Electrical Contractor Insurance (What You Need & Pricing)

·

5 minute read

Electricity is unforgiving. A single crossed wire can start a fire or seriously injure someone, and, fair or not, your company is usually the first place fingers point when anything sparks or smokes on a job site. One poorly written insurance policy can bankrupt a business or drain an owner’s personal assets. After reviewing hundreds of electrical‑contractor programs, I’ve seen both rock‑solid protection and policies so riddled with exclusions they’re closer to a scam than insurance.

This guide explains the coverages an electrical contractor actually needs, shows real‑world pricing benchmarks, and offers a downloadable checklist you can hand to any agent so you’re fully protected without overpaying.

Get Your Electrical Business Insured

Get a quote online or talk to one of our experts

Why You Need Insurance as an Electrical Contractor

Fire & Property‑Damage Liability

Electrical work creates a legitimate fire risk. Even if a blaze is unrelated to your work, you may still be named in the suit.

Bodily‑Injury & Electrocution Hazards

Shocks, falls from ladders, and arc‑flash injuries land workers and bystanders in the hospital, leaving you on the hook for medical bills and lost wages (if they are your employee) and even more if they are a customer.

Contract & Licensing Requirements

Most general contractors, project owners, and state licensing boards require certificates of insurance (COIs), proof of bonding, and sometimes project‑specific umbrellas before you can pull a permit or pull wire.

Completed‑Operations Claims

Weeks, months, or even years after you’ve left the site, undiscovered wiring mistakes can spark fires and cause significant damage, bringing six‑figure lawsuits back to your door.

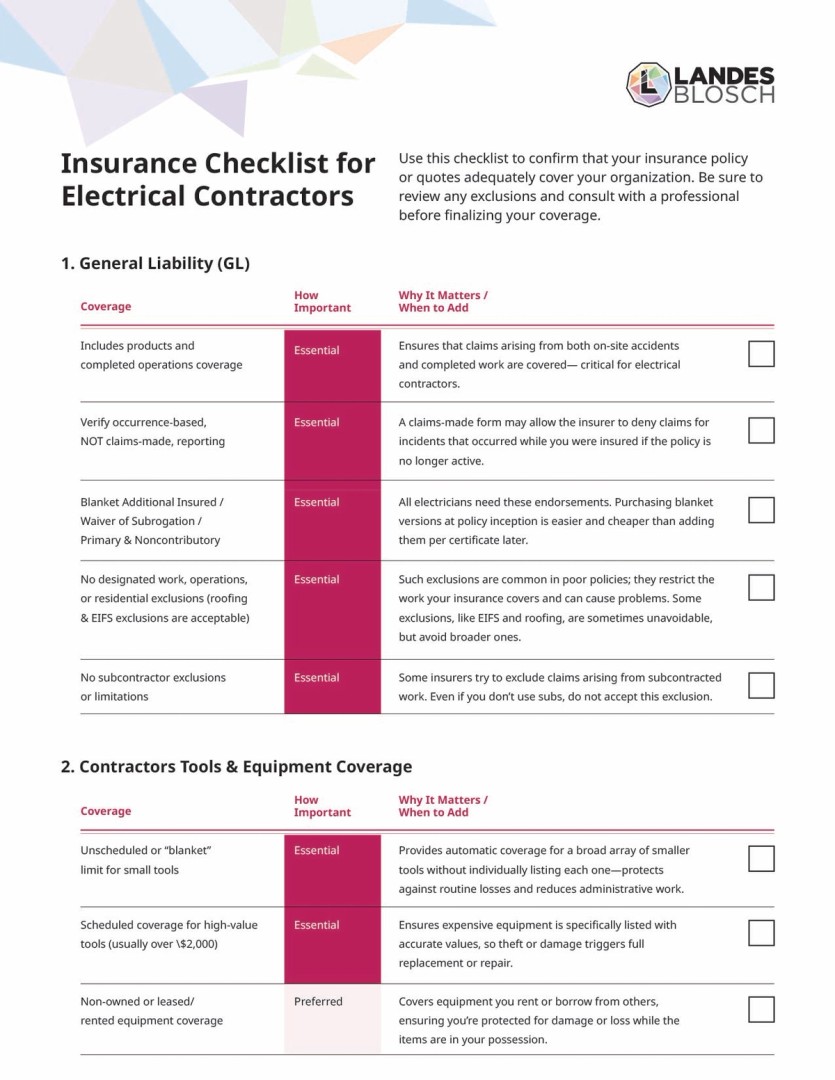

Download: Electrical Contractor Insurance Checklist

Download our electrical contractor coverage checklist to help you get the best deal on your insurance.

Types of Electrical Contractor Insurance You Need

| Policy | What It Covers | Why Electricians Need It |

|---|---|---|

| General Liability (GL) | Third‑party bodily injury and property damage, on site and after completion | Required on nearly every job; first line of defense against liability claims |

| Workers’ Compensation | Employee medical bills and lost wages from on‑the‑job injuries | Most states mandate it once you hire staff; shocks and falls are common |

| Commercial Auto | Liability and physical damage for vans, trucks, and bucket trucks | Service vehicles carry crews, tools, and often tow lifts or generators |

| Inland Marine / Equipment | Theft or damage to tools, wire, testers, and rental equipment | Hand tools walk off jobs; copper and aluminum are prime targets |

| Umbrella / Excess Liability | Extra limits (typically 1 M–10 M dollars) that sit above GL, Auto, and Employer’s Liability | Satisfies large GC or municipal contract requirements |

| License/Bid/Performance Bonds | Guarantee you’ll follow code, finish work, and pay subs and suppliers | Many states and public works jobs will not issue permits without them |

Common Coverage Traps to Avoid

Bad carriers keep premiums low by carving out the very claims you’re most likely to file. Scan the endorsement page and reject policies that include any of the following:

- Operations or “Designated Work” limitations: eliminates coverage for anything outside a narrow description (for example, “residential wiring only”)

- Subcontractor Warranty: voids coverage if a sub’s insurance lapses or limits are too low

- Independent Contractor or “Labor‑Only” exclusions: strips protection when you 1099 extra help

- Prior‑Work or “Sunset” clauses: terminates coverage for jobs completed more than a set number of years ago

If an insurer thinks a claim is very probable, it excludes that scenario. Saving a few hundred dollars on a stripped‑down policy can cost six figures in court.

Pricing Snapshot

| Payroll | # of Autos | GL Premium | Workers' Comp | Auto | Annual Total | Monthly Cost |

|---|---|---|---|---|---|---|

| $104,000 | 0 | $1,212 | $3,762 | NA | $4,974 | $415 |

| $270,000 | 4 | $1,675 | $5,589 | $10,531 | $17,795 | $1,483 |

| $510,000 | 12 | $6,154 | $6,960 | $24,883 | $37,997 | $3,167 |

| $490,000 | 11 | $3,952 | $9,630 | $18,734 | $32,316 | $2,693 |

*Quoted for well‑rated regional and national carriers with little to no restrictive exclusions. Premiums vary by state, prior losses, safety controls, and classification code. Use these numbers as a ballpark only.

Ready To Get A Quote?

We have been insuring electrical contractors for decades. Let us help you insure your business.

Best Insurance Providers for Electrical Contractors

If you run service calls, new construction, or industrial maintenance, the right insurance partner can save you time, money, and headaches when a claim hits. These options deliver coverage built for electrical contractors, including General Liability and Workers’ Comp, Commercial Auto, Inland Marine, and Umbrella.

| Provider | Why It's a Good Fit | Get A Quote |

|---|---|---|

| LandesBlosch | Specialized guidance for trades. We shop multiple A-rated carriers, fine-tune exclusions/endorsements for job-site risk, and handle COIs, additional insureds, and waiver requirements fast. Competitive pricing, built around your real exposures. | → Request a Quote |

| The Hartford | Dependable small-business programs with strong options for GL, Workers’ Comp, Commercial Auto, Property/BOP, and Umbrella. Solid for licensed contractors and growing teams. | Contact via LandesBlosch for a custom quote |

| Chubb | Broad, scalable coverage that can include GL, Umbrella, Builders Risk, and Inland Marine. Great for firms needing higher limits or working on larger commercial or industrial projects. | Contact via LandesBlosch for a custom quote |

| Travelers | Well-known in construction with competitive programs for GL, Workers’ Comp, Commercial Auto and fleets, Inland Marine (tools and equipment), and strong surety/bonding capabilities. Good fit for contractors juggling service work and larger jobs. | Contact via LandesBlosch for a custom quote |

Why LandesBlosch Leads This List

All four are respected carriers for contractor risks, but LandesBlosch stands out for hands-on construction expertise. We review exclusions line-by-line, align limits with your contracts, and place you with carriers that actually understand trade work, so you’re covered from rough-in to final.

The Bottom Line

Electrical work is high‑risk, but insuring it doesn’t have to be high‑stress. Pair a comprehensive General Liability policy with solid Workers’ Comp, Commercial Auto, Inland Marine, and an Umbrella, and you’ll cover 95 percent of the claims electricians face. The premium difference between airtight coverage and a paper‑thin policy is usually a rounding error, at least until the day something sparks and you need it.

Protect your business, your employees, and your personal assets the right way.

Ready to Get a Quote?

- Download the checklist above.

- Hand it to your current agent or, if you’d like us to look at it, start an online quote with our agency or schedule a quick call.

- Compare exclusions, limits, and pricing side by side before signing.

Electrical Contractor Insurance FAQ

About The Author: Austin Landes, CIC

Austin is an experienced Commercial Risk Advisor specializing in and leading LandesBlosch's design professional, real estate, and construction teams.