Liquor Liability Insurance: Everything You Should Know

·

9 minute read

Liquor liability insurance is a commercial policy that pays for certain damages arising from selling, serving, or furnishing alcoholic beverages.

This coverage most commonly protects businesses when they overserve a customer, and that customer subsequently injures or kills themself or someone else due to their intoxication, usually in the form of a car accident.

Get Covered For Liquor Liability Risks

Tell us about your business and get a free, instant, no-obligation quote.

Why would my business be liable for the actions of my customers?

Although the specific wording of laws can differ, dram shop statues exist in many states that hold establishments that overserve liquor liable to anyone injured by the drunken patron or guest.

Due to these rules, any establishment that serves, furnishes, or sells alcohol could potentially be liable for the actions of its patrons even after they leave the establishment.

Are you a restaurant owner looking for more information? Check out our article, "Restaurant Insurance: A Guide For Small Business Owners”

Wouldn't my commercial general liability policy cover alcohol-related incidents?

Yes, it is true that the commercial general liability policy does cover host liquor liability. But there is a catch. It only covers host liquor liability for organizations not in the industry of manufacturing, distributing, selling, serving, or furnishing alcoholic beverages.

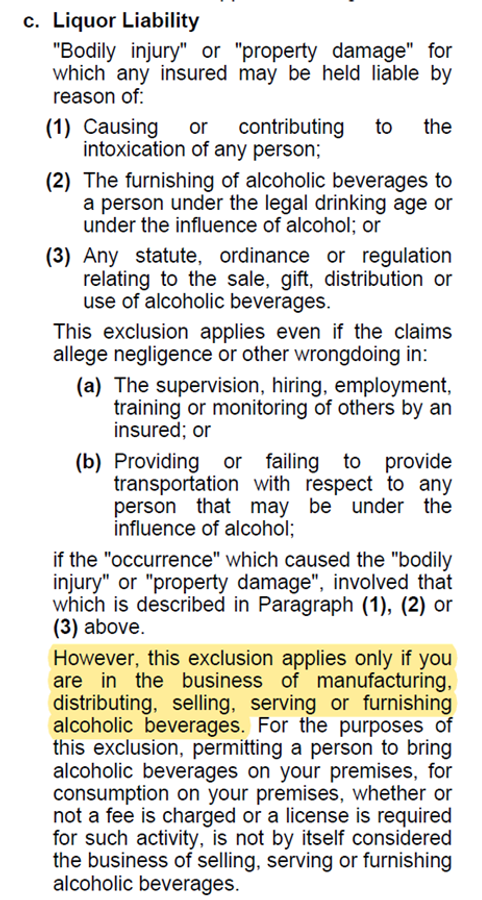

Here is that exclusion included on almost all commercial general liability insurance policies:

This exclusion is the reason why purchasing a liquor liability policy is important for any organization involved in the business of alcoholic beverages.

What type of businesses does this affect?

These liquor liability laws will affect any organization that is in the business of manufacturing, distributing, selling, serving, or furnishing alcoholic beverages, whether those beverages are consumed on the organization’s premises or not. Here are some examples:

- Bars

- Restaurants

- Breweries

- Wineries

- Distilleries

- Grocery Stores

- Liquor Stores

- Convenience Stores

- Non-Profit Fundraising Events

How does liquor liability insurance protect businesses?

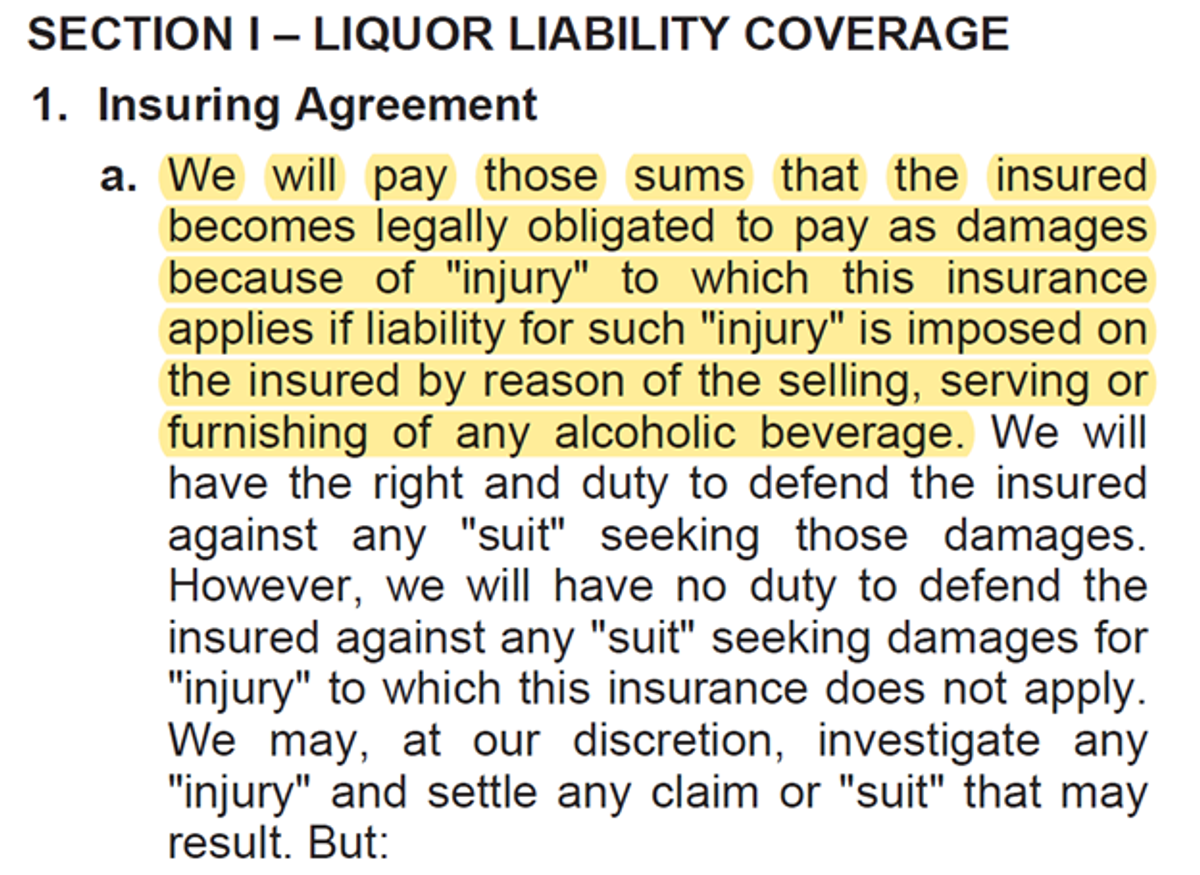

A liquor liability policy fills the coverage gaps left by the commercial general liability's liquor liability exclusion. To illustrate that, here is the insuring agreement on a liquor liability policy:

What are the different ways to purchase liquor liability insurance?

There are multiple ways to purchase liquor liability coverage and sometimes, it can be tough to understand the differences between your options. Here are the two primary coverage options that you will most likely see when requesting a quote

Monoline (Or Stand-Alone) Liquor Liability Coverage

Purchasing a monoline insurance policy means that it is the only insurance you purchase from that specific carrier—it’s a “one off.” In this scenario, you might have your general liability with Travelers Insurance and your liquor liability insured through Chubb Insurance. In other words, if your liquor liability is quoted with a different insurance company than your general liability insurance company, it is monoline.

Monoline Liquor Liability Insurance Pros:

- If you own a lot of commercial property that is insured on a commercial package policy (general liability + property insurance), it can be advantageous to protect your property insurance rates by separating out any potential liquor liability claims. For example, if you had a $300,000 liquor liability claim, it would not affect the property insurance rates.

- Monoline liquor liability policies are more flexible and offer more coverage options if you run a unique business. A common example of this is companies that frequently serve alcohol at off-site events or festivals.

Monoline Liquor Liability Insurance Cons:

- Coverage costs are generally more expensive.

- Claims can get more complicated if they could potentially fall under general liability and liquor liability (e.g. an assault and battery claim).

- Only non-admitted insurers will write monoline liquor liability policies, which means less regulation and less standardization on coverage wording (which generally doesn't fall in favor of the policyholder).

General Liability + Liquor Liability Combination Policy

Combination Policy Pros:

- Prices are generally more competitively than a monoline policy.

- General liability and liquor liability work better when on the same policy with the same insurance company (less coverage overlap and the policies are designed to be compatible).

- Combination policies are often offered by admitted carriers, which means more regulated coverage forms, broader coverage, and lower prices.

- If you purchase general liability and liquor liability from the same insurance carrier, you only have to complete a single audit for both coverages, instead of doing it twice.

Combination Policy Cons:

- Less customizations are available for any unique events.

- There are stricter guidelines to qualify for combination policies versus the monoline options.

Wondering what admitted or non-admitted insurance companies are? Check out our article, "What Is Excess And Surplus Insurance?"

Our Tips & Tricks

Purchase commercial general liability and liquor liability from the same insurance company.

Although the monoline option can be advantageous for many businesses, we generally recommend purchasing liquor liability and general liability from the same insurance company.

These two policies are meant to work hand-in-hand, and having a single claims adjuster will make your life much easier when handling a challenging claim. Using one carrier also simplifies you insurance renewal process and limits the chances of a mistake being made such as data entry, renewal limit changes, coverage form changes, and various underwriting changes.

LandesBlosch Tip: Even though you might be unable to purchase a liquor liability (or more often, unable to get the right coverages on the liquor liability) policy from your general liability insurance company, try to get a quote from their non-admitted subsidiary. For example, you could insure your restaurant's general liability policy with Travelers and purchase liquor liability from Northfield (a Travelers subsidiary). Or, if you purchase general liability with Chubb, you could get a liquor liability quote from Westchester (a Chubb subsidiary). With this method, you can get the advantages of monoline liquor liability, while avoiding some of the disadvantages.

Purchase more than $1,000,000 in coverage.

Liquor liability claims can be rare, but when they happen, the potential liability can be huge. These types of claims usually involve a car accident fatality or serious injury after a driver is overserved at your establishment. Claims can exceed $1,000,000 quickly, especially if multiple people are severely injured in the accident. For liquor stores and restaurants, this is slightly less of a concern; but if you own a bar, purchasing more than $1 million in coverage is highly recommended.

Look at your liability deductibles.

Find out if your policy has a liability deductible. This is more important for businesses who only sell liquor or have a significant portion of their sales coming from liquor, than for those who only serve or sell limited quantities of alcohol.

While many people realize that property insurance or auto insurance has a deductible, that’s not always understood with liquor liability policies. For alcohol businesses, sometimes your liability policy will have a deductible for $1000, $5000, or even $10,000. Make sure you know how much you will be responsible for if a claim arises.

Summary

Facing a claim due to an accident arising from your liquor sales is a risk that any establishment that serves alcohol needs to consider. Let us know if you want help reviewing your liquor liability insurance, or get an online quote.

About The Author: Austin Landes, CIC

Austin is an experienced Commercial Risk Advisor specializing in and leading LandesBlosch's design professional, real estate, and construction teams.