How Much Is A Business Insurance Policy?

There are significant risks when running a company. Doing business and performing services for others opens you up to liability, resulting in out-of-pocket payments that can potentially threaten the stability of your company.

Risks also arise as businesses start to acquire significant assets. Usually, this property (whether it be real estate, equipment, or inventory) is purchased over time or in a strategic manner. A sudden loss of that property would require you to pour capital in to replace or fix it, putting significant stress on the business.

Business insurance is a mechanism that allows you to pay a monthly or yearly premium, and in exchange, the insurance company assumes some of your business risks. This way, you aren’t required to have millions of dollars in the bank to prepare for a large loss to happen to your business. And you don’t need piles of cash ready to repurchase equipment after a natural disaster.

For this reason, most businesses decide to purchase insurance. The types of insurance they purchase depends on their individual tolerance for risk, but it is always advantageous to know how business insurance policies are priced, so that you can get the best deal.

Need Help Navigating The Cost Of Commercial Insurance?

Let's find a policy that fits your budget. Request a free quote now.

What is a business insurance policy?

A business insurance policy is a contract between you and an insurance company that agrees to transfer certain business risk to the insurance company in exchange for a monthly or annual premium payment.

There are multiple forms of insurance that your business might need throughout its different stages of growth. Here are the three basic policies:

Liability Insurance (Third-Party Coverage)

Liability insurance is a policy that covers allegations or incidents of you harming other people or organizations. These claims oftentimes involve a lawsuit of demand from another business or person. At the resolution of a claim, if you were held responsible for causing damages, the insurance company would pay the claimant (or plaintiff)… not you.

Examples of liability policies are:

- Commercial General Liability

- Professional Liability (E&O)

- Auto Liability

- Pollution Liability

- Liquor Liability

Property Insurance (First-Party Coverage)

Property insurance is a policy that covers property you own. Unlike liability insurance, which pays the person you caused damage to, property insurance protects your physical business property from perils such as severe weather or fire. At the resolution of a property insurance claim, the insurance company would pay you (or sometimes your lender to pay off debt on the property).

Examples of property insurance policies are:

- Building Insurance

- Business Personal Property Insurance (Contents)

- Auto Physical Damage

- Contractor Tools Coverage

- Business Equipment Insurance

Workers Compensation (Statutory Coverage)

Workers compensation insurance is a policy that protects business owners and employees from injuries that happen while on the job.

Unlike many other policies, the insurance company does not determine what is covered and what is excluded, and the customer cannot negotiate these terms either. Your state’s legislation determines the workers compensation insurance coverage that companies must provide.

How does business insurance pricing work?

Now that you understand the difference between liability, property, and workers comp insurance policies, here is some guidance for determining how much business insurance will be for your company.

Liability Coverages

With liability insurance policies, it is the insurance company’s job to determine how much liability is involved with any given business. This is calculated using two different metrics: what type of work the business performs (rate) and the size of the company (exposure).

Given those two metrics, the first thing an insurance company will do when pricing your liability coverage is contextualize your business in their actuarial data using an SIC, NAICS, or ISO GL classification code. It doesn't matter which classification system they use as much as it matters how they describe your business, in the context of a classified business type that they have claims data on. This classification determines your rate.

The second factor insurance companies determine is the size of your business. Their goal is to be as accurate as possible, but calculating company size can vary greatly by business type. The most common metrics used are total payroll amount or gross sales.

Insurance companies multiply these two metrics (rate and exposure) to determine the premium price. Note that the rate is usually “per $1000 in sales” or “per $1000 in payroll.”

Formula:Rate x Exposure = Premium Charged

A Real-Life Example (Based On Gross Sales):

Formula: Rate Per $1000 Gross Sales x (Gross Sales / $1,000) = Premium

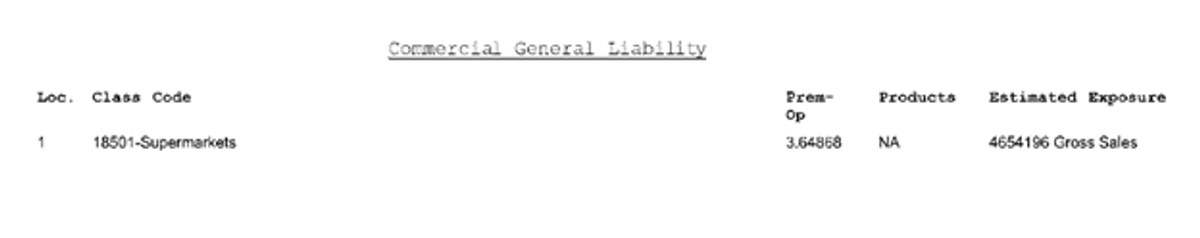

Here is an example of a grocery store general liability quote:

The grocery store’s classification code is based on its total amount of sales. As you can see below, the rate is $3.64868 per $1,000 in sales. For this particular quote, the anticipated sales are $4,654,196, meaning the liability premium for this business would be $16,982 annually.

A Real-Life Example (Based On Total Payroll)

Formula: Rate per $1000 Payroll x (Payroll / $1,000) = Premium

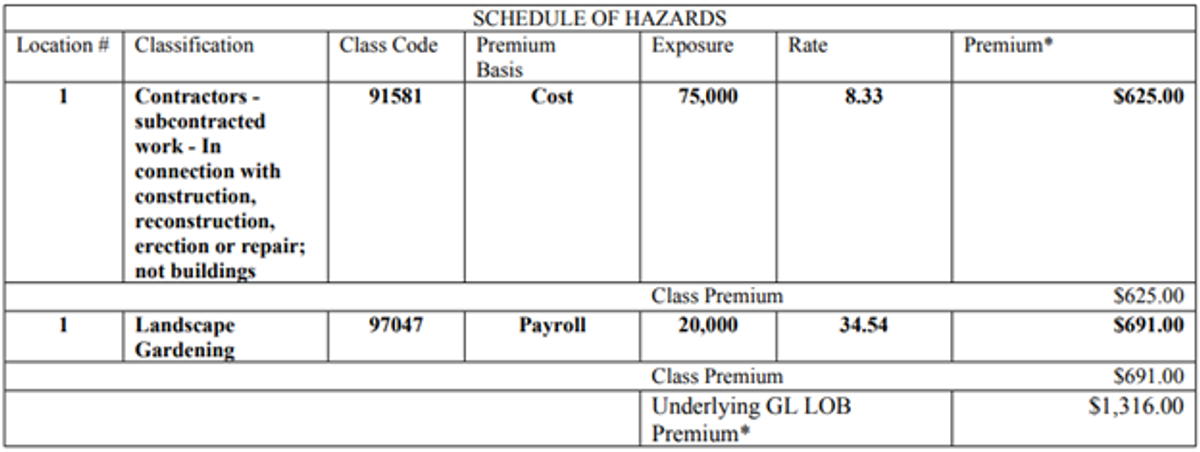

Here is an example of a payroll class code in action. This landscaper owns the business and hires some subcontractors. In their state, $20,000 is the required payroll for owner-only businesses, and the landscaping rate is $34.54 per $1000 in payroll.

Additionally, the subcontractors are rated on a total cost basis, which is the gross amount of money you pay subcontractors in a 12-month period.

Property Coverages

Property coverage is rated a little differently than liability insurance policies, but the same basic principles still apply: rate x exposure. The difference is that in property insurance, rate is determined by the size, quality, and location of the property. And the rating factor is the total amount of coverage requested.

For example, if you have a newer frame building located in North Texas that has a replacement cost of $2,000,000, the underwriter might offer a $0.50 rate per $100 in replacement cost.

Formula:Rate x (insured value / 100) = premium

North Texas Building Example:Formula: $0.50 rate x ($2,000,000 value / 100) = $10,000 premium

A Real-Life Policy Example:

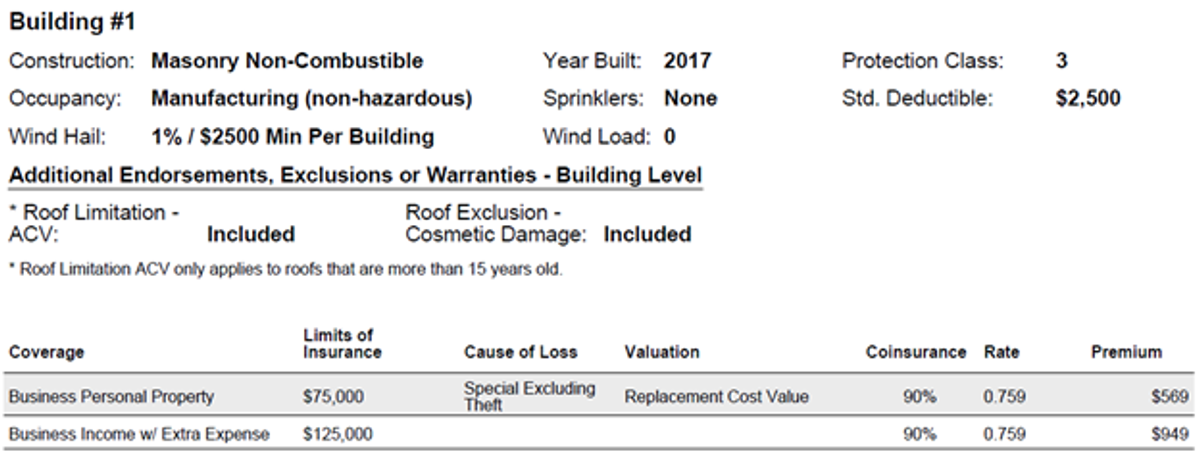

A manufacturing company is requesting business personal property and business income coverage for their business premises. As you can see below, the customer is requesting a $75,000 limit at this location, and the underwriter quoted a $0.759 rate per every $100 in property value. The total premium for just the property will be $569. The business income coverage will be calculated in the same way.

Workers Comp Coverage

Workers compensation insurance has the strictest, most regulated rules regarding how these policies should be priced by insurance companies. Since workers compensation is a required coverage by law, insurance carriers have to file the rates they are going to use for the year and can only deviate from those rates by a certain percentage on any given quote.

Similar to payroll-based liability coverage, workers comp is based on the insurance carrier’s rate for a classification (which is based on the type of work being performed) and multiplied by the payroll amount in each category. The rate is usually per $100 in payroll.

Formula:Rate x (Payroll / $100) = Premium

A Real-Life Policy Example:

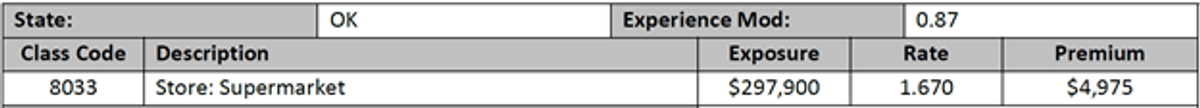

In this example, the rate for supermarket employees is $1.67 per $100 in payroll. Since the payroll for this classification is $297,000 and the rate is $1.67 per $100 in payroll, the premium amount charged will be $4,975.

With workers compensation quotes, the rated premium will always differ a bit from the final premium because of required coverages, such as terrorism, catastrophe, and the expense constant. Overall, the extra charges will be a very small portion of the premium, but are worth mentioning nonetheless.

How much does business insurance cost?

There isn’t an average cost of business insurance because so many factors must be taken into account that are unique to each company. Each state and business type has different insurance costs. That being said, we put together the following quotes to show you what various business insurance quotes look like for different types of companies throughout the U.S.

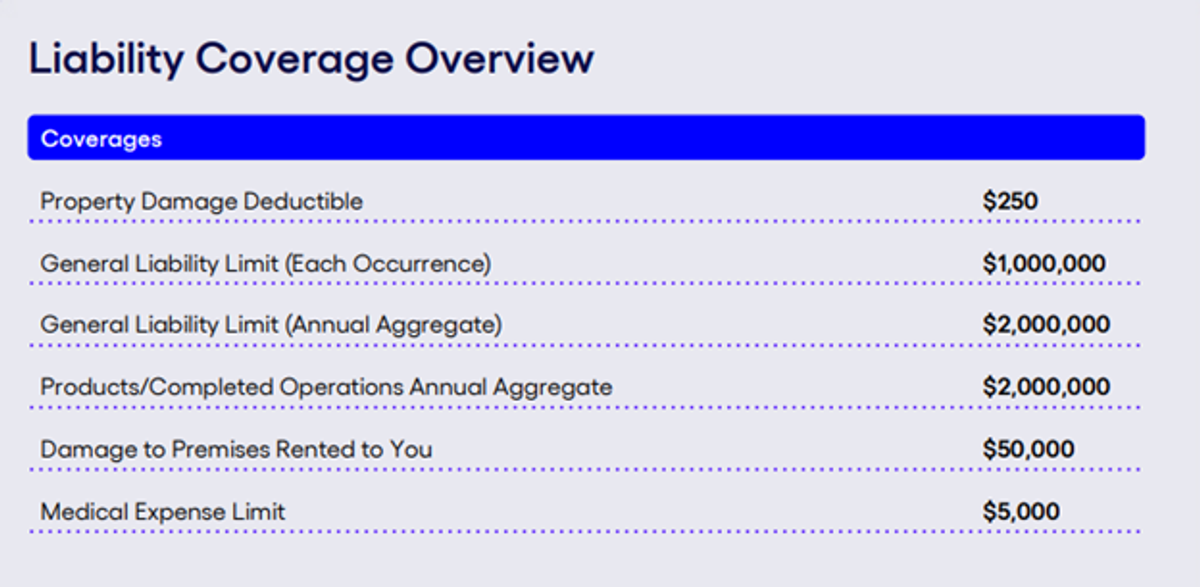

General Liability: $100,000 Payroll / Plumbing Contractor In Wyoming

Industry Classification: Plumbers

State: Wyoming

Business Age: 5 years

Number of Employees: 2

Past claims? No

Annual Payroll: $100,000

Annual Sales: $200,000

Quote

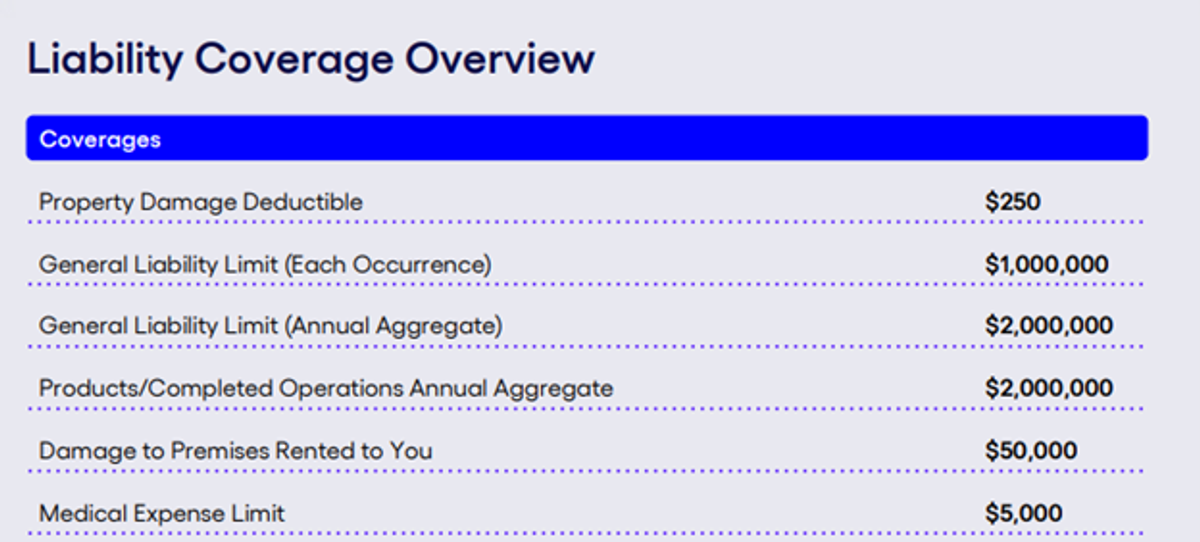

General Liability & Professional Liability: $250,000 Revenue / Property Management Company In Texas

Industry Classification: Property managers' offices, residential real estate

State: Texas

Business Age: 5 years

Number of Employees: 4

Past claims? No

Annual Payroll: $150,000

Annual Sales: $250,000

Quote

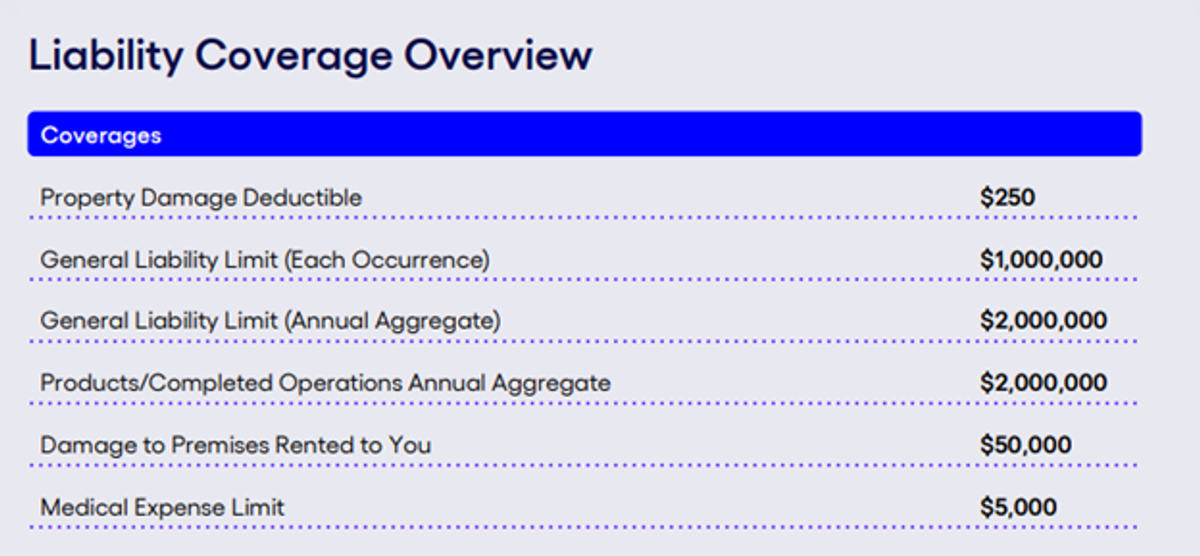

General Liability: $120,000 Revenue / Nail Salon in Virginia

Industry Classification: Manicure and pedicure salons

State: Virginia

Business Age: 5 years

Number of Employees: 3

Past claims? No

Annual Payroll: $100,000

Annual Sales: $120,000

Quote

General Liability: Owner-Only Landscaping Contractor in California

Industry Classification: Landscape contractors (except construction)

State: California

Business Age: 5 years

Number of Employees: 1

Past claims? No

Annual Payroll: $50,000

Annual Sales: $50,000

Quote

Summary

Although commercial insurance can seem complicated, there are easy ways to determine your rate on each policy and figure out how much insurance will cost as your business grows or shrinks. This knowledge will help you optimize your insurance policies so you can meet your business goals.

If you want a better idea of what an insurance policy will cost your business, let us know! For most types of businesses, you can get an online quote within a couple of minutes. With higher risk businesses, we can usually provide a quote within 4 hours from the initial request.

About The Author: Austin Landes, CIC

Austin is an experienced Commercial Risk Advisor specializing in property & casualty risk management for religious institutions, real estate, construction, and manufacturing.