Defamation Insurance For Businesses - Explained

We have been known to say that commercial general liability insurance covers two primary things: property damage and bodily injury.

That is a simple way to put it, but is not the entire story. There is a section in this policy that covers other business-related liabilities (including defamation insurance), and it’s called personal and advertising injury liability.

We’ll explain more about that clause and defamation-related liability in this article.

What is defamation?

The Legal Information Institute defines defamation as a statement that injures a third party's reputation. The tort of defamation includes both libel and slander .

To prove defamation, the statement must include four elements:

- You must present the false statement as fact.

- You must communicate that false statement to a third party.

- You must at least be negligent.

- Your statement must have caused harm to the subject of your statement.

Secure Your Business Against Defamation Claims

Check out our options and create the perfect insurance plan. Get your free quote now.

Libel Vs. Slander

The differences in libel and slander lie in the medium where the defamation occurs. Libel is committing defamation in written statements or communication. In comparison, slander is verbal communication.

Social Media Is Increasing Libel Risk

The ability for individuals and businesses to rapidly release information online with little to no oversight has increased the risks associated with libel.

We most commonly see this in scenarios where entry-level employees make ill-advised remarks about a competitor or fail to get approval when posting photos and advertisements. As the world goes digital and the barrier to releasing communication weakens, the risk for defamation lawsuits goes up.

Does insurance cover defamation?

Yes, insurance can cover defamation, but how it covers defamation will depend on your business. Here are the four common ways that defamation can be covered on a business insurance policy:

General Liability

As mentioned above, the most common way businesses are covered from defamation claims is their commercial general liability insurance policy is under the "Personal & Advertising Injury" section of the policy.

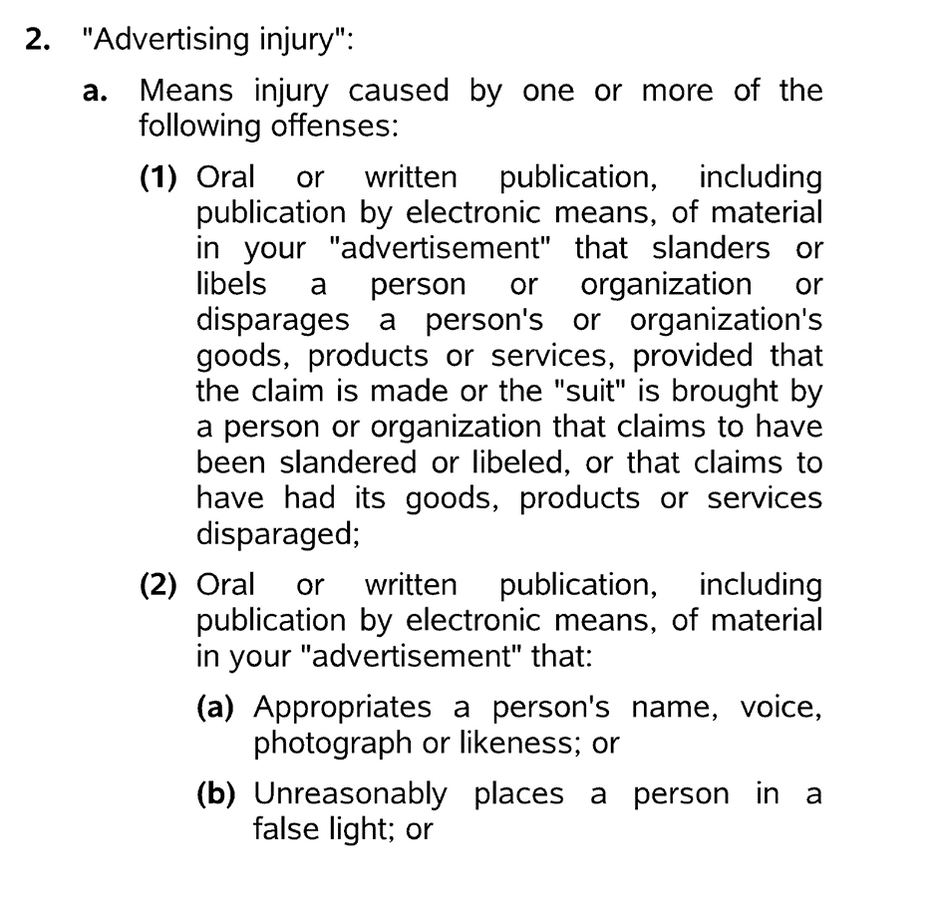

Here is an example of what types of communication a general liability policy can cover:

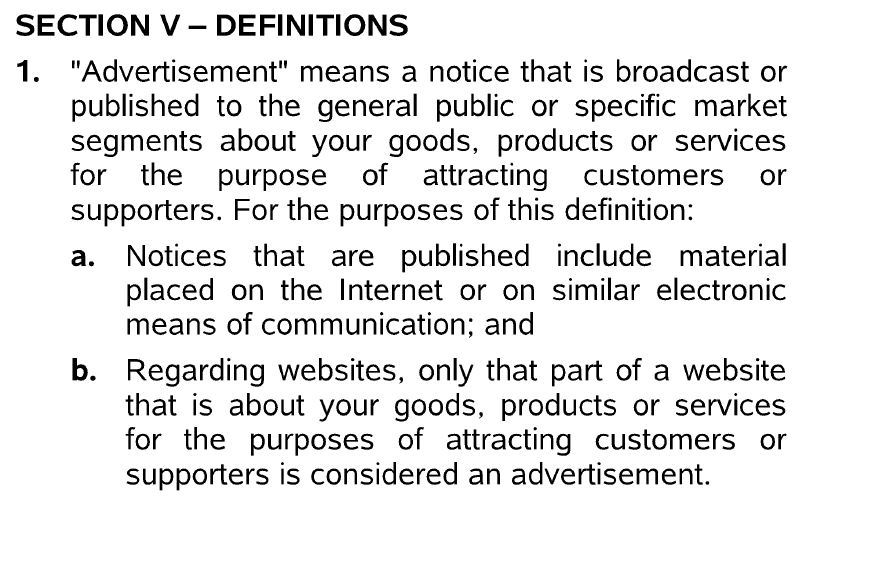

And to further clarify the definition, let’s look at how the policy defines “advertisement”:

Directors And Officers Insurance

Some directors and officers insurance policies include "personal injury" coverage, which is an umbrella term that covers libel and slander.

Unlike the commercial general liability coverage for defamation, coverage on this policy is not standardized. You need to understand your unique policy; if you have personal injury coverage, make sure that the policy covers individuals besides your board of directors.

Cyber Liability (Recommended)

Many modern-day cyber insurance policies cover defamation in their media liability section. These policies often fill the defamation coverage gaps in the commercial general liability policy.

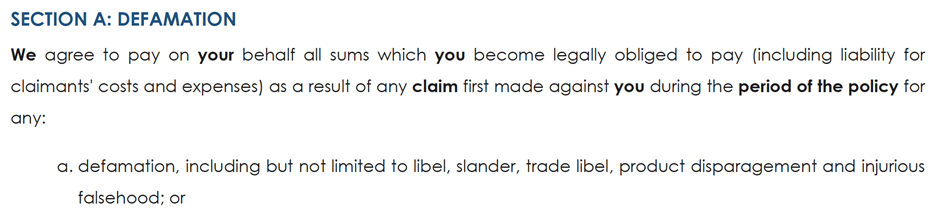

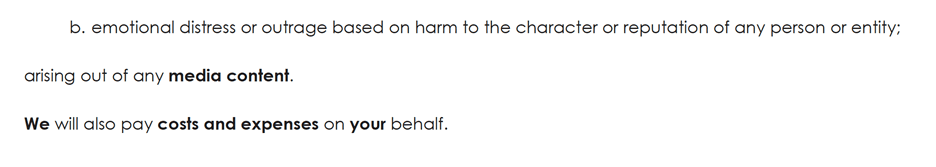

For example, Evolve, a leading provider of cyber insurance in the U.S., offers a policy that complements the standard general liability policy very well.

Their policy states:

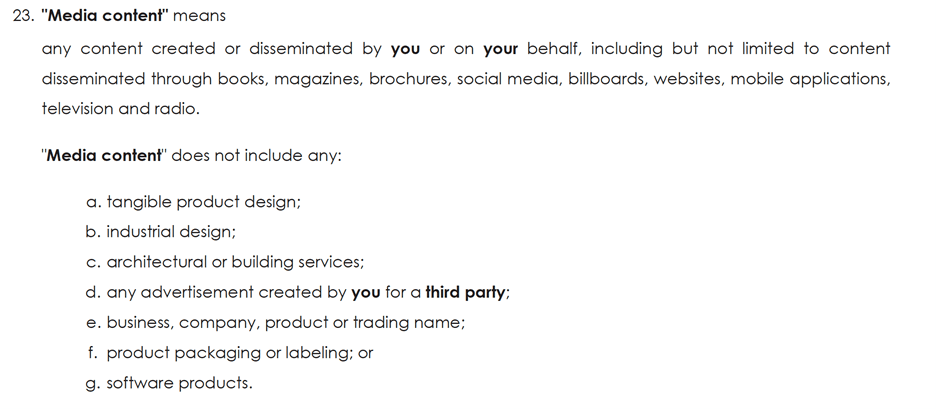

If you flip a couple of pages to the definition of media content, you’ll see the policy covers a broad array of situations that the general liability policy does not cover. Additionally, it excludes claims arising from advertisements, which are not covered under the commercial general liability policy. This way, you avoid a double insured situation.

Real-World Examples of Defamation Coverage in Commercial Insurance Policies

- Online Review: The owner of a clothing store in Dallas, Texas, posted a negative online review about a rival boutique in Austin. This false review caused the Austin-based boutique to suddenly lose customers. The Austin boutique owner sued the Dallas store for defamation. The legal team of the accused, backed by their commercial liability insurance, decided to settle the matter out of court. The insurance coverage helped to pay the settlement, covering the loss of business income for the Austin boutique.

- Social Media (Twitter): In San Francisco, California, an intern for a small tech startup tweeted a false statement about a rival firm. The firm filed a defamation suit against the startup, alleging its reputation had been damaged in the tightly-knit tech community. Thankfully, the startup's commercial general liability insurance policy included defamation under its coverage. The insurer appointed a legal team to handle the case, which was successfully settled before reaching the courtroom, sparing the startup from a financially ruinous legal process.

- Media Publication: A New York media conglomerate published an article falsely accusing a high-profile actor of criminal activities. The actor filed a defamation suit against the media company, seeking substantial damages for reputational harm. Following a heated court battle, the judge ruled in favor of the actor. The media liability insurance policy covered the publisher’s legal costs and damages awarded in the lawsuit.

- Public Speaking Event: The CEO of a national retail corporation falsely accused a competitor of using unethical business practices in public speech at a large corporate conference in Seattle, Washington. The competitor sued the retail corporation for defamation. The retail corporation’s directors and officers (D&O) liability insurance policy included personal injury coverage, which kicked in to cover the legal costs and potential damages. The case ended in a settlement negotiated by the insurance company's lawyers, saving the retail corporation from a drawn-out legal battle and potential reputational damage.

The Rub

Keep in mind that defamation insurance won't cover any and all claims. Every defamation insurance policy excludes intentional or malicious acts, which means you cannot intentionally slander someone and expect insurance to cover it. The intention of insurance is to cover unintentional accidents and situations that arise while running a business.

Summary

If you are looking for additional clarity on your current insurance policy or want defamation coverage, let us know. We will walk you through and let you know how to best protect your business from this growing problem.

About The Author: Austin Landes, CIC

Austin is an experienced Commercial Risk Advisor specializing in property & casualty risk management for religious institutions, real estate, construction, and manufacturing.

THE INFORMATION ON THIS WEBSITE IS PROVIDED FOR INFORMATIONAL PURPOSES ONLY. Nothing on this website should be construed as a solicitation, proposal, offer, recommendation, endorsement, or advice regarding any insurance product. The information on this website is of a general nature and is not intended as a substitute for individual consultation with a licensed insurance professional. In no event will we undertake to advise you regarding your need for any insurance product. YOU ARE RESPONSIBLE FOR DETERMINING WHAT INSURANCE PRODUCTS YOU NEED AND IN WHAT AMOUNTS, BASED ON YOUR UNIQUE EXPOSURE TO RISKS AND ABILITY TO BEAR LOSSES. We are licensed insurance brokers in the following states: WA, OR, ID, MT, WY, CA, NV, UT, AZ, CO, MN, SD, NE, KS, OK, TX, IA, MO, AR, LA, WI, IL, KY, TN, MS, IN, GA, FL, OK, VA, NC, SC, DE, MD, DC, NJ, CT, RI, VT, NH, PA, and ME. Insurance products and features are subject to underwriting criteria and may not be available in all states.