Manufacturing Insurance: What You Need To Know

Manufacturing companies are an essential component of society. Every product has been designed and built to specifications.

Whether you are manufacturing for the food, aviation, automotive, medical device, or even furniture industry - your product plays an essential role in people's lives.

For this reason, manufacturing operations come with a lot of potential liability risks.

What if your product fails? What if your product hurts someone? Can you afford a large-scale product recall? Can you afford for your facility to be down for weeks at a time?

These are all questions you should be asking yourself. These are also items that insurance can cover at a reasonable cost.

Here is what you need to know about protecting your business prior to getting a manufacturing insurance online quote.

Get The Manufacturing Coverage You Need

Find an affordable, no-obligation insurance quote today by filling out the form below.

What To Understand Before Getting A Manufacturing Insurance Online Quote

There are many manufacturing business insurance options. For the specifics, you should look at your policy or consult your insurance broker.

We will be covering the key points relevant to most manufacturing companies and what they should know to get the most out of their manufacturing and factory insurance policy.

General Liability Insurance

General liability insurance for manufacturers covers a variety of different scenarios. It is the overarching insurance policy that covers bodily injury and property damage you may cause others due to your business operations.

General liability claims can be as simple as a tree blowing down on a neighboring business or unknowingly using copyrighted material.

This coverage will also pay costs associated with defending against legal accusations, including lawyer fees, as long as the accusation is a covered claim.

Products Liability Insurance

Products liability insurance is one of the most important coverages that a manufacturing company can purchase and has the highest average claim payout of any coverage in existence.

As people and businesses interact with and consume your product, there are strong possibilities that your product might harm someone. Additionally, if your product is a component of another product, such as a car, you could potentially be brought into any number of lawsuits from the car manufacturer while they figure out who is responsible.

Products liability insurance is oftentimes included in your general liability policy, but for many manufacturers of high-hazard products, product liability has to be purchased separately.

Two common examples of companies that have to purchase product liability separately are energy and aerospace manufacturers. Sometimes, if you produce a wide variety of products across different industries, you'll be unable to find an insurer that will cover both the general liability and products liability for those particular industries of which you are in.

Property Insurance

It takes a considerable amount of property to machine, fabricate, or assemble different materials. You might have assembly lines, CNC machines, large printing equipment, or boilers.

No matter the specialty, this equipment costs a LOT of money and if it were to be damaged, your business could be inoperable for a long time.

Property insurance helps manufacturers by not only replacing their damaged equipment, but also by covering your net income and ordinary payroll while your operations are down.

Manufacturers' E&O Insurance

Causing bodily injury or property damage to a third party is an obvious exposure covered by your general liability, product liability, and your product recall program. But what if you cause financial damages that are neither property damage nor bodily injury?

Manufacturers have a wide variety of risks that don't necessarily cause property damage or bodily injury. If you make a part that goes within a larger system, and your part makes the entire system inoperable, you could be on the hook for financial damages that arise out of your product.

Design, development, manufacturing, selling/reselling, installation, consulting, plan specification, labeling, packing, and instructions for use are all examples of activities that could trigger manufacturers' E&O coverage.

Intellectual Property Insurance

Intellectual property (IP) insurance helps your business defend itself against claims of IP infringement and can help you pursue those who are infringing on your patent, copyright, or trademark. - CFC Underwriting

IP Infringement policies are typically triggered as a result of a third party alleging that their intellectual property rights are being infringed by the products and services being manufactured (including the process(es) of manufacture), sold or distributed by the defendant. The third party may be seeking a permanent injunction to prevent further sale of the infringing products; financial compensation (damages); or more typically both. The defendant does not need to have any patents, for example, to be sued for patent infringement. - CFC Underwriting

Workers' Compensation Insurance

If you have employees working for you, you need workers' compensation insurance. This coverage pays for the medical bills and the time off work for the injured employee. In most states, this coverage is required.

Product Recall Insurance

Manufacturers are often confronted with the financial impact of having to recall their product due to it being unsafe, defective, or contaminated. Not only can it be costly, but it can harm the reputation of your business, too.

Product recall insurance can help you pay for the financial costs associated with recalling your products.

Check our manufacturing page for additional information on manufacturing insurance products.

Lower Your Product Liability Risk

The second thing you should do before getting a manufacturing insurance online quote is to mitigate your exposure to the primary product liability risks. Underwriters will be looking at this area when pricing your new or renewal insurance policy. Not only will this lower your incident rate, but it will also show insurance companies that you are a good partner for them.

Conduct A Product Liability Evaluation

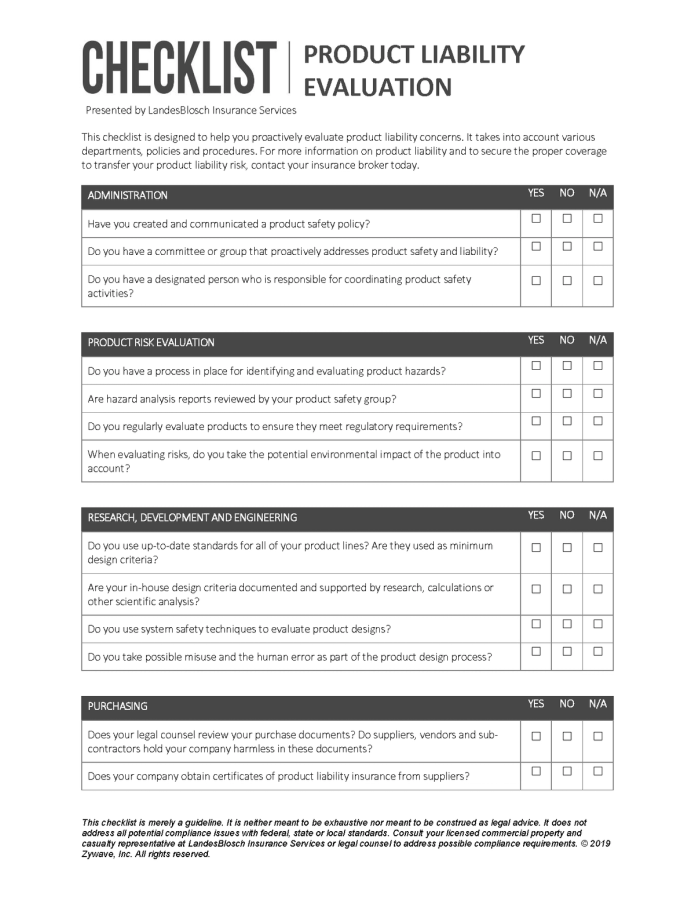

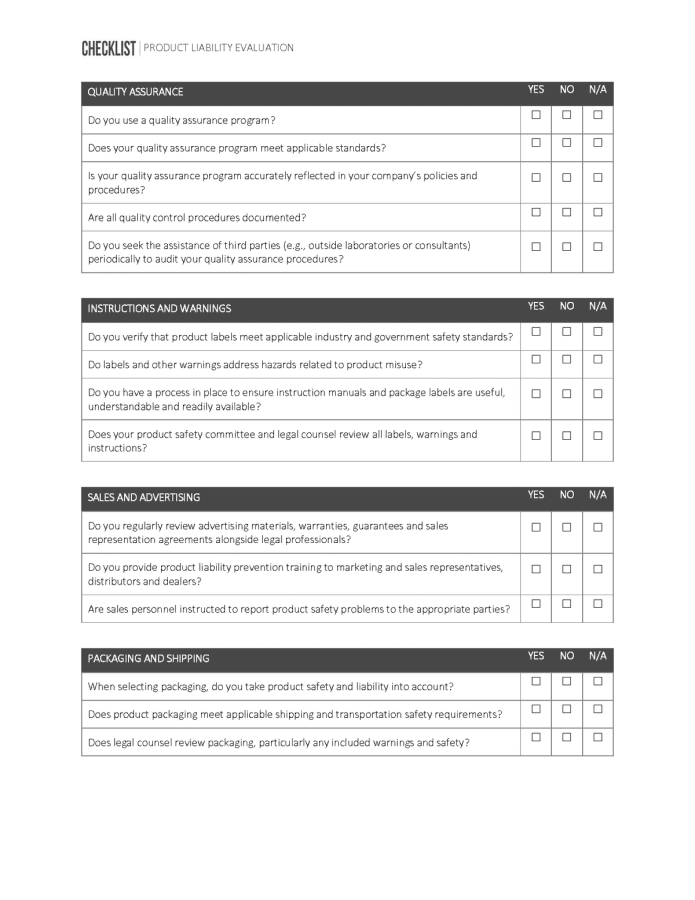

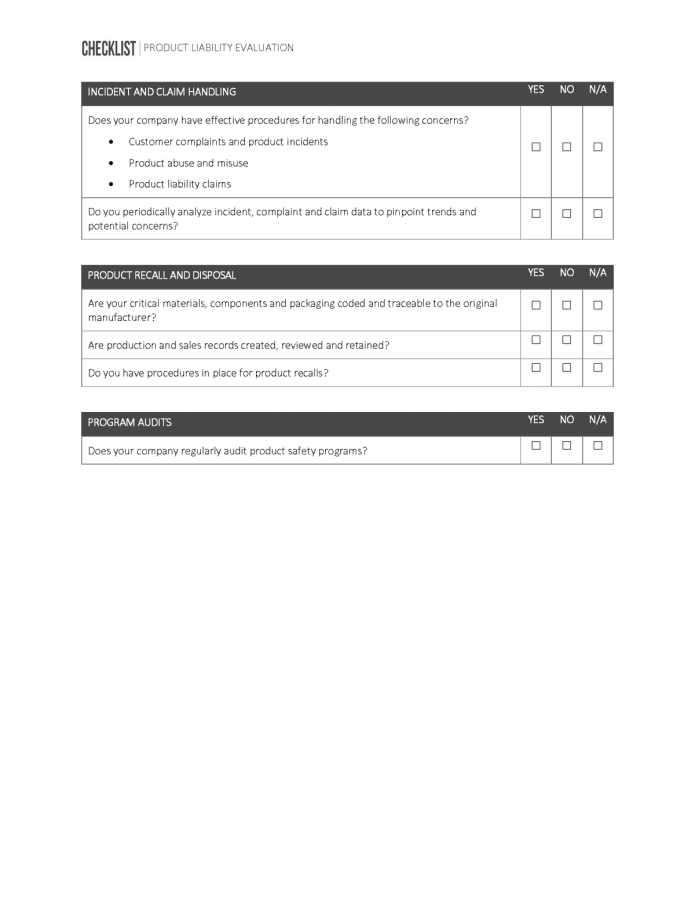

Find your product liability vulnerabilities with a product liability evaluation. Although many brokers use a variety of different valuations, here is an example of the one we use at LandesBlosch.

Have A Product Liability Prevention Program

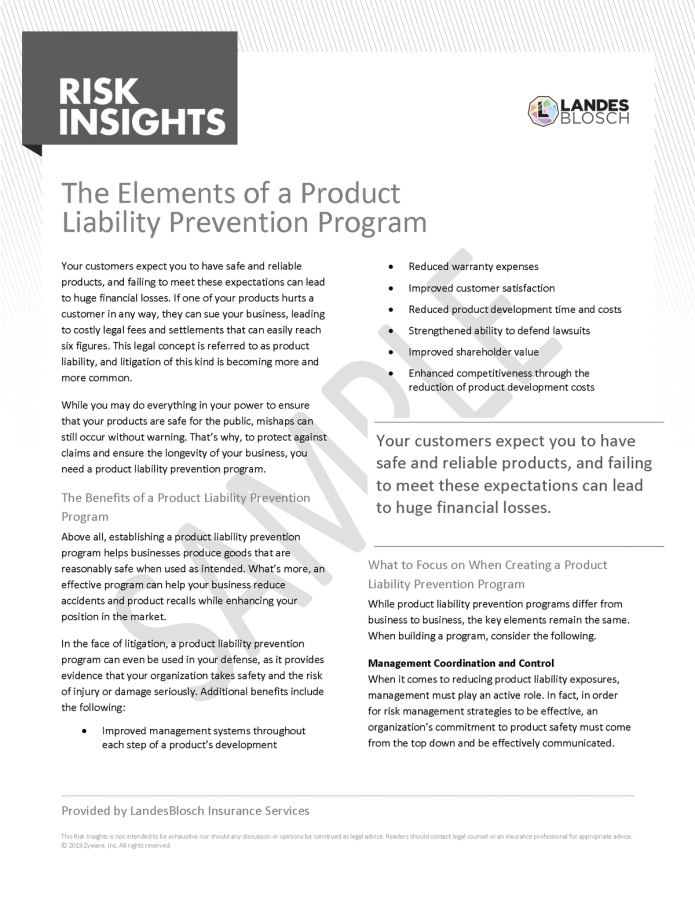

Once you know your risks, you can work on preventing them. A product liability prevention program incorporates all aspects of your business to help minimize your liabilities.

When designing a prevention program, consider the following: management coordination and control, design and product development, product warnings and instructions, sales and marketing, vendor management, legal, field service, and post-sale management.

Understand Your Product Design Risks

It is important for you to understand what liability risks your products have. The carrier underwriters will know, and it is essential so that you can address their fears before you start negotiating price and coverage terms.

Have a plan for your worst-case scenario and share that plan with your insurance broker.

Understand Your Vendor And Customer Contracts

Obtain Certificates From Certain Vendors With Additional Insured Endorsements

You must obtain certificates from critical vendors and certain customers. If you get in a lawsuit arising from a vendor's services or how a customer uses or sells your product, it is important to ensure that their insurance will cover your associated costs.

For example, if you purchase a component to manufacture a product and that component causes harm to someone, you would inevitably be out of pocket on any litigation and legal defense costs.

But if the proper additional insured requirements were in place, the vendor would pay for all costs associated with the lawsuit. Since the insurance company could be responsible for those costs and settlements, having these requirements in place WILL lower the cost of your insurance.

We highly recommend speaking to a local attorney about the specific requirements you should have. You can also contact one of our risk advisors to discuss different recommendations and common requirements.

Use Hold Harmless Agreements

Having a contract in place that limits your responsibility to pay for damages you cause a customer or vendor is always a good idea. Usually, this is called a hold harmless agreement.

It manages the risk you have of a catastrophic incident incurring costs that could close your doors or significantly harm your business.

Depending on what you produce, some manufacturers insurance companies require this agreement; most will give you better rates if you have it.

Considerations For Certain Manufacturers

Manufacturing companies have vastly different risks and your insurance policy should account for exactly what you are producing. While manufacturing operations vary widely, here are three that need special consideration.

DoD Manufacturing

Department of Defense contract manufacturers have certain protections from traditional product liability standards. Certain contract manufacturing insurance companies design their policy and pricing around the relevant laws surrounding DoD manufacturing. It is important your insurance carrier understands the laws surrounding defense manufacturing and has a tailor-made policy to help you address this scenario.

Aviation/Aerospace Manufacturing

Standard policy forms have exclusions for product liability claims arising out of aviation and aerospace-related operations.

If you are involved in manufacturing these products, make sure that this typical exclusion does not affect you. Additionally, you might have to purchase a stand-alone products liability policy to fill any coverage gaps.

Breweries/Distilleries/Wineries

Unlike typical manufacturers, there are additional risks associated with making alcoholic beverages. If someone is over-served, there is the potential that you could be held liable.

This is especially true if you serve your drinks directly to the customer. Ensure that your insurance program covers you for liquor liability arising from your business locations AND off-premises.

Summary

Manufacturing companies come with unique risks and challenges that require expert handling. You can start a review process with our manufacturing insurance online quote platform or schedule a call with one of our risk advisors.

About The Author: Austin Landes, CIC

Austin is an experienced Commercial Risk Advisor specializing in property & casualty risk management for religious institutions, real estate, construction, and manufacturing.