Licensed, Bonded And Insured Business: What Does This Mean?

If you are like many others, you probably have seen "Licensed, Bonded, and Insured" on contractor work vans, advertisements, and even the brochures of businesses you work with.

If you’re a business, you might be wondering, “What does this mean?” You might also be curious about whether you also need to be licensed, bonded, and insured.

In this post, we hope to bring more clarity to the phrase "licensed, bonded, and insured," so you’ll know what it means and whether you need to fall under that banner.

If you are a contractor looking for more information on what types of insurance coverages you need, check out our "Guide to Contractor Insurance."

Let’s first explain what each term means.

What does licensed mean for a business?

When companies refer to themselves as licensed, they are usually referring to a state license that they hold to perform certain types of work.

This usually comes in the form of a contractor license, but other types of businesses may also require licensing. For example, as an insurance broker, LandesBlosch is licensed, bonded, and insured! So it isn't just contractors that might need this information.

For certain types of work, businesses must register with specific state agencies, meet certain requirements, and sometimes even pass tests before they can get started in that profession.

Each state has its own licensing requirements, costs, and procedures, so you will want to check with your specific state for more information on getting licensed.

What businesses typically need licenses?

Generally, businesses that require extensive technical skills that can potentially cause damage to their customers will require licenses.

But each state is different, and this list could be huge. Here are some examples of businesses that require licenses from their state governments before they can operate.

- Electrical, plumbing, and HVAC contractors

- Roofing contractors

- Automotive dealerships

- Engineers

- Architects

- Attorneys

- Insurance agents

- Liquor establishments

- Certified public accountants

Quality Coverage for Licensed Businesses

Find out which insurance you need, which you don't, and how much it will cost. Available in most states.

What does bonded mean for a business?

One of the primary reasons why "licensed, bonded, and insured" is so confusing is because saying you are "bonded" doesn't mean anything specific. There are hundreds of different bond types, and a company saying it is bonded doesn't really describe what it is bonded for, or the amount of the financial guarantee.

So, what is bond insurance for a business? Generally, when a company indicates they are licensed, bonded, and insured, they are indicating they have purchased a surety bond of some kind.

A surety bond is a financial guarantee made by a surety that promises to pay an obligee on behalf of the principal if the principal is unable to meet their debt obligation.

- The surety is the insurance company issuing the bond

- The principal is you (or the bonded company)

- The obligee is the organization requiring the bond

What makes bonds different from an insurance policy is that the bonding company requires you to pay them if they pay out a claim.

This can be very serious. The surety company expects to be paid back, and often, you are required to pay them back individually, even if the bond is taken out in the business name.

This is why bonding gives businesses and project owners a sense of trust. When they see your paperwork, they know how serious this can be for you if you try to run off with their money or go bankrupt.

As we mentioned above, when talking about a company becoming bonded, we are talking about surety bonds. There are two categories of surety bonds that you need to consider: contract surety bonds and commercial surety bonds.

Here is what each means:

Contract Surety Bonds

Contract surety bonds are written for specific construction projects and are usually provided as an assurance to the project owner that the contractor will fulfill their obligation, even if they are insolvent or no longer in business.

Here are four specific examples of contract surety bonds:

Bid bond: A bid bond provides financial protection to the project owner if a contractor wins a bid but does not (or is unable) to sign the final contract.

Performance bond: A performance bond is a guarantee to a project owner that in the event of a contractor default, the surety (insurance company) will complete the project on behalf of the defaulted contractor.

Payment bond: A payment bond is a guarantee that subcontractors, vendors, and suppliers in a construction project will get paid.

Warranty bond (or maintenance bond): The warranty bond guarantees a project owner that any workmanship or product defects found in the original construction will be repaired during the warranty period.

Commercial Surety Bonds

License and permit bonds: A license bond is a financial guarantee that the principal (the policyholder) shall fully comply with all laws, rules, and regulations required of them to perform the business authorized by the license or permit.

Usually, a small bond for a fixed amount guarantees that the principal shall fully comply with all laws, rules, and regulations required of them to perform the business authorized by the license or permit.

Court bonds (or judicial bonds): Court bonds such as appeal bonds, supersedeas bonds, attachment bonds, and injunction bonds are types of surety bonds that ensure the fulfillment of a court-appointed task.

Fiduciary bonds (or probate bonds): Similarly, this bond is to fulfill a court-appointed task, but this it usually deals with the handling or management of other people's money or assets.

Miscellaneous bonds: There are hundreds of other types of commercial surety bonds. The bond is just a financial guarantee that you will fulfill a certain duty or task that you agreed to fulfill.

What does insured mean for a business?

When companies refer to themselves as "insured," they are usually referring to having business liability insurance that protects their customers. This includes commercial general liability and workers compensation insurance.

Some businesses have success in using their insurance in their advertising. Many of their customers will either require them to have insurance, and knowing the business has it will give them peace of mind.

General Liability Insurance

The commercial general liability insurance policy covers a business against property damage or bodily injury they cause to others during their business operations.

These damages can occur while the business is on your premises, and many policies also cover liability arising out of completed projects.

Workers Compensation

If a business has employees, it is usually required by law to have workers compensation insurance. This covers things such as medical bills and lost wages that happen due to work-related injuries.

What does insured mean for your business in particular?

We can tell you, in just 5 minutes. Fill out the form below for a free quote. Available in most states.

How can my business get licensed, bonded, and insured?

How your company goes about getting licensed, bonded, and insured will depend on what you do and what state you reside in. For example, each license has different requirements, insurance minimums, and bonding amounts that licensed businesses need to obtain.

Here is the easiest way to check all the requirements off your list:

Step 1: Find Out Licensing Requirements

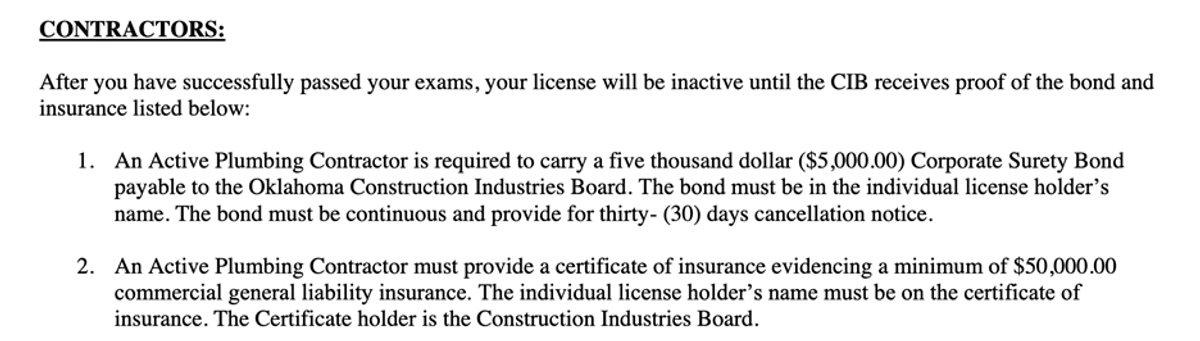

To find out exactly what you need, go to your state's website for the industry that you need to get licensed in (for example, Oklahoma construction contractors would go to the Construction Industries Board).

Once you find the requirements to get licensed, you will see a section for both the bonding and insurance requirements to finish your licensing.

Here is an example:

Step 2: Purchase A License Bond

Once you know what type of bond you need, you can purchase that bond instantly through our online bonding portal. This portal has over a thousand bonds that you can purchase in as little as five minutes.

Step 3: Purchase A General Liability (And Maybe A Workers Compensation) Insurance Policy

Finding a liability policy that meets all your licensing requirements takes a little more effort than purchasing a bond, but it is the final step. You can start that process by clicking

here to get an online liability insurance quote.

You will usually have to meet certain requirements. Just make sure your insurance broker knows what you need to buy to get your license. As a general rule, you usually cannot go wrong with a $1,000,000 liability limit. It is the industry standard for general liability insurance.

If you have any employees, you might also need to take out a workers compensation policy to comply with your state's labor laws.

Summary

Although “licensed, bonded, and insured” doesn't mean anything too specific, it does indicate that you can perform the work and that you are trustworthy. It also tells potential customers you have insurance to cover any accidents while performing the work.

If you are looking to get licensed, bonded, and insured, let us know or get started using our online bonding portal. You can also get an online insurance quote in less than 15 minutes.

About The Author: Austin Landes, CIC

Austin is an experienced Commercial Risk Advisor specializing in property & casualty risk management for religious institutions, real estate, construction, and manufacturing.