yes, pricing depends on location, payroll, vehicles, underground exposure, claims history, and classification. Still, real examples help set expectations. The quotes below come from strong carriers without the exclusions listed above.

| Annual Payroll | # of Autos | GL | Workers Comp | Auto | Annual Total | Monthly Cost |

|---|---|---|---|---|---|---|

| $270,000 | 13 | $7,258 | $5,663 | $51,642 | $64,563 | $5,380.25 |

| $40,000 | 0 | $1,963 | $1,220 | $0 | $3,183 | $265.25 |

| $584,792 | 9 | $13,411 | $8,156 | $41,488 | $63,055 | $5,254.58 |

Cost Drivers (Why Prices Vary)

- Payroll & receipts – Higher payroll typically means higher GL/WC premiums.

- Autos & drivers – More vehicles, moving violations, or claims will raise commercial auto.

- Type of work – Service vs. new construction, residential vs. commercial/industrial, and underground utilities.

- Claims & safety – Loss history, water‑damage prevention (e.g., pressure‑testing, leak detection, shutoff procedures).

- Contract requirements – Higher limits and umbrellas for big GCs or municipal jobs.

Best Insurance Providers for Plumbing Contractors

Whether you’re a one-truck shop or a mid-size crew, the right carrier (and broker) can speed up COIs, satisfy GC/municipal requirements, and keep claims from derailing jobs. Below are strong markets we frequently use for plumbing contractors.

| Provider | Why it’s a good fit | How to get it |

|---|---|---|

| LandesBlosch | ndependent broker with construction‑trades expertise. We shop multiple carriers and tailor GL with completed ops, Workers’ Comp, Commercial Auto, Inland Marine (tools/installation floater), Umbrella, and bonds. We also handle jobsite endorsements (AI, Waiver, Primary/Non‑Contributory, Per‑Project Agg.) to match bid specs and permits. | → Request a quote |

| Travelers | A mainstay for plumbing/mechanical contractors—stable market with the endorsements you’ll need and capacity that scales as you add trucks and crews. | Contact via LandesBlosch for a custom quote |

| The Hartford | Strong option when you want higher excess limits (often up to $10M). Offers limited Contractors Pollution Liability and Contractors Professional Liability as convenient add‑ons. | Contact via LandesBlosch for a custom quote |

| Chubb | Known for broad forms and fewer restrictive exclusions. The contractors enhancement endorsement bundles common compliance endorsements (AI, Waiver, Primary/Non‑Contributory), streamlining setup. | Contact via LandesBlosch for a custom quote |

| Liberty Mutual | Robust program for plumbers; readily accommodates most endorsement requests you’ll encounter. Solid claims handling and strong coverage forms. | Contact via LandesBlosch for a custom quote |

The Bottom Line

Plumbers face real risk, but insuring it does not have to be painful. Pair a comprehensive GL with strong Workers’ Comp, Auto, Inland Marine, and an Umbrella, and you will cover almost all the losses plumbers actually have. The premium difference between airtight coverage and a thin policy is usually small, until the day water starts running and you need it.

Plumbing Contractor Insurance Checklist

About The Author: Austin Landes, CIC

Austin is an experienced Commercial Risk Advisor specializing in and leading LandesBlosch's design professional, real estate, and construction teams.