E&O Vs. D&O Insurance Coverage: What's The Difference?

·

6 minute read

Figuring out which insurance policies your organization needs can be tough. After you get past the standard general liability, property, and workers’ compensation policies, the coverages can sometimes blend together, causing confusion on what you really need.

It also doesn’t help when insurance coverages such as errors and omissions (E&O) and directors and officers (D&O) sound like they cover the same thing! And the more you read into a policy’s details, it can seem like a foreign language. This article explains E&O versus D&O to help you be sure you’re getting the right coverage for your business.

Does Your Organization Have The Best Insurance Policy?

Fill out the form below to get a free, no-obligation quote today!

D&O And E&O: What’s the Difference?

When trying to determine the difference between D&O and E&O insurance coverages, start by reviewing the Insuring Agreement section of the policy. This section will tell you what incidences each policy will cover. For example:

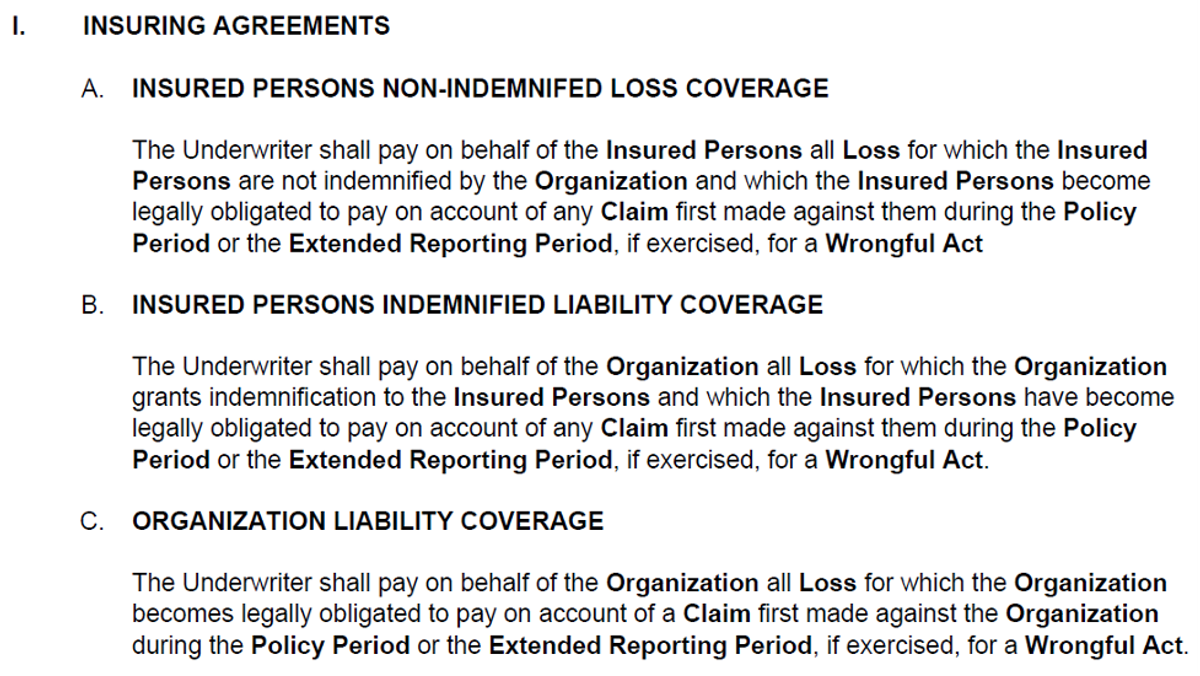

The D&O Insuring Agreement

In simple terms, the D&O policy does three things:

- Indemnifies (protects) directors and officers when the company cannot,such as due to bankruptcy or a court order. This keeps their personal assets (savings, investments, houses, other businesses, etc.) from being seized if the company loses the lawsuit.

- Pays back the insured organization when it indemnifies its directors and officers.

- Covers the organization when it’s sued along with its directors and officers. The policy will kick in for both settlements and legal fees.

The policy’s intent is to protect both an organization and its leadership for damages caused by “wrongful acts.”

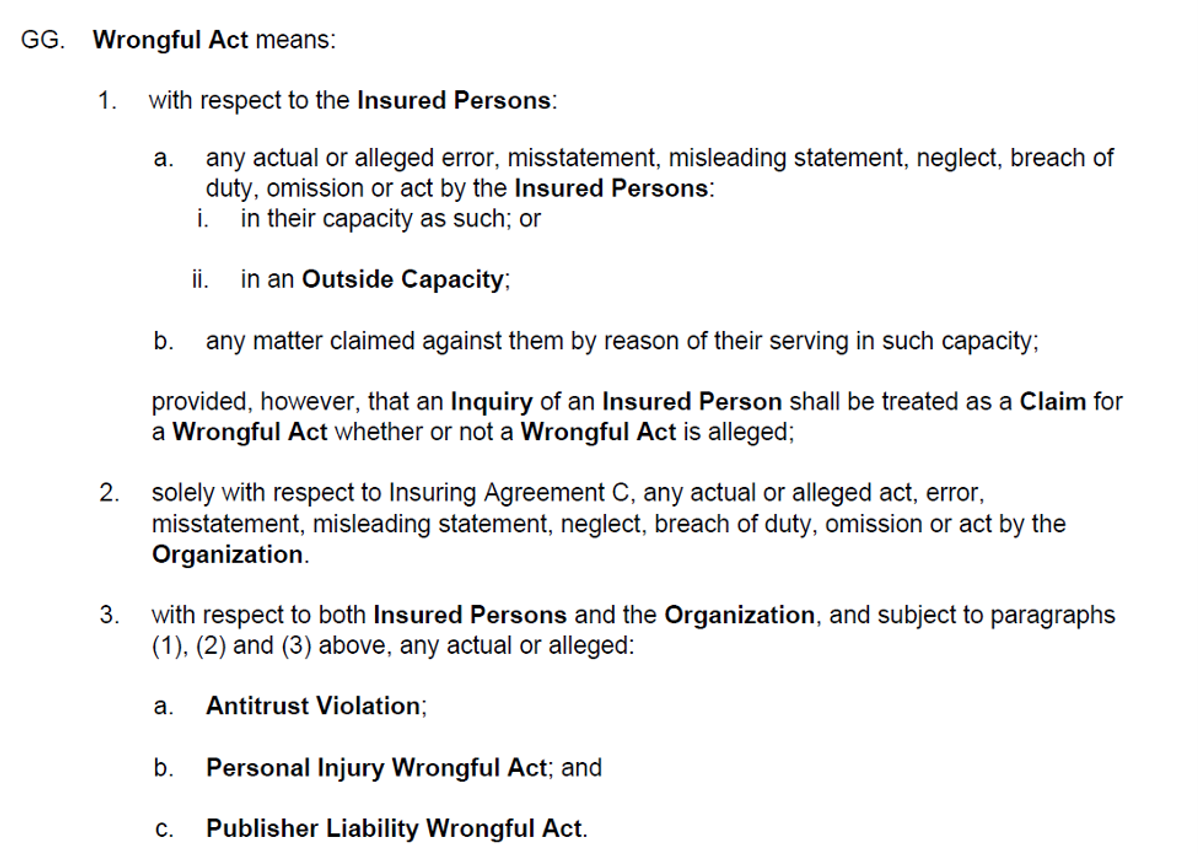

In fact, all the covered claims from A, B, and C are triggered by a "wrongful act." But what is that? The answer to this question will be the primary difference between this policy and an E&O policy. A D&O policy defines the term as:

Focus on the phrase “…any actual or alleged error, misstatement, misleading statement, neglect, breach of duty, omission or act by the insured person in their capacity as such.”

In short, directors and officers insurance covers organizations and their leaders from management decisions that cause harm to the community, employees, shareholders, or investors. Legally speaking, “harm” is a broad term—it can mean a range of things, from causing someone to lose money or get physically injured. Examples of claims that fall into this category are:

- Breach of fiduciary duty (e.g. fraud, embezzlement, large-scale irresponsibility)

- Wrongful interference with a contract (e.g. deception, lies, or threats to win or break a contract)

- Unfair trade practices (e.g. false advertising or noncompliance that increases business or injures customers)

- Consumer protection violations (e.g. defective products, unfair services or charges)

- Self-dealing and conflicts of interest (e.g. professional selfishness, nepotism)

- Violations of state or federal laws

For more information on how this policy can protect your business or non-profit, check out our article, “What Is D&O Insurance.”

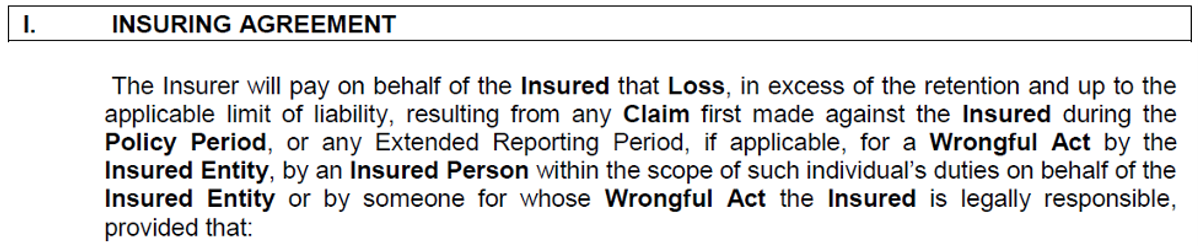

The E&O Insuring Agreement

The insuring agreement for an E&O insurance policy looks very similar to that of a D&O policy.

This policy also covers “wrongful acts”! It’s clear why this can be confusing to many organizations when trying to understand their insurance coverages.

Again, we must break down what a “wrongful act” is to discover what claims would trigger coverage under this insurance policy:

This policy covers any act, error, omission, neglect, or breach of duty committed in the rendering of your professional services.

This covers the decisions, statements, and advice you give to clients. E&O obviously won’t cover wrongful acts in relation to claims by colleagues, friends, or anyone who has not paid for your services. But if a client sues you because they lost money, were injured, or even suffered due to something you provided in a professional relationship, you would be covered.

For more information on how it can protect your business or non-profit, check out our blog, “What Is Errors And Omissions Insurance?”

Side-By-Side Comparison Of E&O Vs. D&O Coverage

| D&O Insurance (Directors & Officers) | E&O Insurance (Errors & Omissions) | |

|---|---|---|

| Purpose & Coverage | Protects company leaders and board members from lawsuits related to poor management decisions. (Their personal assets won’t be at risk if the company is sued.) | Protects professionals who were wrong or made a mistake when providing their services from client lawsuits. (Professionals will have financial and legal support if they’re sued.) |

| Who Is It For? | Executives, board members, and officers of corporations or non-profits. | Anyone providing professional services, from real estate agents and financial consultants to IT professionals and architects. |

| Claim Examples | A board is sued by a shareholder for a decision that reduced the company’s stock value. | A general contractor is sued by their client for providing incorrect information about property zoning, which led to a financial loss. |

| Reason To Buy | Attract and retain qualified senior leaders by safeguarding their personal assets from potential lawsuits. | Keep your business from shouldering the steep financial costs of handling a claim and paying legal fees (and possibly a settlement) as a consequence of making professional mistakes or oversights. |

E&O Vs. D&O Coverage In Context

Let’s put the differences between these two types of coverage into context by using an example. If an attorney gave inaccurate advice to a client, which resulted in costing the client $250,000 in a lawsuit, it would qualify as an E&O claim. The attorney was rendering professional legal services to a client and made an error that resulted in a claim.

If that same attorney sat on the board of directors of a large company and was accused by a shareholder of enriching himself by sending the company’s legal business to his law firm, that would be a D&O claim. The attorney was accused of self-dealing while in his capacity as a board member.

Wondering If You Should Get E&O or D&O Insurance?

Get expert guidance and a free quote tailored to your business needs.

Summary

The difference between D&O and E&O insurance can be tricky to understand. From breaking down the definition of “wrongful acts” to reviewing the insuring agreement, we’re here to help. If you need expert guidance to sort through your policies or advice on what insurance is best for your company, let us know!

About The Author: Austin Landes, CIC

Austin is an experienced Commercial Risk Advisor specializing in and leading LandesBlosch's design professional, real estate, and construction teams.