A Guide To Commercial Landlord Insurance: What To Know

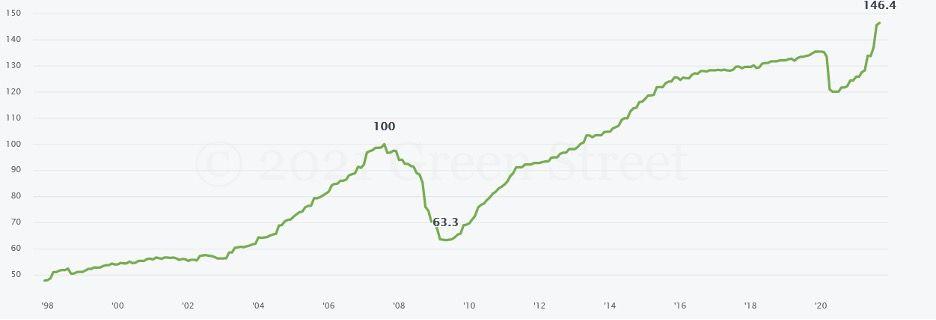

U.S. commercial real estate has been a great way for investors to gain returns. According to the Green Street Commercial Property Price Index, commercial real estate values have increased nearly 46.4% since 2007.

Although the investment returns are excellent, owning real estate doesn't come without its challenges. For one, you have a very expensive asset sitting outside, vulnerable to weather, vandals, fires, or natural catastrophes.

Landlord insurance for commercial property allows real estate investors to pay a monthly fixed premium amount to an insurance company in exchange for stability in their portfolio.

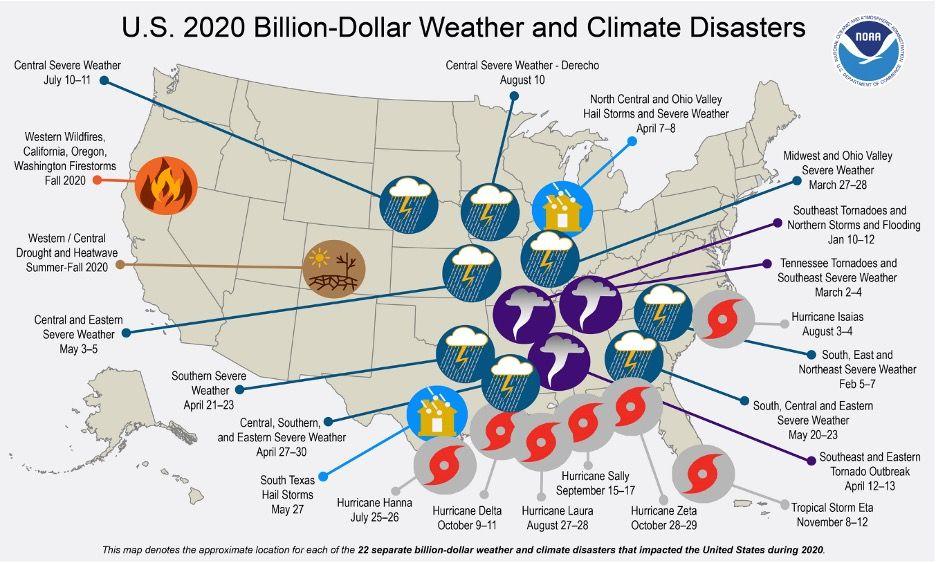

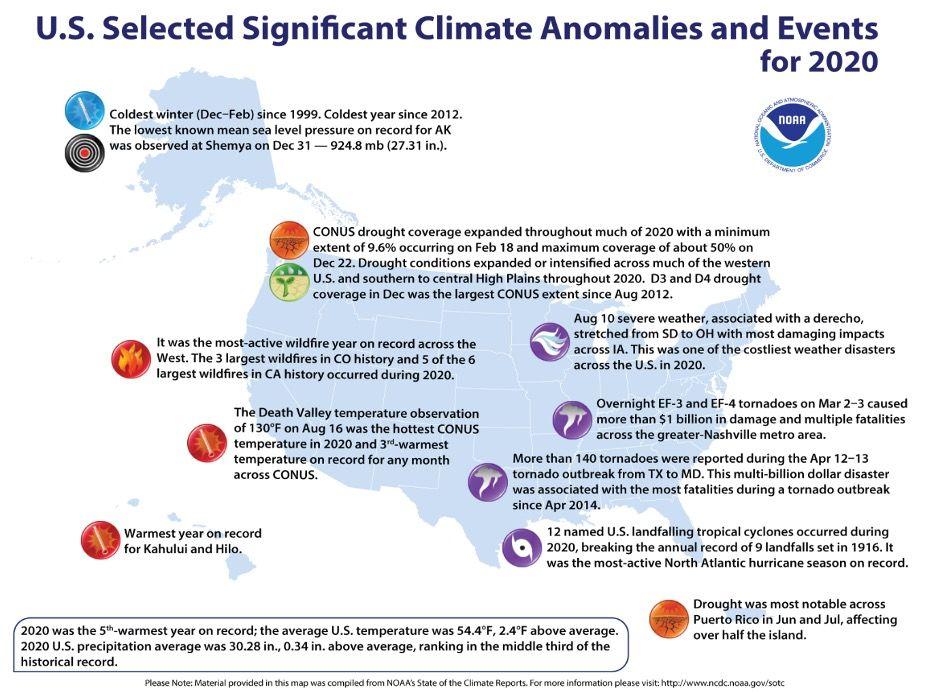

As simple as that might sound, it can be a difficult task to find a comprehensive insurance policy at a fair price. According to the National Oceanic and Atmospheric Administration (NOAA), 2020 was the worst year for weather and climate disasters on record, and these crazy events are happening at an increasing frequency.

Even if you ignore weather patterns altogether, wildfires occurrences are going up and driving billions of dollars in insurance claims costs.

Source: NOAA

With trends like these, it is logical to conclude that insurance costs will be adjusted for the increased claims activity.

In addition to the increased claims activity, commercial property insurance has also recently been affected by supply chain issues and inflation. As the cost of building materials and equipment goes up, insurance will follow suit, because materials are what insurance is spent on when a claim happens.

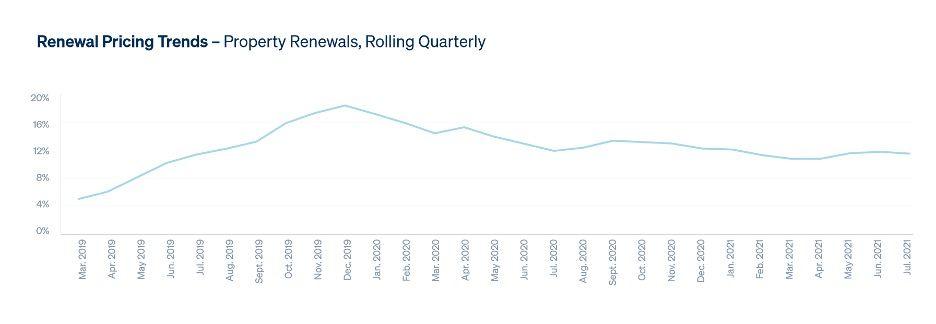

The combination of these factors has led to a situation where we are seeing double-digit renewal rate increases across many types of commercial property insurance and this greatly impacts commercial landlords, because insurance is a large expenditure for real estate investors.

Source: AmWins, Inc

Although some rate increases are unavoidable, you can mitigate many large renewal increases with a little knowledge of how your insurance policies work, and an understanding of what underwriters are looking for. Here is what you need to know:

What insurance do commercial landlords need?

The goal of any landlord insurance program should be to financially guard the real estate owner from building damage and lawsuits. Here are our recommended coverages to help commercial landlords cover their bases and ultimately lower the risk of operating a real estate business.

Commercial Property Insurance (All Landlords)

The most critical (and usually, most expensive) policy that every commercial landlord needs to purchase is the commercial property insurance policy. This policy covers your investment properties from perils such as weather, fire, vandalism, and many other damages.

Many commercial landlords choose to have all their buildings on a single policy, but some want individual policies, and some want properties grouped together based on occupancy type (e.g. one policy covers all apartments, and another policy covers all warehouses). Either way, if you own more than a single property, you are going to have to strategize with your insurance broker on how to structure your insurance program.

Business Income Insurance (All Landlords)

Business income coverage is part of the commercial property landlord insurance policy, but is often overshadowed by the primary building coverage.

If you have any expenses on your property, or are financing any of your buildings, this coverage will pay your net income when your building cannot function as a leased property and is being rebuilt.

This coverage is critical and will assist with paying the banks and taxes while your property isn’t generating revenue due to property damage.

Commercial General Liability (All Landlords)

While property insurance covers damage to property that you own, Commercial General Liability (or CGL) covers damage (property damage and bodily injury) that you cause other people.

General liability claims often involve a lawsuit with someone who experienced harm in the form of either bodily injury or property damage on your premises. This could be a tenant, a tenant's customer, a neighboring business, or even a random person.

For example, if a fire in your building caused significant smoke damage to your neighbor’s building, the neighbor would seek compensation from your commercial general liability insurance policy.

Need to control the costs of coverage?

Our team can help. Get a free quote in 5 minutes. Available in most states.

Flood & Earthquake Insurance (Location Dependent)

Depending on where your property is located, you might consider purchasing a flood or earthquake insurance policy. Although some commercial property insurance policies do cover flood and earthquake events (usually large portfolios), the vast majority do not.

These perils are rare, but they are so large and widespread that insurance companies have to underwrite this insurance on stand-alone policies.

What is important to know is that these perils are excluded from coverage the majority of the time. You have to request a specific quote to get either flood or earthquake added as a covered peril to your commercial property insurance program.

Wind Deductible Buy-Down (Location Dependent)

If you are located in hail, tornado, or hurricane-prone areas, you might have to deal with insurers wanting a high wind and hail deductible. This isolates wind and hail damage from all other claim types, and creates a dedicated deductible for it.

There are a couple reasons why this deductible is required in certain areas. First, the insurance company doesn't want to act as a maintenance policy for roofs that will statistically be damaged every few years. Second, it allows commercial landlords to own property on the east and southern coasts and still have reasonable deductibles for all other perils and more infrequent events, such as fires or vandalism.

A wind deductible buy-down policy is for insurance purchasers who feel uncomfortable with a large deductible and would pay more to have a smaller deductible, but their insurance company can't offer the lower deductible. This policy covers the gap between where you want your deductible to be and where your main property insurance deductible is.

For example, if you wanted a $10,000 deductible for wind and hail, but your primary property insurance carrier could only offer a $100,000 deductible, a wind deductible buy-down would insure the difference between $10,000 and $100,000, providing a deductible you are comfortable with.

What factors determine insurance pricing for commercial landlords?

Building Construction

The construction of your building affects insurance pricing because some materials and building compositions are more susceptible to certain damages. For example, a wood-frame building would be more expensive to insure in an area prone to wildfires, or a metal building would be more affordable to insure in an area with frequent hail damage.

Underwriters of commercial property insurance like to insure buildings that can easily withstand the elements most common to the geographic area where the building is located.

Building Occupancy

The tenant who occupies your building will have a significant impact on your premium amount. For example, an accounting firm will cost much less to insure than a manufacturing facility with the same square footage.

Building Protections & Safeguards

Although not as big of a factor as building construction or occupancy, the proximity to the fire department, presence of sprinkler systems, use of central station alarms, and other protections will lower your property insurance premiums.

Building Location

The location of your commercial property has the biggest impact on the premium you will pay for insurance. Areas that historically experience more property damage will pay more than areas that experience less damage. The most expensive areas to insure are within 10 miles of any coastal areas, where severe weather events happen frequently.

On the flip side, states like Washington and Utah will have much lower premiums because their weather isn't as severe as the coastal regions of the county.

Building Updates

Insurance companies always want to know if your building is properly maintained and updated. This includes the state of the wiring, plumbing, HVAC systems, and roofs. If everything is in good shape, it has proven to reduce claims, and insurance companies give discounts to property owners with updated buildings.

Check Our Prices for Commercial Landlord Insurance

Tell us some basic information and get a free, instant quote. Available in most states.

Our Tips & Tricks

If you want to lower costs, increase the deductible instead of underinsuring your building.

Insurance buyers commonly try to lower their cost of insurance by decreasing the building valuation until they get to the price they desire. Although this worked a decade ago, this is no longer the most advantageous route to take. Underwriters can now view satellite images of your property and get property valuation analytics that provide an extremely accurate estimate of your building’s value.

When requested with an unreasonably low building value, the underwriters will increase the rate until they get enough premium to match their claims models. So, you will get a worse policy for not much savings.

In addition, you now have an underinsurance penalty. This can sometimes result in having to pay a percentage portion of the entire claim as a penalty.

Instead of dealing with penalties and playing games with building valuation limits, we suggest finding a fair building valuation and altering the price by changing the deductible.

This is the only reliable way that you can plan for exactly how much you will be out of pocket in the event of a catastrophe, and it also results in the best bang for your buck with insurance coverage.

Always ask for full replacement cost

We have customers frequently asking about getting "market value" coverage or "actual cash value" (which accounts for depreciation during claims payments) as a method to reduce their insurance premiums. In our experience, the premium difference full replacement cost and these degraded coverage options are minimal.

For many insurance companies, coverages such as actual cash value exist as a way insure risky property, not as a way to save on costs.

If you live in a weather-prone area, you might be able to get a discount if you negotiate actual cash value on an older roof; but in general, quoting the full building on actual cash value will not bring much benefit.

For more information on what actual cash valuation means for your property and a full overview of the commercial property insurance policy, visit our article, "Commercial Property Insurance: The Ultimate Guide"

Keep a list of building updates to get better insurance rates

Having a list of updates for each building that you own could mean the difference between getting preferred rates and non-preferred rates. Insurance companies prefer buildings that have modern updates. To get the best pricing available, document the year of the most recent updates for:

- Electrical

- Plumbing

- HVAC

- Roof

Require tenants to add you as an additional insured to their liability insurance

Having a tenant add you as an additional insured to their commercial general liability policy is required in many commercial landlord liability policies, but if your policy doesn't require this, we highly suggest implementing it anyway.

Having your tenants add you as an additional insured to their policy forces their insurance carrier to pay for the claim (and defense costs) if you (the landlord) were to get involved in a lawsuit arising out of a tenant's actions or negligence.

For example, let’s say you had a grocery store tenant in your shopping center and a customer slipped and fell on the floor, injuring their back. The injured person might sue the landlord as well as the grocery store, claiming that the landlord contributed to the fall since it was their property. It is also lucrative to target landlords because they are viewed as having deep pockets.

In this situation, listing you as an additional insured on the grocery store tenant’s policy would cover both of you in the lawsuit, keeping your liability and insurance program insulated from loss.

Require all contractors to provide a proof of liability insurance before working on your properties.

Just like with tenants, you should require contractors to have liability insurance and list you as an additional insured. This includes anyone you hire to repair, maintain, or renovate your properties.

If you have an uninsured contractor on your property, you not only have little recourse against any damage they cause you, but you could also be responsible for any damage they cause others, including having to pay for injuries the contractor’s employees sustain on your property.

For more information on what you are liable for if you hire an uninsured contractor, visit our article, "Hiring a Contractor Without Insurance - What Are The Risks?"

Summary

If you are a landlord and need help navigating the commercial property insurance market, let us know. We’re here to help.

If you are a landlord needing help on your first property, you can get a quick commercial landlord insurance quote online; or, if you are a national property development company, you can give us a call. Regardless, we will make the process straightforward and simple to help you get the best rates and value on your insurance program.

About The Author: Austin Landes, CIC

Austin is an experienced Commercial Risk Advisor specializing in property & casualty risk management for religious institutions, real estate, construction, and manufacturing.

THE INFORMATION ON THIS WEBSITE IS PROVIDED FOR INFORMATIONAL PURPOSES ONLY. Nothing on this website should be construed as a solicitation, proposal, offer, recommendation, endorsement, or advice regarding any insurance product. The information on this website is of a general nature and is not intended as a substitute for individual consultation with a licensed insurance professional. In no event will we undertake to advise you regarding your need for any insurance product. YOU ARE RESPONSIBLE FOR DETERMINING WHAT INSURANCE PRODUCTS YOU NEED AND IN WHAT AMOUNTS, BASED ON YOUR UNIQUE EXPOSURE TO RISKS AND ABILITY TO BEAR LOSSES. We are licensed insurance brokers in the following states: WA, OR, ID, MT, WY, CA, NV, UT, AZ, CO, MN, SD, NE, KS, OK, TX, IA, MO, AR, LA, WI, IL, KY, TN, MS, IN, GA, FL, OK, VA, NC, SC, DE, MD, DC, NJ, CT, RI, VT, NH, PA, and ME. Insurance products and features are subject to underwriting criteria and may not be available in all states.